Region:Middle East

Author(s):Shubham

Product Code:KRAB7295

Pages:100

Published On:October 2025

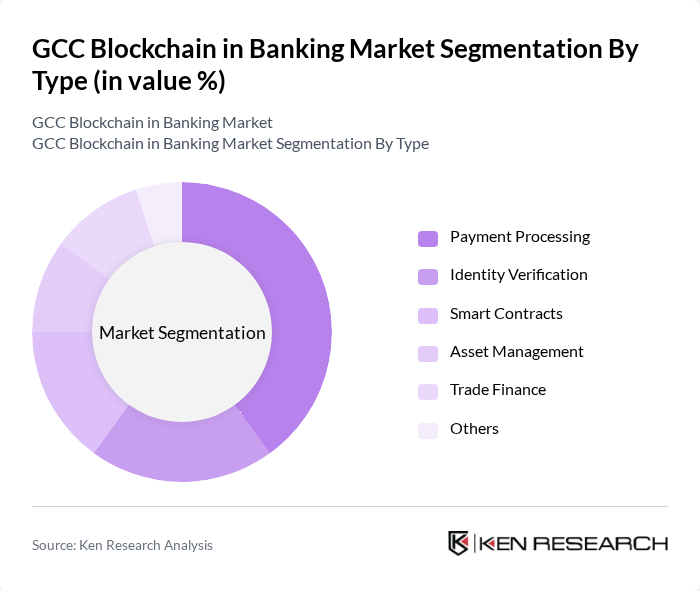

By Type:The market is segmented into various types, including Payment Processing, Identity Verification, Smart Contracts, Asset Management, Trade Finance, and Others. Among these, Payment Processing is the leading sub-segment, driven by the increasing demand for faster and more secure transaction methods. The rise of digital payments and the need for cross-border transactions have further solidified its dominance.

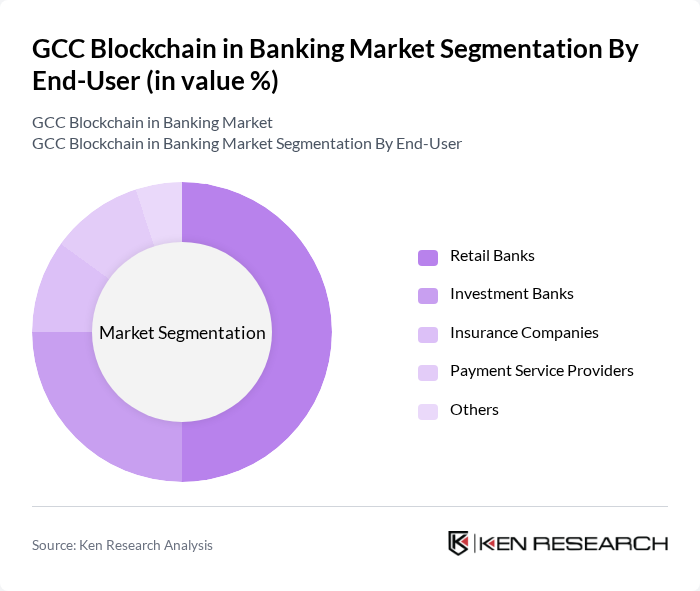

By End-User:The end-user segmentation includes Retail Banks, Investment Banks, Insurance Companies, Payment Service Providers, and Others. Retail Banks dominate this segment, as they are increasingly adopting blockchain technology to enhance customer experience and streamline operations. The growing trend of digital banking and the need for secure transactions have made retail banks the primary users of blockchain solutions.

The GCC Blockchain in Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Qatar National Bank, National Bank of Abu Dhabi, Saudi National Bank, Dubai Islamic Bank, Abu Dhabi Commercial Bank, Gulf Bank, Bank of Bahrain and Kuwait, Al Baraka Banking Group, Arab Bank, Mashreq Bank, First Abu Dhabi Bank, Kuwait Finance House, Qatar Islamic Bank, Bank Al Jazira contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC blockchain in banking market appears promising, driven by increasing regulatory support and technological advancements. As governments in the region implement frameworks to facilitate blockchain adoption, banks are likely to enhance their operational efficiencies and customer engagement. The rise of decentralized finance (DeFi) and the integration of smart contracts will further transform traditional banking models, fostering innovation and collaboration among financial institutions and fintech startups, ultimately reshaping the banking landscape in the GCC.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Processing Identity Verification Smart Contracts Asset Management Trade Finance Others |

| By End-User | Retail Banks Investment Banks Insurance Companies Payment Service Providers Others |

| By Application | Cross-Border Payments Fraud Prevention Regulatory Compliance Customer Onboarding Others |

| By Deployment Model | Public Blockchain Private Blockchain Hybrid Blockchain |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Investment Source | Venture Capital Government Funding Private Equity Crowdfunding |

| By Policy Support | Tax Incentives Grants for Innovation Regulatory Sandboxes Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Blockchain Applications | 100 | Retail Banking Managers, Digital Transformation Officers |

| Corporate Banking Innovations | 80 | Corporate Banking Executives, Risk Management Heads |

| Investment Banking Blockchain Solutions | 70 | Investment Analysts, Compliance Officers |

| Fintech Collaborations in Banking | 90 | Fintech Founders, Partnership Managers |

| Regulatory Impact on Blockchain Adoption | 60 | Regulatory Affairs Specialists, Legal Advisors |

The GCC Blockchain in Banking Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the adoption of blockchain technology to enhance security, transparency, and efficiency in banking operations across the region.