Region:Middle East

Author(s):Rebecca

Product Code:KRAD1380

Pages:82

Published On:November 2025

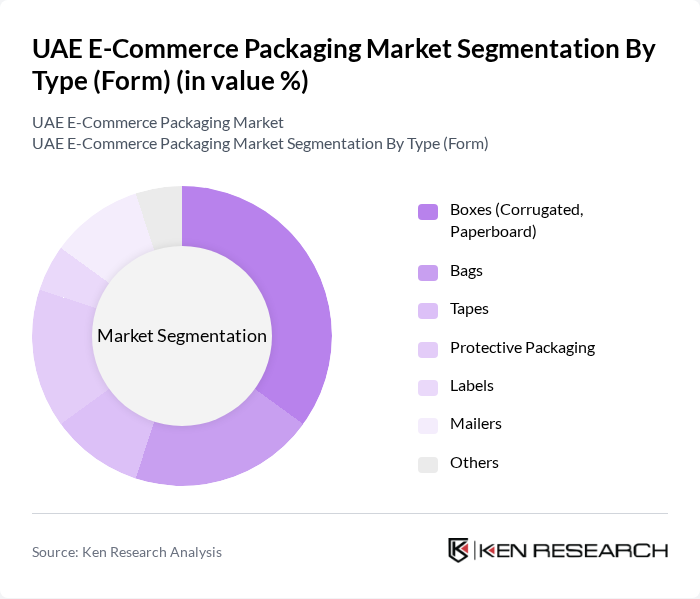

By Type (Form):The segmentation by type includes various forms of packaging used in e-commerce, such as boxes, bags, tapes, protective packaging, labels, mailers, and others. Each of these sub-segments plays a crucial role in ensuring the safe delivery of products to consumers, with boxes and mailers particularly favored for their protective qualities and adaptability to a wide range of product categories .

The boxes segment, particularly corrugated and paperboard boxes, dominates the market due to their versatility, strength, and cost-effectiveness. They are widely used for shipping a variety of products, providing excellent protection during transit. The increasing trend of online shopping has led to a higher demand for boxes, as they are essential for packaging and delivering goods safely. Additionally, the eco-friendly nature of paperboard boxes aligns with the growing consumer preference for sustainable packaging solutions .

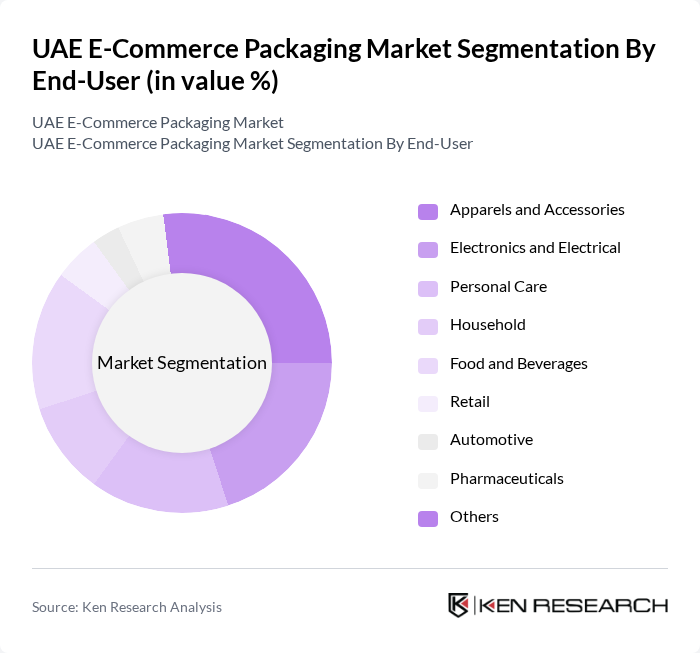

By End-User:The end-user segmentation includes various industries that utilize e-commerce packaging, such as apparels and accessories, electronics and electrical, personal care, household, food and beverages, retail, automotive, pharmaceuticals, and others. Each sector has unique packaging requirements based on the nature of the products being shipped, with apparel and electronics demanding visually appealing and protective solutions to enhance the consumer experience and minimize returns .

