Region:Europe

Author(s):Geetanshi

Product Code:KRAA0166

Pages:89

Published On:August 2025

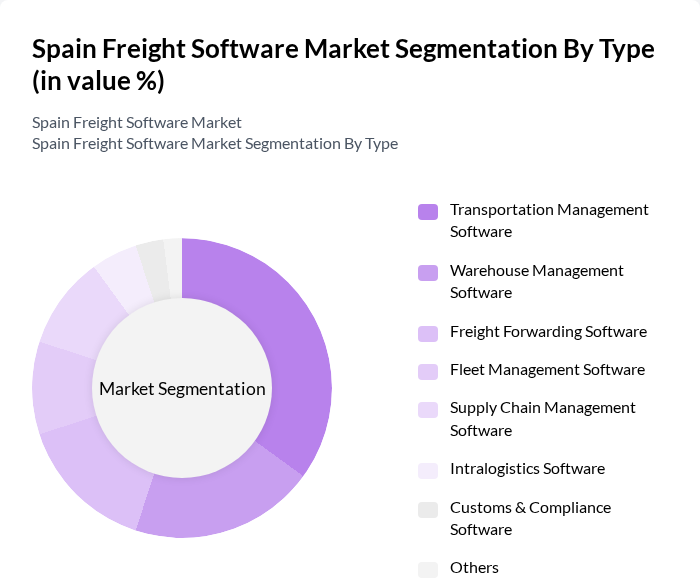

By Type:The freight software market in Spain is segmented into Transportation Management Software, Warehouse Management Software, Freight Forwarding Software, Fleet Management Software, Supply Chain Management Software, Intralogistics Software, Customs & Compliance Software, and Others. Among these,Transportation Management Softwareleads the market, driven by its critical role in optimizing logistics operations, enabling real-time tracking, and enhancing supply chain visibility. Adoption is further supported by the integration of AI, IoT, and cloud-based solutions, which streamline operations and improve efficiency.

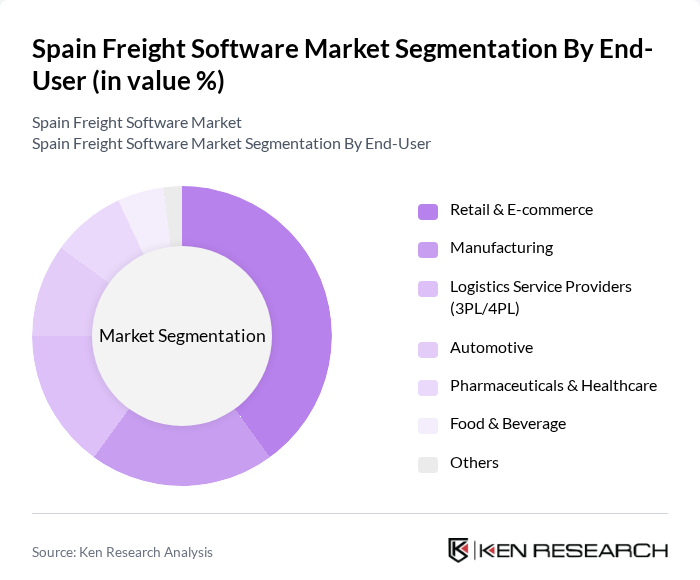

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Logistics Service Providers (3PL/4PL), Automotive, Pharmaceuticals & Healthcare, Food & Beverage, and Others. TheRetail & E-commercesegment is the most significant contributor to the market, propelled by the rapid growth of online shopping and the need for agile, efficient logistics solutions to meet evolving consumer expectations. Manufacturing and logistics service providers also represent substantial demand, as they increasingly rely on digital freight management to streamline operations and improve service quality.

The Spain Freight Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Blue Yonder (formerly JDA Software Group), Manhattan Associates, Descartes Systems Group, Transporeon, WiseTech Global (CargoWise), Freightos, Trimble Inc., Kuebix (Trimble), project44, FourKites, Logista, Grupo Sesé, Grupo Carreras contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain freight software market appears promising, driven by technological advancements and evolving consumer demands. As logistics companies increasingly adopt real-time tracking and integrated supply chain management solutions, operational efficiency is expected to improve significantly. Additionally, the emergence of blockchain technology will enhance transparency and security in logistics operations. These trends indicate a shift towards more sophisticated freight software solutions that prioritize customer experience and sustainability, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Freight Forwarding Software Fleet Management Software Supply Chain Management Software Intralogistics Software Customs & Compliance Software Others |

| By End-User | Retail & E-commerce Manufacturing Logistics Service Providers (3PL/4PL) Automotive Pharmaceuticals & Healthcare Food & Beverage Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid SaaS (Software as a Service) Others |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain Central Spain |

| By Functionality | Order Management Inventory Management Shipment Tracking & Visibility Route Optimization Reporting and Analytics Freight Rate Management Others |

| By Industry Vertical | Automotive Pharmaceuticals Food and Beverage Chemicals Construction & Engineering Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Management Software Users | 100 | Logistics Coordinators, IT Managers |

| Warehouse Management System Implementers | 60 | Warehouse Managers, Operations Directors |

| Transportation Management System Users | 80 | Supply Chain Analysts, Fleet Managers |

| ERP Software Users in Logistics | 50 | Finance Managers, IT Directors |

| End-users in E-commerce Logistics | 40 | eCommerce Operations Managers, Customer Service Leads |

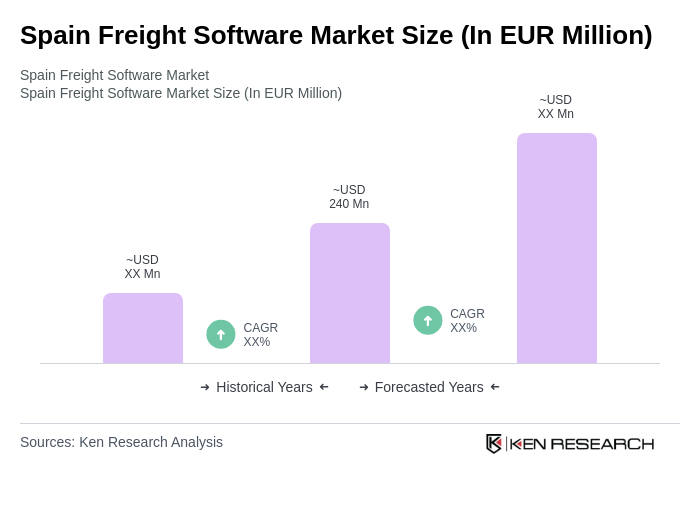

The Spain Freight Software Market is valued at approximately EUR 240 million, reflecting a significant growth driven by the demand for efficient logistics solutions, e-commerce expansion, and the need for real-time freight management.