Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3282

Pages:95

Published On:September 2025

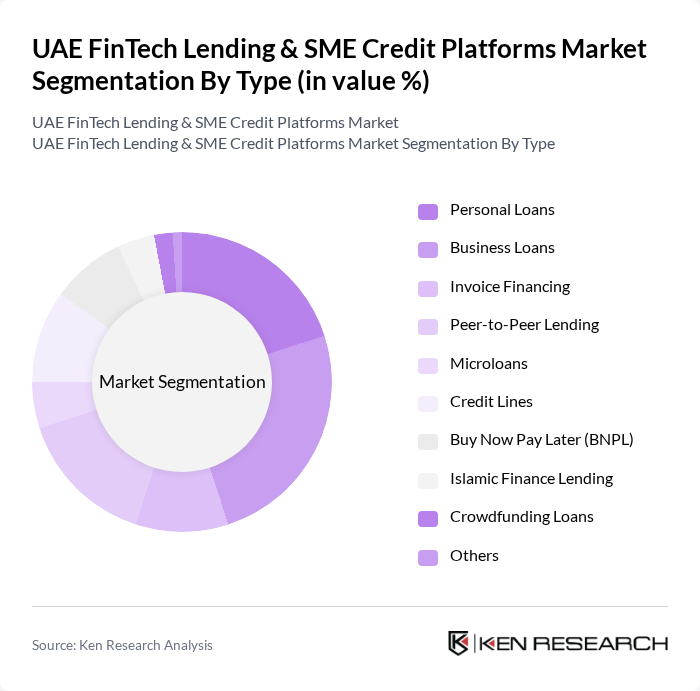

By Type:The market is segmented into various types of lending solutions, each catering to different borrower needs. Personal loans are popular among individual consumers seeking quick access to funds, while business loans are essential for SMEs looking to expand operations. Invoice financing and peer-to-peer lending have gained traction due to their flexibility and lower barriers to entry. Microloans and credit lines are also significant, providing tailored solutions for startups and small enterprises. The Buy Now Pay Later (BNPL) model has emerged as a preferred choice for consumers, allowing them to make purchases without immediate payment. Islamic finance lending is increasingly relevant in the UAE, aligning with the region's cultural and religious values. Crowdfunding loans are also on the rise, enabling collective funding for various projects .

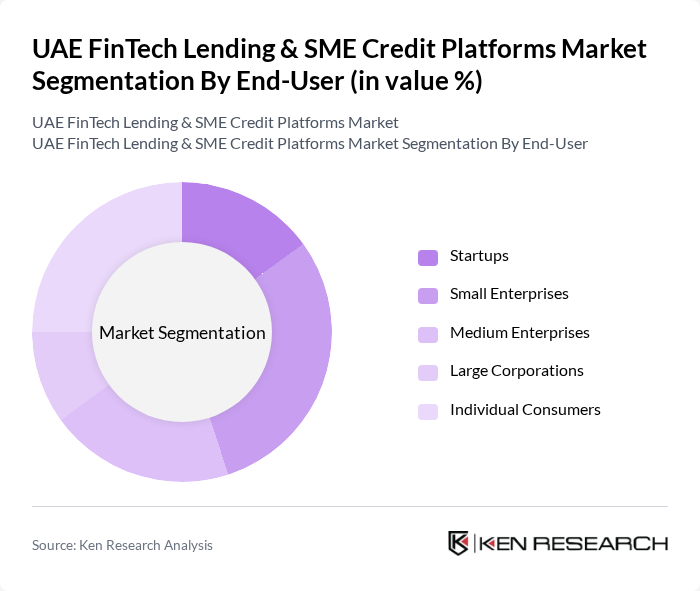

By End-User:The end-user segmentation highlights the diverse range of borrowers utilizing FinTech lending solutions. Startups are increasingly leveraging these platforms for initial funding, while small and medium enterprises (SMEs) are the primary users of business loans to support growth and operational needs. Large corporations also participate, albeit to a lesser extent, as they often have access to traditional financing. Individual consumers represent a significant portion of the market, seeking personal loans for various purposes. The demand from these segments reflects the evolving landscape of financing in the UAE .

The UAE FinTech Lending & SME Credit Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tabby, Tamara, Beehive, YallaCompare, FinTech Galaxy, Zand, RAKBANK, Emirates NBD, Abu Dhabi Commercial Bank, Dubai Islamic Bank, Noor Bank, Qarar, PayFort (Amazon Payment Services), LendingTree UAE, Aafaq Islamic Finance, Commercial Bank of Dubai, National Bank of Fujairah, Mashreq Bank, Dubai SME, EdfaPay contribute to innovation, geographic expansion, and service delivery in this space.

The UAE FinTech lending landscape is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital payment solutions expand, the integration of AI and machine learning will enhance credit assessment processes, making lending more accessible. Additionally, the government's continued support for SMEs will likely foster innovation, encouraging new entrants to develop tailored financial products that meet the unique needs of diverse business sectors, ultimately driving economic growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Invoice Financing Peer-to-Peer Lending Microloans Credit Lines Buy Now Pay Later (BNPL) Islamic Finance Lending Crowdfunding Loans Others |

| By End-User | Startups Small Enterprises Medium Enterprises Large Corporations Individual Consumers |

| By Industry | Retail Manufacturing Services Technology Healthcare Construction Logistics & Transportation Others |

| By Loan Amount | Under AED 50,000 AED 50,000 - AED 200,000 AED 200,000 - AED 500,000 Over AED 500,000 |

| By Loan Duration | Short-term Loans Medium-term Loans Long-term Loans |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Financial Institutions Embedded Finance (APIs/Open Banking) |

| By Customer Segment | Individual Borrowers Business Borrowers Institutional Borrowers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| FinTech Lending Platforms | 60 | CEOs, Product Managers, Risk Analysts |

| SME Owners Seeking Credit | 120 | Business Owners, Financial Managers, Accountants |

| Financial Advisors in SME Sector | 50 | Financial Consultants, Investment Advisors |

| Regulatory Bodies and Financial Institutions | 40 | Policy Makers, Compliance Officers, Economic Analysts |

| Industry Experts and Analysts | 45 | Market Analysts, Economic Researchers, FinTech Experts |

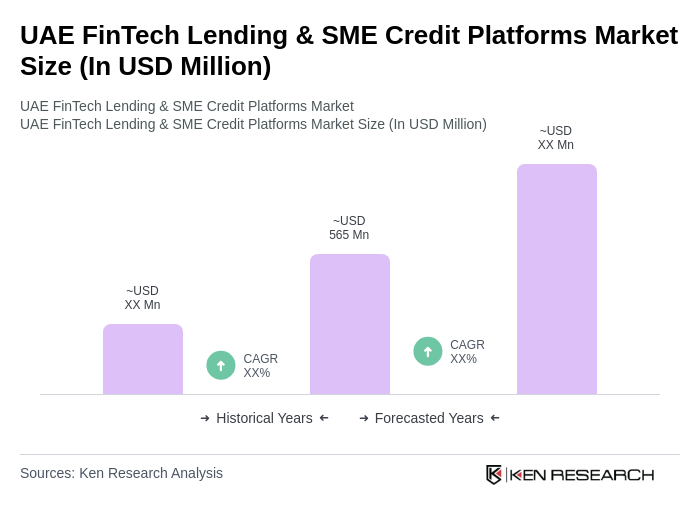

The UAE FinTech Lending & SME Credit Platforms Market is valued at approximately USD 565 million, reflecting significant growth driven by the demand for alternative financing solutions and the rapid digital transformation in financial services.