Region:Africa

Author(s):Geetanshi

Product Code:KRAB6378

Pages:87

Published On:October 2025

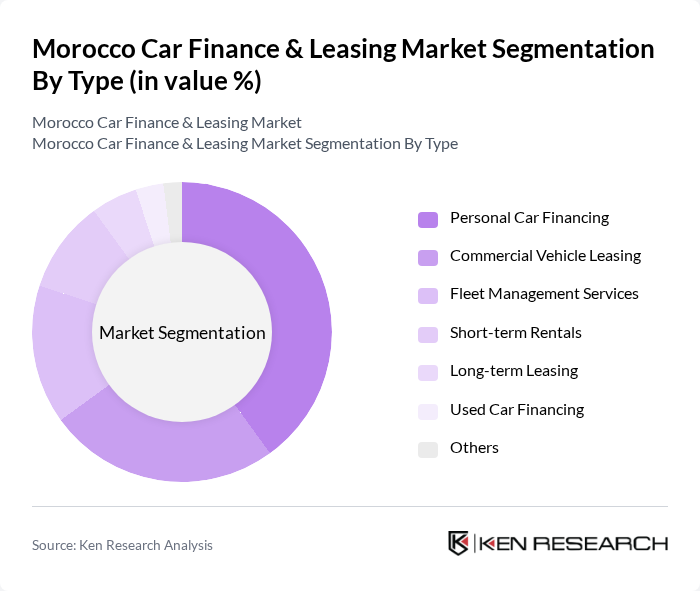

By Type:The market can be segmented into various types, including Personal Car Financing, Commercial Vehicle Leasing, Fleet Management Services, Short-term Rentals, Long-term Leasing, Used Car Financing, and Others. Each of these segments caters to different consumer needs and preferences, with Personal Car Financing being the most popular due to the increasing number of individual consumers seeking vehicle ownership.

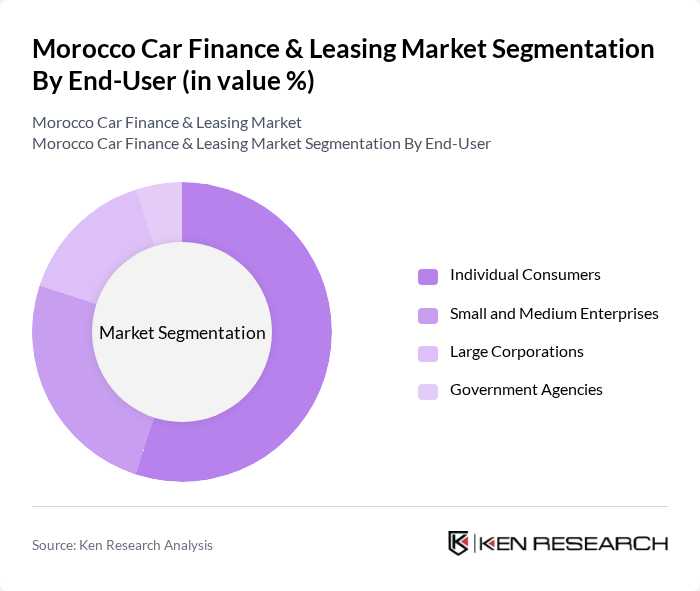

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises, Large Corporations, and Government Agencies. Individual Consumers dominate the market, driven by the increasing trend of personal vehicle ownership and the availability of tailored financing options that cater to their specific needs.

The Morocco Car Finance & Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banque Populaire, Attijariwafa Bank, BMCE Bank, Crédit Agricole du Maroc, Société Générale Maroc, Wafa Assurance, Auto Hall, RMA Watanya, Al Barid Bank, Marocaine de Leasing, Cetelem Maroc, Crédit du Maroc, Banque Centrale Populaire, LeasePlan Maroc, Axa Assurance Maroc contribute to innovation, geographic expansion, and service delivery in this space.

The Morocco car finance and leasing market is poised for significant growth, driven by increasing consumer demand and urbanization. As disposable incomes rise, more individuals will seek financing options, particularly for electric vehicles, which are gaining traction due to government incentives. Additionally, the development of digital financing platforms will streamline the application process, making it easier for consumers to access financing. These trends indicate a promising future for the market, with potential for innovation and expansion in various segments.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Financing Commercial Vehicle Leasing Fleet Management Services Short-term Rentals Long-term Leasing Used Car Financing Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Government Agencies |

| By Financing Method | Bank Loans Credit Unions Peer-to-Peer Lending In-house Financing |

| By Vehicle Type | Sedans SUVs Trucks Vans |

| By Lease Duration | Short-term Leases Medium-term Leases Long-term Leases |

| By Payment Structure | Fixed Payments Variable Payments Balloon Payments |

| By Policy Support | Subsidies for Electric Vehicles Tax Exemptions for Leasing Companies Government Grants for Infrastructure Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 150 | Car Buyers, Financial Advisors |

| Leasing Company Insights | 100 | Leasing Managers, Financial Analysts |

| Dealership Financing Practices | 80 | Dealership Owners, Sales Managers |

| Regulatory Impact Assessment | 60 | Policy Makers, Regulatory Affairs Specialists |

| Consumer Preferences in Leasing | 90 | Leasing Customers, Market Researchers |

The Morocco Car Finance & Leasing Market is valued at approximately USD 1.5 billion, reflecting a significant growth driven by increasing consumer demand for vehicle ownership and favorable financing options from financial institutions.