Region:Europe

Author(s):Shubham

Product Code:KRAA1130

Pages:93

Published On:August 2025

By Type:The market is segmented into various types of services that address different aspects of inventory management. The subsegments include Third-Party Logistics (3PL), Inventory Optimization Services, Demand Forecasting Services, Warehouse Management Services, Fulfillment & Order Processing Services, Reverse Logistics Services, and Others. Each of these service types is integral to streamlining operations, reducing costs, and meeting evolving customer expectations. Third-Party Logistics (3PL) remains the largest segment, driven by the need for integrated logistics solutions and value-added services such as warehousing, transportation, and order fulfillment . Inventory Optimization and Demand Forecasting Services are increasingly sought after as companies focus on data-driven decision-making and inventory accuracy. Warehouse Management Services are critical for operational efficiency, while Fulfillment, Reverse Logistics, and other specialized services address the complexities of e-commerce and returns management.

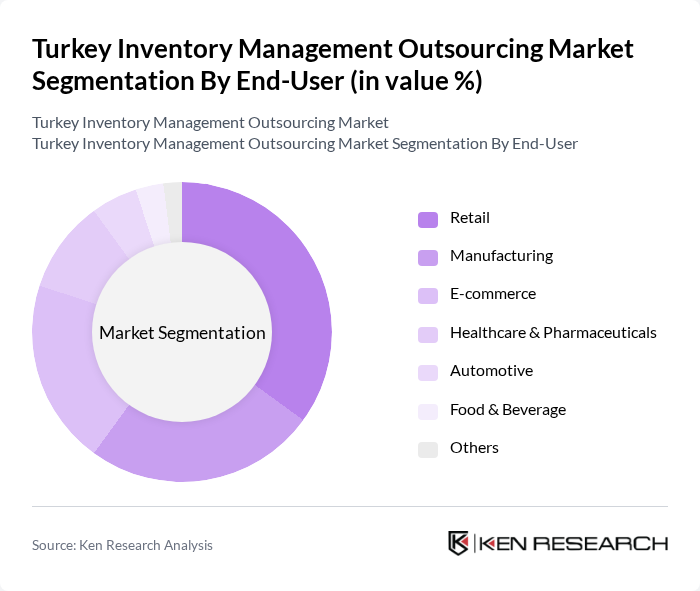

By End-User:The end-user segmentation covers industries that rely on inventory management outsourcing to optimize their supply chains. The primary segments are Retail, Manufacturing, E-commerce, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, and Others. Retail and E-commerce sectors are the largest users, driven by the need for real-time inventory visibility and rapid fulfillment. Manufacturing companies seek outsourcing to manage complex inventories and streamline production logistics. Healthcare & Pharmaceuticals require precise inventory controls for compliance and patient safety, while Automotive and Food & Beverage sectors depend on specialized logistics for timely deliveries and quality assurance .

The Turkey Inventory Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netlog Logistics, Borusan Lojistik, Ekol Logistics, Mars Logistics, Omsan Logistics, Horoz Logistics, Reysa? Logistics, DHL Supply Chain, CEVA Logistics, DB Schenker Arkas, Kuehne + Nagel, UPS Supply Chain Solutions, Aramex, Yusen Logistics, and DSV Solutions contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Turkey inventory management outsourcing market appears promising, driven by technological innovations and evolving consumer behaviors. As businesses increasingly adopt automated inventory systems and data analytics, the demand for outsourcing is expected to rise. Additionally, the focus on sustainability will push companies to seek eco-friendly logistics solutions. The integration of AI and machine learning in inventory management is projected to enhance operational efficiency, further solidifying the role of outsourcing in the supply chain ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Logistics (3PL) Inventory Optimization Services Demand Forecasting Services Warehouse Management Services Fulfillment & Order Processing Services Reverse Logistics Services Others |

| By End-User | Retail Manufacturing E-commerce Healthcare & Pharmaceuticals Automotive Food & Beverage Others |

| By Service Model | On-Demand Services Subscription-Based Services Project-Based Services Managed Services Others |

| By Industry Vertical | Consumer Goods Automotive Electronics Food and Beverage Healthcare Others |

| By Geographic Coverage | Istanbul Region Marmara Region Central Anatolia Aegean Region Mediterranean Region Cross-Border Services Others |

| By Technology Integration | RFID Technology IoT Solutions Cloud-Based Platforms Warehouse Automation Systems Data Analytics & AI Integration Others |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-Based Pricing Transaction-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 98 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Outsourcing Strategies | 70 | Operations Managers, Procurement Specialists |

| E-commerce Fulfillment Solutions | 60 | Logistics Coordinators, eCommerce Directors |

| Third-party Logistics Providers | 50 | Business Development Managers, Service Delivery Heads |

| Technology Integration in Inventory Management | 40 | IT Managers, Systems Analysts |

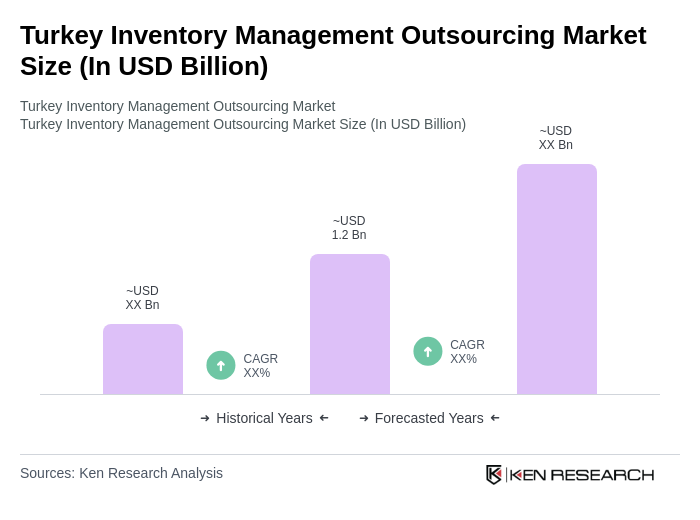

The Turkey Inventory Management Outsourcing Market is valued at approximately USD 1.2 billion, reflecting a robust demand for outsourced business processes within the broader Turkish BPO services sector.