Region:Europe

Author(s):Shubham

Product Code:KRAC0737

Pages:96

Published On:August 2025

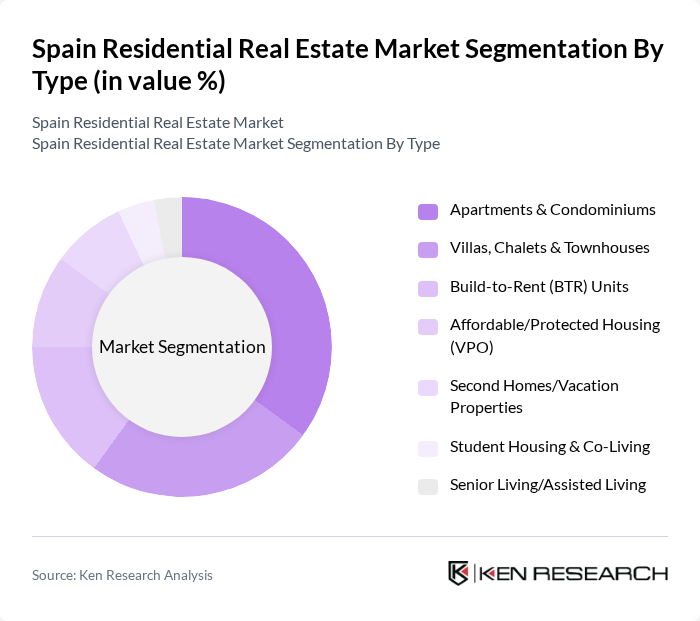

By Type:The residential real estate market can be segmented into various types, including Apartments & Condominiums, Villas, Chalets & Townhouses, Build-to-Rent (BTR) Units, Affordable/Protected Housing (VPO), Second Homes/Vacation Properties, Student Housing & Co-Living, and Senior Living/Assisted Living. Each of these subsegments caters to different consumer needs and preferences, reflecting the diverse landscape of the market. Ongoing trends include strong demand in major cities and constrained supply that supports pricing; coastal and island areas continue to attract second-home buyers; and institutional activity sustains BTR development where rental demand is strongest.

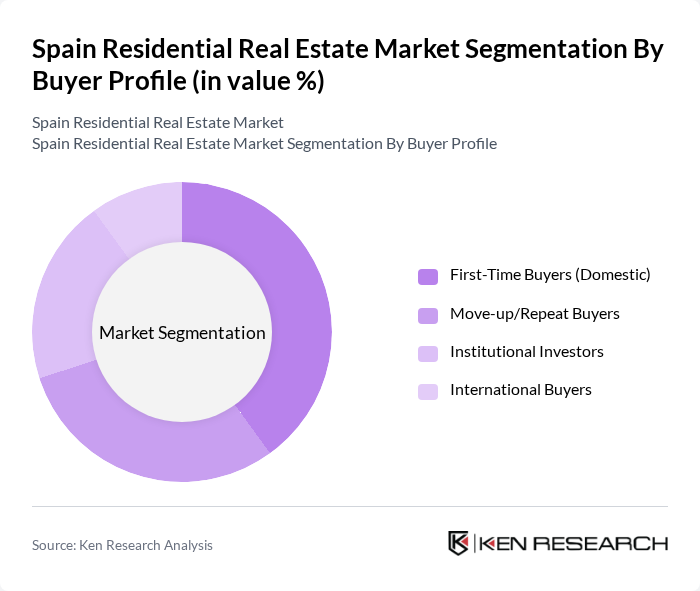

By Buyer Profile:The buyer profile segmentation includes First-Time Buyers (Domestic), Move-up/Repeat Buyers, Institutional Investors, and International Buyers. Each group has distinct motivations and financial capabilities, influencing their purchasing decisions in the residential real estate market. International buyers remain an important share of transactions and have grown markedly versus pre-pandemic levels, while institutional investors continue to target rental-led strategies in supply-constrained urban nodes.

The Spain Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as AEDAS Homes, Metrovacesa, Neinor Homes, Habitat Inmobiliaria, Taylor Wimpey España, Kronos Homes, Grupo Lar, Inmobiliaria del Sur (INSUR), Vía Célere, Culmia, Sareb, Acciona Inmobiliaria, Aelca, Pryconsa, Grupo Avintia contribute to innovation, geographic expansion, and service delivery in this space.

The Spain residential real estate market is poised for continued evolution, driven by urbanization and technological advancements. As remote work becomes more prevalent, demand for flexible housing solutions is expected to rise, influencing property designs and locations. Additionally, sustainability will play a crucial role, with eco-friendly developments gaining traction. The integration of smart home technologies will enhance property appeal, attracting tech-savvy buyers. Overall, the market is likely to adapt to changing consumer preferences while navigating economic challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Apartments & Condominiums Villas, Chalets & Townhouses Build-to-Rent (BTR) Units Affordable/Protected Housing (VPO) Second Homes/Vacation Properties Student Housing & Co-Living Senior Living/Assisted Living |

| By Buyer Profile | First-Time Buyers (Domestic) Move-up/Repeat Buyers Institutional Investors International Buyers |

| By Price Band (EUR) | Below €200,000 €200,000–€500,000 Above €500,000 (Prime & Luxury) |

| By Location | Tier-1 Cities (Madrid, Barcelona) Tier-2 Cities (Valencia, Málaga, Sevilla, Bilbao, Zaragoza) Coastal & Islands (Costa del Sol, Costa Blanca, Balearic & Canary Islands) |

| By Property Condition | New-Build/Developments Renovated/Refurbished Second-Hand (To Be Renovated) |

| By Financing Type | Cash Purchases Mortgages (Fixed/Variable) Government-Backed & Subsidized Loans |

| By Investment Purpose | Owner-Occupied (Primary Residence) Long-Term Rental (Buy-to-Let) Short-Term/Tourist Rental Capital Appreciation/Flips |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Residential Buyers | 150 | First-time Homebuyers, Young Professionals |

| Luxury Property Market | 80 | High Net-Worth Individuals, Real Estate Investors |

| Rental Market Insights | 100 | Property Managers, Tenants |

| New Developments Feedback | 70 | Real Estate Developers, Architects |

| Market Trends and Sentiment | 90 | Real Estate Analysts, Economic Advisors |

The Spain Residential Real Estate Market is valued at approximately EUR 1.6 trillion, reflecting sustained price growth and a large existing housing stock, driven by urbanization, economic activity, and foreign-buyer demand.