Region:Middle East

Author(s):Dev

Product Code:KRAB7064

Pages:80

Published On:October 2025

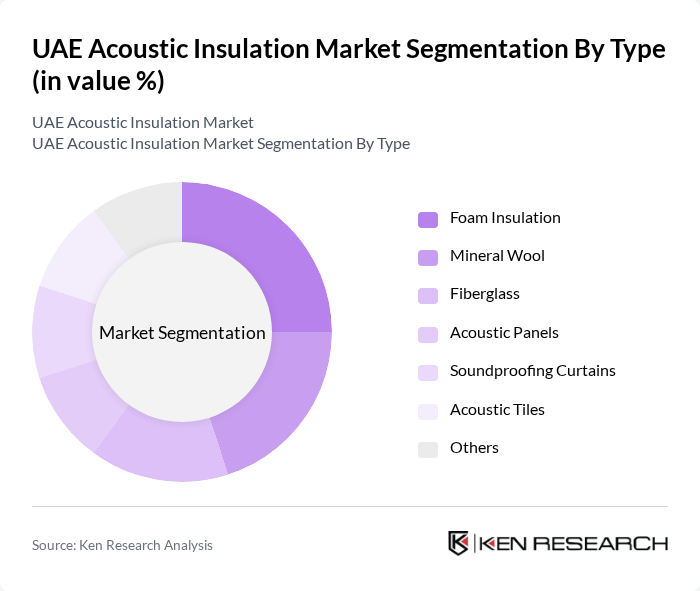

By Type:The market is segmented into various types of acoustic insulation materials, including Foam Insulation, Mineral Wool, Fiberglass, Acoustic Panels, Soundproofing Curtains, Acoustic Tiles, and Others. Each type serves specific applications and consumer needs, contributing to the overall market dynamics.

The Foam Insulation segment is currently dominating the market due to its lightweight properties, ease of installation, and effective sound absorption capabilities. This type of insulation is widely used in both residential and commercial applications, making it a preferred choice among consumers. Additionally, the growing trend of eco-friendly building materials has further propelled the demand for foam insulation, as manufacturers are increasingly offering sustainable options.

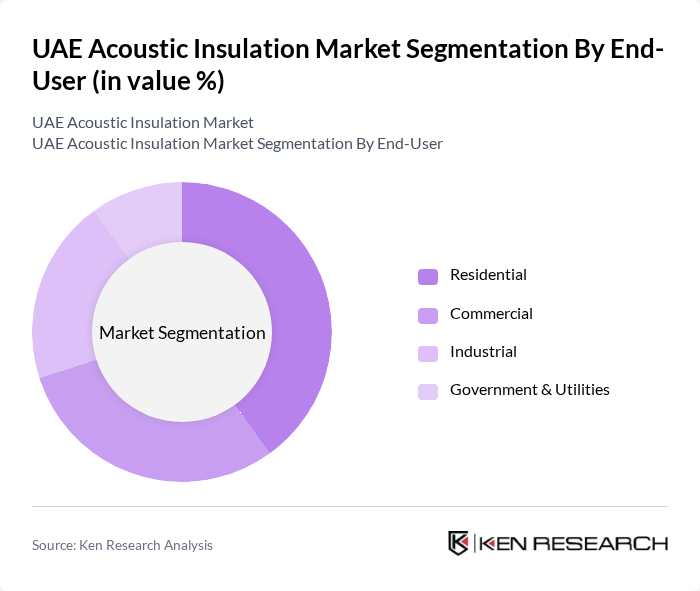

By End-User:The market is segmented based on end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and applications for acoustic insulation, influencing market trends and growth.

The Residential segment leads the market, driven by increasing consumer awareness regarding noise pollution and the desire for enhanced living conditions. Homeowners are increasingly investing in acoustic insulation solutions to improve comfort and privacy, particularly in urban areas where noise levels are high. This trend is further supported by government initiatives promoting sustainable living environments.

The UAE Acoustic Insulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rockwool International A/S, Saint-Gobain, Owens Corning, Knauf Insulation, BASF SE, Armacell International S.A., Johns Manville, 3M Company, Acoustical Surfaces, Inc., Soundproof Cow, Auralex Acoustics, Inc., Thermafiber, Inc., EcoBatt Insulation, QuietRock, Acoustics First Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The UAE acoustic insulation market is poised for significant growth as urbanization accelerates and noise pollution becomes a pressing concern. With government initiatives promoting sustainable construction, the integration of acoustic solutions in building designs is expected to rise. Additionally, advancements in materials technology will enhance the performance and appeal of acoustic insulation products. As awareness of acoustic comfort increases, the market is likely to see innovative solutions tailored to meet diverse consumer needs, fostering a more sound-friendly environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Foam Insulation Mineral Wool Fiberglass Acoustic Panels Soundproofing Curtains Acoustic Tiles Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | New Construction Renovation Soundproofing Acoustic Treatment |

| By Distribution Channel | Direct Sales Distributors Online Retail |

| By Material Source | Domestic Production Imports |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies Tax Exemptions Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Acoustic Insulation | 100 | Homeowners, Interior Designers |

| Commercial Building Insulation | 80 | Facility Managers, Architects |

| Industrial Soundproofing Solutions | 70 | Plant Managers, Safety Officers |

| Acoustic Panels and Products | 60 | Retail Buyers, Product Managers |

| Regulatory Compliance in Insulation | 50 | Building Inspectors, Compliance Officers |

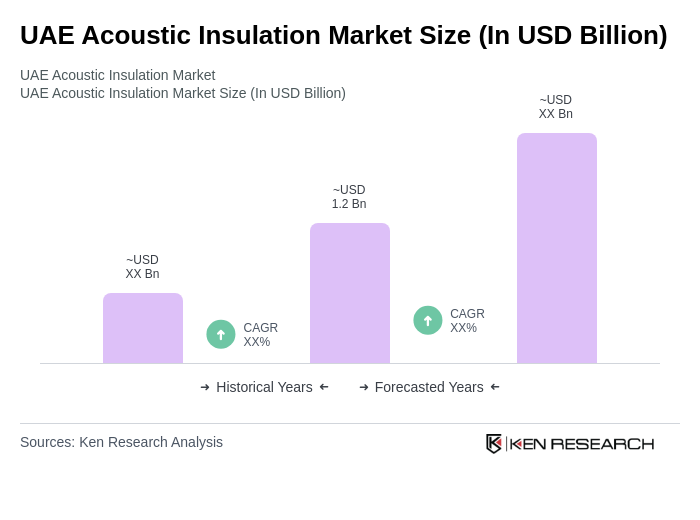

The UAE Acoustic Insulation Market is valued at approximately USD 1.2 billion, driven by rapid urbanization, increasing construction activities, and growing awareness of noise pollution among consumers, particularly in residential and commercial sectors.