Region:Middle East

Author(s):Shubham

Product Code:KRAD5486

Pages:89

Published On:December 2025

By Type:The compostable multilayer films market can be segmented into four main types: High-Barrier Compostable Multilayer Films, Medium-Barrier Compostable Multilayer Films, Low-Barrier Compostable Multilayer Films, and Others (Specialty & Customized Structures). This classification aligns with how global compostable multilayer films are engineered for different oxygen, moisture, and aroma barrier requirements in food and non-food packaging. High-Barrier films are currently dominating the market due to their superior protective qualities, extended shelf-life performance for dry foods, snacks, coffee, pet food, and ready-to-eat products, and their ability to replace conventional high-barrier structures in pouches and lidding applications. The increasing demand for longer shelf life, reduction of food waste, and preservation of freshness in food products drives the preference for high-barrier solutions among manufacturers and consumers alike.

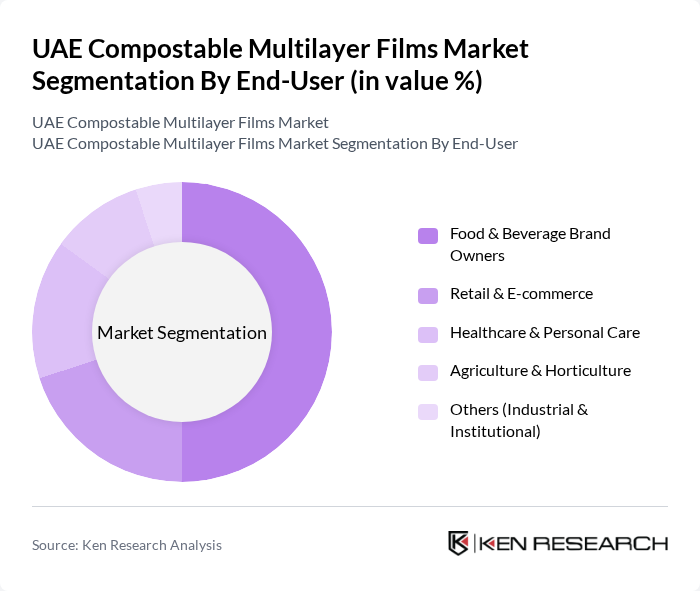

By End-User:The end-user segmentation includes Food & Beverage Brand Owners, Retail & E-commerce, Healthcare & Personal Care, Agriculture & Horticulture, and Others (Industrial & Institutional). Food & Beverage Brand Owners represent the leading end-user segment, consistent with global trends where food packaging accounts for more than half of compostable multilayer film demand, as brands substitute conventional plastic pouches, wraps, and lidding films with compostable options. This trend is further supported by regulatory and retailer sustainability requirements, ESG and circular packaging commitments of multinational FMCG companies operating in the UAE, and rising consumer preference for eco-friendly and certified compostable packaging in both modern retail and e?commerce channels.

The UAE Compostable Multilayer Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as TIPA Corp Ltd., BASF SE, Novamont S.p.A., NatureWorks LLC, UFlex Ltd., Amcor plc, Mondi Group, Smurfit Kappa Group plc, Sealed Air Corporation, Biome Bioplastics Ltd., Taghleef Industries LLC (Dubai), Hotpack Packaging Industries LLC (UAE), Rotopacking Materials Ind. LLC (UAE), Huhtamaki Flexible Packaging Middle East, BioBag International AS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE compostable multilayer films market appears promising, driven by increasing environmental regulations and consumer demand for sustainable products. As the government continues to implement stringent plastic bans and incentives for eco-friendly packaging, companies are likely to invest more in research and development. Additionally, the shift towards a circular economy will encourage innovation in biodegradable materials, positioning the UAE as a leader in sustainable packaging solutions in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | High-Barrier Compostable Multilayer Films Medium-Barrier Compostable Multilayer Films Low-Barrier Compostable Multilayer Films Others (Specialty & Customized Structures) |

| By End-User | Food & Beverage Brand Owners Retail & E-commerce Healthcare & Personal Care Agriculture & Horticulture Others (Industrial & Institutional) |

| By Application | Food Packaging (Snacks, Fresh Produce, Confectionery) Pouches, Sachets & Bags Labels & Wraps Agricultural & Mulch Films Others |

| By Material Composition | Starch-Based Blends PLA (Polylactic Acid) Multilayer Structures PHA (Polyhydroxyalkanoates) Multilayer Structures Cellulose & Paper-Based Composites Others (PBS, PBAT, Blends) |

| By Distribution Channel | Direct Sales to Converters & Brand Owners Specialized Sustainable Packaging Distributors Online B2B Platforms Others |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others (Ajman, Fujairah, Ras Al Khaimah, Umm Al Quwain) |

| By Regulatory Compliance | EN 13432 / ISO 17088-Compliant ASTM D6400 / D6868-Compliant UAE / GCC-Specific Compostability & Packaging Regulations Others (Private & Retailer Standards) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Manufacturers | 100 | Production Managers, Sustainability Officers |

| Retail Sector Users of Compostable Films | 80 | Procurement Managers, Store Operations Heads |

| Environmental NGOs and Advocacy Groups | 40 | Policy Analysts, Program Directors |

| Research Institutions Focused on Biodegradable Materials | 40 | Research Scientists, Academic Professors |

| Government Regulatory Bodies | 30 | Regulatory Affairs Specialists, Environmental Policy Makers |

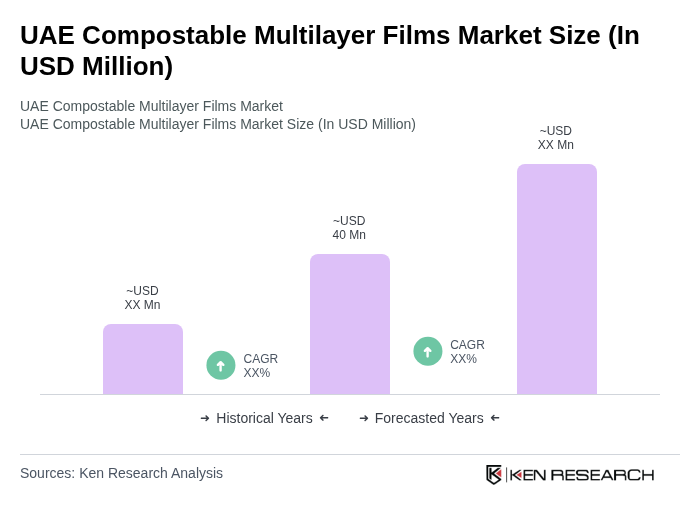

The UAE Compostable Multilayer Films Market is valued at approximately USD 40 million, reflecting a growing trend towards sustainable packaging solutions driven by consumer awareness and corporate sustainability commitments across various sectors.