The apparels and accessories segment leads the market due to the high volume of online clothing sales. This sector requires diverse packaging solutions that are not only protective but also visually appealing to enhance the unboxing experience. The growth of fashion e-commerce platforms has significantly increased the demand for specialized packaging that caters to the unique needs of clothing and accessories, making it a key driver in the e-commerce packaging market .

The UAE E-Commerce Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Bayader International, Gulf East Paper and Plastic Industries LLC, Hotpack Packaging Industries LLC, Falcon Pack, Arabian Packaging Co. LLC, Emirates Printing Press LLC, Al Khat Packaging LLC, Al Masah Paper Industries LLC, United Carton Industries Company (UCIC), Al Taqnyah Paper and Packaging LLC, Printopack Packaging Industries LLC, Al Jazeera International Catering LLC (Packaging Division), Al Fajer Establishment (Packaging Division), Al Khaimah Packaging, and Emirates Packaging contribute to innovation, geographic expansion, and service delivery in this space.

The UAE e-commerce packaging market is poised for significant transformation, driven by the increasing emphasis on sustainability and technological integration. As consumer preferences shift towards eco-friendly solutions, businesses will need to innovate continuously to meet these demands. Additionally, the rise of smart packaging technologies will enhance operational efficiencies and customer engagement. With government support for e-commerce growth, the market is expected to evolve rapidly, presenting new opportunities for businesses to thrive in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type (Form) | Boxes (Corrugated, Paperboard) Bags Tapes Protective Packaging Labels Mailers Others |

| By End-User | Apparels and Accessories Electronics and Electrical Personal Care Household Food and Beverages Retail Automotive Pharmaceuticals Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales B2B Sales Others |

| By Material | Plastics Corrugated Board Paper & Paperboard Glass Others |

| By Size | Small Medium Large Custom Sizes Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Application | Shipping and Logistics Retail Packaging Industrial Packaging E-commerce Fulfillment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retail Packaging Solutions | 120 | Packaging Managers, E-commerce Directors |

| Consumer Electronics Packaging | 90 | Product Managers, Supply Chain Analysts |

| Food & Beverage E-commerce Packaging | 60 | Quality Assurance Managers, Operations Supervisors |

| Fashion & Apparel Packaging Trends | 50 | Brand Managers, Sustainability Coordinators |

| Logistics and Distribution Packaging Insights | 70 | Logistics Coordinators, Warehouse Managers |

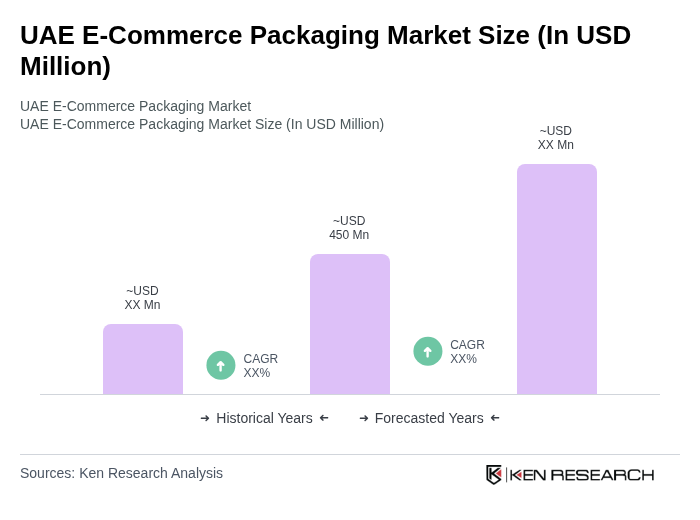

The UAE E-Commerce Packaging Market is valued at approximately USD 450 million, driven by the rapid growth of the e-commerce sector, increased consumer demand for online shopping, and the need for sustainable packaging solutions.