Region:Asia

Author(s):Rebecca

Product Code:KRAB6382

Pages:99

Published On:October 2025

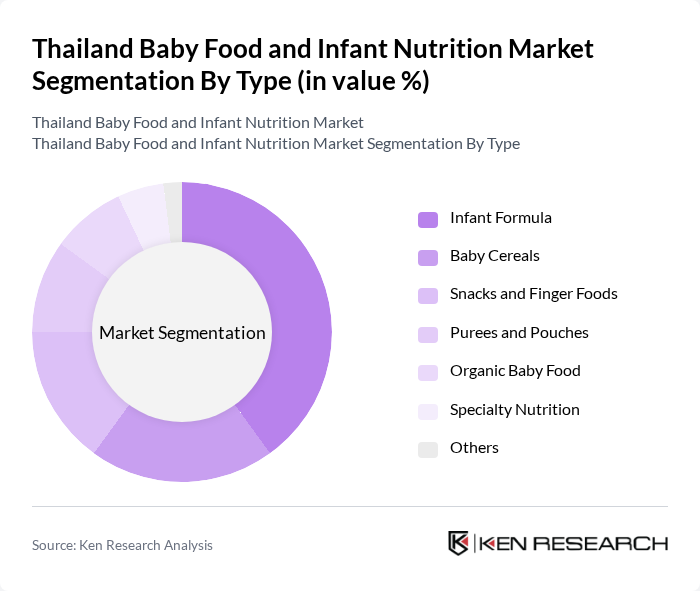

By Type:The market is segmented into various types of baby food products, including Infant Formula, Baby Cereals, Snacks and Finger Foods, Purees and Pouches, Organic Baby Food, Specialty Nutrition, and Others. Among these, Infant Formula is the leading sub-segment due to its essential role in providing complete nutrition for infants who are not breastfed. The increasing trend of working mothers and the growing awareness of the importance of nutrition in early childhood development further drive the demand for Infant Formula.

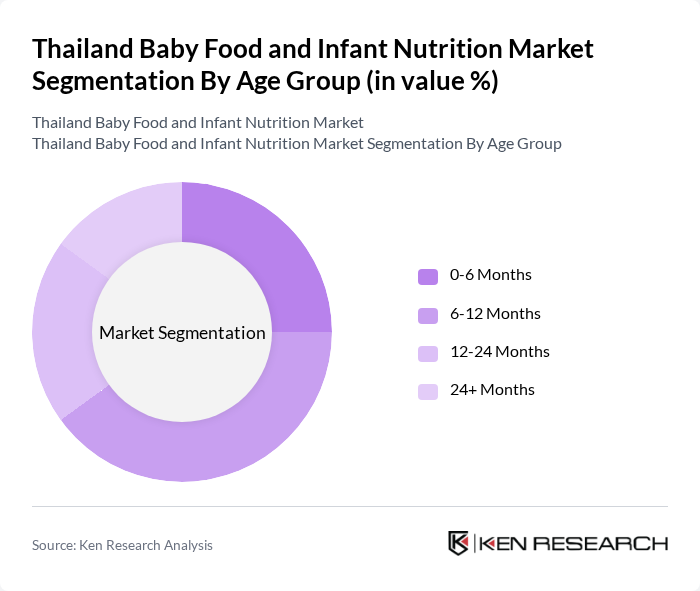

By Age Group:The market is also segmented by age group, including 0-6 Months, 6-12 Months, 12-24 Months, and 24+ Months. The 6-12 Months age group is the most significant segment, as this is the period when infants transition to solid foods. Parents are increasingly seeking nutritious and easy-to-digest options for their babies during this critical growth phase, leading to a higher demand for products tailored to this age group.

The Thailand Baby Food and Infant Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé (Thailand) Ltd., Danone Nutricia, Mead Johnson Nutrition (Thailand) Ltd., Abbott Laboratories (Thailand) Ltd., FrieslandCampina, Hero Group, Wyeth Nutrition, Bledina, Earth’s Best, Happy Family Organics, Holle Baby Food, Baby Gourmet Foods, Plum Organics, Little Spoon, Yumi contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand baby food and infant nutrition market is poised for significant growth, driven by increasing consumer awareness and rising disposable incomes. As urbanization continues, the demand for convenient and nutritious baby food options will likely rise. Additionally, the trend towards organic and specialized nutrition products is expected to gain momentum, appealing to health-conscious parents. Companies that adapt to these trends and invest in innovative product development will be well-positioned to capture market share in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Infant Formula Baby Cereals Snacks and Finger Foods Purees and Pouches Organic Baby Food Specialty Nutrition Others |

| By Age Group | 6 Months 12 Months 24 Months + Months |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Pharmacies Specialty Stores Direct Sales Others |

| By Packaging Type | Jars Pouches Tetra Packs Cans |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | National Brands Private Labels Local Brands |

| By Nutritional Content | High Protein Low Sugar Fortified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Pediatricians, Nutritionists, Childcare Experts |

| Parents of Infants | 150 | New Mothers, Fathers, Caregivers |

| Retailers and Distributors | 80 | Store Managers, Supply Chain Coordinators |

| Manufacturers of Baby Food | 60 | Product Development Managers, Marketing Executives |

| Market Analysts and Researchers | 50 | Industry Analysts, Market Research Professionals |

The Thailand Baby Food and Infant Nutrition Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and increased awareness of infant nutrition among parents.