Region:Europe

Author(s):Dev

Product Code:KRAC0348

Pages:93

Published On:August 2025

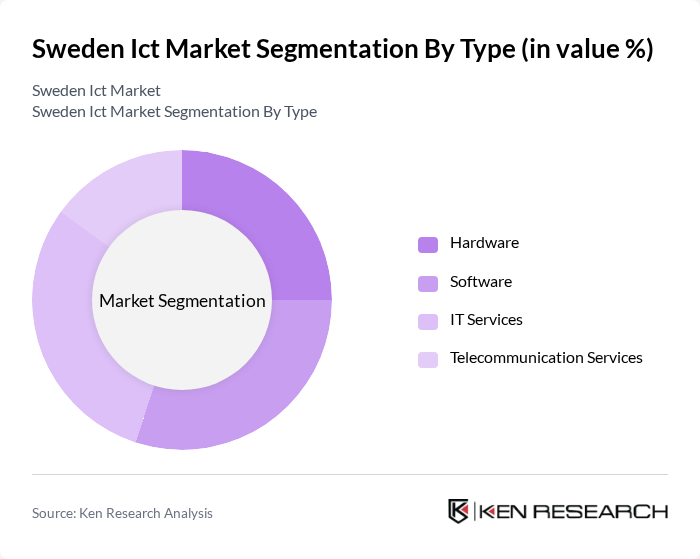

By Type:

The Sweden ICT market is segmented into four main types: Hardware, Software, IT Services, and Telecommunication Services. Among these, Telecommunication Services is a leading sub-segment, driven by the country's advanced digital infrastructure, widespread adoption of 5G technology, and high mobile and broadband penetration. IT Services and Software also show strong growth, particularly in areas like enterprise software, SaaS solutions, and IT consulting, as organizations seek to enhance operational efficiency and digital capabilities .

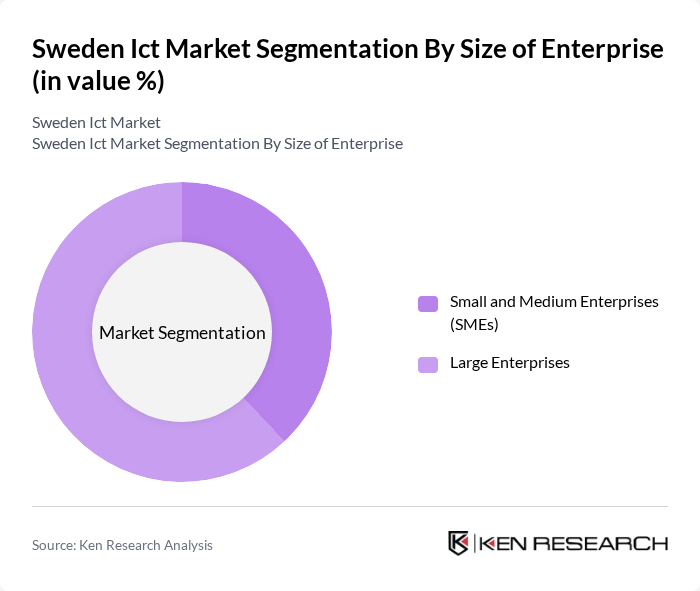

By Size of Enterprise:

The market is also segmented by the size of enterprises, which includes Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs are increasingly adopting ICT solutions to enhance their operational efficiency and competitiveness, contributing significantly to market growth. However, Large Enterprises dominate the market due to their substantial IT budgets and the need for comprehensive ICT solutions to manage complex operations. The trend of digital transformation is pushing both segments to invest in advanced technologies, but Large Enterprises tend to lead in terms of overall expenditure .

The Sweden ICT market is characterized by a dynamic mix of regional and international players. Leading participants such as Ericsson, Telia Company, TietoEVRY, Atea AB, Addnode Group, Sectra AB, Clavister, Visma, Qlik, IFS AB, Cybercom Group, Cygni, NetEnt, Kinnevik AB, Microsoft Sweden contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Swedish ICT market appears promising, driven by ongoing digital transformation and technological advancements. With the government’s commitment to enhancing digital infrastructure and the increasing adoption of AI and IoT technologies, the sector is poised for substantial growth. Additionally, the focus on cybersecurity and data privacy will likely shape new service offerings, creating a dynamic environment for innovation and investment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Software IT Services Telecommunication Services |

| By Size of Enterprise | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Industry Vertical | BFSI (Banking, Financial Services & Insurance) IT and Telecom Government Retail and E-commerce Manufacturing Energy and Utilities Other Industry Verticals |

| By Geography | Stockholm Gothenburg Malmö Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Services | 100 | Network Engineers, Service Managers |

| Software Development Firms | 80 | Product Managers, Software Architects |

| Cybersecurity Solutions | 60 | Security Analysts, IT Compliance Officers |

| Cloud Computing Providers | 50 | Cloud Solutions Architects, Business Development Managers |

| Emerging Technologies (AI, IoT) | 40 | Innovation Managers, R&D Directors |

The Sweden ICT market is valued at approximately USD 27 billion, reflecting significant growth driven by digital transformation, cloud computing, and enhanced mobile and broadband services. This valuation is based on a comprehensive five-year historical analysis.