Region:Middle East

Author(s):Rebecca

Product Code:KRAA9289

Pages:100

Published On:November 2025

Market.png)

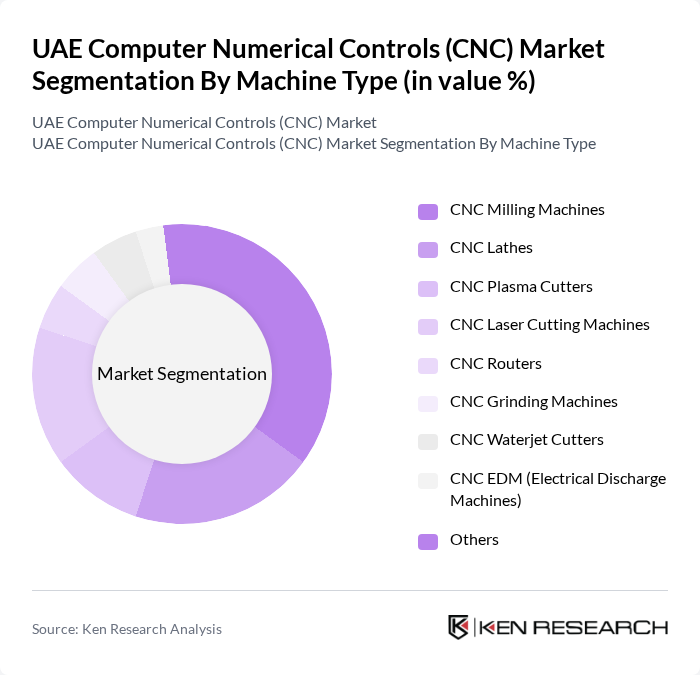

By Machine Type:

The CNC market is segmented by machine type into several categories, including CNC Milling Machines, CNC Lathes, CNC Plasma Cutters, CNC Laser Cutting Machines, CNC Routers, CNC Grinding Machines, CNC Waterjet Cutters, CNC EDM (Electrical Discharge Machines), and Others. Among these, CNC Milling Machines dominate the market due to their versatility and widespread application in various industries, including aerospace and automotive. The increasing need for precision machining and the ability to handle complex geometries make CNC Milling Machines a preferred choice for manufacturers. The adoption of multi-axis and high-speed milling solutions, along with the growing trend of customization in production processes, further supports the demand for these machines .

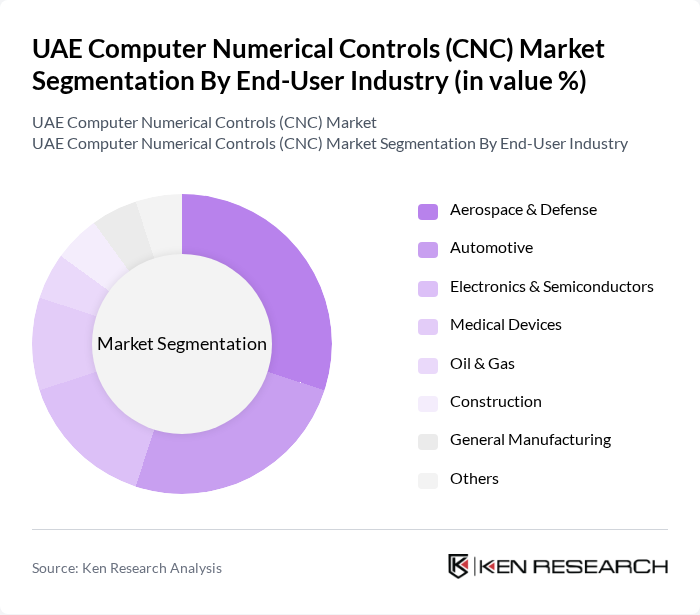

By End-User Industry:

The CNC market is also segmented by end-user industry, which includes Aerospace & Defense, Automotive, Electronics & Semiconductors, Medical Devices, Oil & Gas, Construction, General Manufacturing, and Others. The Aerospace & Defense sector is a significant contributor to the CNC market, driven by the need for high-precision components and parts. The automotive industry follows closely, as manufacturers increasingly adopt CNC technology to enhance production efficiency and meet stringent quality standards. The growing demand for advanced medical devices and components further propels the market, as CNC machines are essential for producing intricate parts with high accuracy. The electronics and semiconductor industry is also a key growth driver, reflecting the UAE’s focus on high-tech manufacturing and export-oriented production .

The UAE Computer Numerical Controls (CNC) Market is characterized by a dynamic mix of regional and international players. Leading participants such as DMG MORI, Haas Automation, Mazak Corporation, Siemens AG, FANUC Corporation, Mitsubishi Electric, Okuma Corporation, Hurco Companies, Inc., EMCO Group, KUKA AG, Yaskawa Electric Corporation, Schuler AG, TRUMPF GmbH + Co. KG, Biesse Group, JTEKT Corporation, Hexagon AB, Sandvik AB, Doosan Machine Tools, Hyundai WIA, Gulf Industrial Machinery Co. LLC (UAE), Al Ghurair Manufacturing (UAE), Al-Futtaim Engineering (UAE), Global Surfaces FZE (UAE), Al Shirawi Equipment Company LLC (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE CNC market appears promising, driven by technological advancements and increased automation across various sectors. As industries embrace Industry 4.0 principles, the integration of IoT and AI into CNC systems will enhance operational efficiency and predictive maintenance capabilities. Furthermore, the government's commitment to diversifying the economy and investing in advanced manufacturing technologies will likely create a conducive environment for sustained growth in the CNC sector, fostering innovation and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Machine Type | CNC Milling Machines CNC Lathes CNC Plasma Cutters CNC Laser Cutting Machines CNC Routers CNC Grinding Machines CNC Waterjet Cutters CNC EDM (Electrical Discharge Machines) Others |

| By End-User Industry | Aerospace & Defense Automotive Electronics & Semiconductors Medical Devices Oil & Gas Construction General Manufacturing Others |

| By Application | Metal Fabrication Prototyping Tool & Die Making Component Manufacturing Others |

| By Material Type | Metals (Steel, Aluminum, Titanium, etc.) Plastics Composites Wood Others |

| By Technology | Axis CNC Axis CNC Axis CNC Hybrid CNC Advanced CNC (IoT-enabled, Cloud-based, etc.) Others |

| By Distribution Channel | Direct Sales Authorized Distributors Online Sales System Integrators Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al-Quwain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Manufacturing | 60 | Production Managers, Quality Assurance Engineers |

| Automotive Component Production | 50 | Operations Directors, Supply Chain Managers |

| Metal Fabrication Services | 55 | Workshop Supervisors, CNC Operators |

| Electronics Manufacturing | 40 | Technical Leads, Product Development Engineers |

| General Manufacturing Sector | 45 | Plant Managers, Maintenance Supervisors |

The UAE Computer Numerical Controls (CNC) market is valued at approximately USD 190 million, reflecting a significant growth trend driven by increased automation in manufacturing and advancements in technology across various sectors.