Region:Middle East

Author(s):Dev

Product Code:KRAD0395

Pages:92

Published On:August 2025

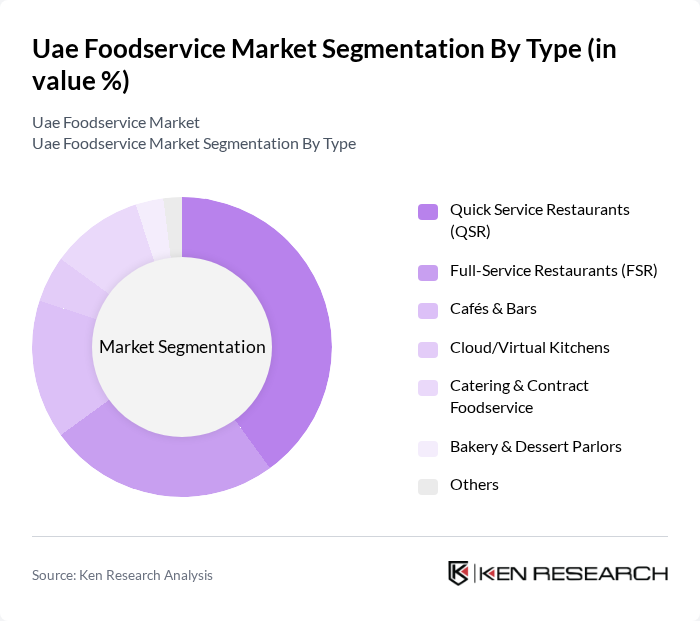

By Type:The foodservice market can be segmented into various types, including Quick Service Restaurants (QSR), Full-Service Restaurants (FSR), Cafés & Bars, Cloud/Virtual Kitchens, Catering & Contract Foodservice, Bakery & Dessert Parlors, and Others. Each of these segments caters to different consumer preferences and dining experiences. The QSR segment is particularly dominant within chained formats due to the increasing demand for fast, convenient meal options and the strong footprint of global brands; however, full-service restaurants account for the largest share of total sector sales when measured by value, followed by cafés and bars .

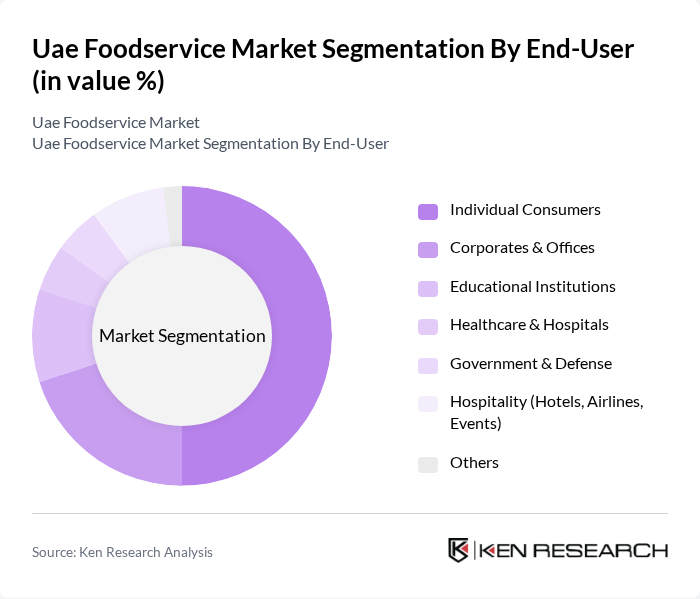

By End-User:The end-user segmentation includes Individual Consumers, Corporates & Offices, Educational Institutions, Healthcare & Hospitals, Government & Defense, Hospitality (Hotels, Airlines, Events), and Others. The Individual Consumers segment is the largest, driven by the growing trend of dining out, the rapid rise of app-based delivery platforms, and the breadth of independent and chained outlets serving resident and tourist demand .

The UAE Foodservice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Americana Restaurants (KFC, Pizza Hut, Hardee’s, Krispy Kreme), Emirates Fast Food Company LLC (McDonald’s UAE), Al Baik UAE, Alshaya Group (Starbucks, Shake Shack, The Cheesecake Factory), Tim Hortons UAE (AG Café, Apparel Group JV), Dunkin’ UAE (Novo Cinemas Food & Beverage/Pragma with Bateel-affiliated operators), Costa Coffee UAE (Emirates Leisure Retail), Subway UAE (Franchise Brands Middle East/KEI), Nando’s UAE (Alshaya-operated), Papa Johns UAE (PJP Investments Group), Chili’s UAE (Cravia Group), Five Guys UAE (Rise LLC), P.F. Chang’s UAE (Alshaya Group), Black Tap UAE (Sunset Hospitality Group), Bateel Café contribute to innovation, geographic expansion, and service delivery in this space .

The UAE foodservice market is poised for continued growth, driven by urbanization, rising incomes, and a thriving tourism sector. As consumer preferences evolve towards healthier and sustainable dining options, foodservice operators are likely to adapt their offerings accordingly. Additionally, technological advancements in ordering and delivery services will enhance customer experiences. The market will also see increased investment in innovative dining concepts, such as food halls and ghost kitchens, catering to the changing landscape of consumer behavior.

| Segment | Sub-Segments |

|---|---|

| By Type | Quick Service Restaurants (QSR) Full-Service Restaurants (FSR) Cafés & Bars Cloud/Virtual Kitchens Catering & Contract Foodservice Bakery & Dessert Parlors Others |

| By End-User | Individual Consumers Corporates & Offices Educational Institutions Healthcare & Hospitals Government & Defense Hospitality (Hotels, Airlines, Events) Others |

| By Sales Channel | Dine-In Takeaway/Counter Pickup Online Delivery (Aggregator & Direct) Catering/Institutional Contracts Others |

| By Cuisine Type | Emirati & Middle Eastern Asian (Indian, Chinese, Japanese, Korean, Southeast Asian) Western (American, European) Fast Food & Quick Bites Healthy/Functional & Plant-Based Others |

| By Price Range | Budget Mid-Range Premium Luxury/Fine Dining Others |

| By Location | Malls & Retail Districts Standalone High-Street Leisure & Tourist Areas Travel Hubs (Airports, Metro, Fuel Stations) Residential & Community Areas Others |

| By Service Type | Table Service Self-Service Delivery-Only Buffet/All-You-Can-Eat Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Quick Service Restaurants | 150 | Franchise Owners, Store Managers |

| Full Service Restaurants | 100 | Restaurant Managers, Executive Chefs |

| Catering Services | 80 | Catering Managers, Event Coordinators |

| Food Delivery Services | 100 | Operations Managers, Marketing Directors |

| Food Trucks and Mobile Vendors | 60 | Owner-Operators, Business Development Managers |

The UAE Foodservice Market is valued at approximately USD 12 billion, driven by factors such as a rising population, increasing disposable incomes, and a growing preference for dining out, alongside the expansion of branded chains and digital ordering adoption.