Qatar Green Hydrogen Market Overview

- The Qatar Green Hydrogen Market is valued at USD 15 million, based on a five-year historical analysis. This growth is primarily driven by the country's commitment to diversifying its energy sources and reducing carbon emissions. The increasing global demand for clean energy solutions and the strategic investments in renewable energy infrastructure, such as the Al Kharsaah Solar PV Plant and pilot hydrogen projects, have significantly contributed to the market's expansion .

- Key players in this market include QatarEnergy, Qatargas, and Qatar Solar Technologies, alongside major international firms such as Air Products and Chemicals, Inc., Linde plc, Siemens Energy, TotalEnergies, ENGIE, Thyssenkrupp, Masdar, and ACWA Power. Qatar's competitive position in the green hydrogen market is supported by its abundant solar resources, advanced energy infrastructure, and strong government support for renewable energy initiatives. The country's established LNG export network and strategic location also facilitate access to international markets, enhancing its competitive edge .

- In 2023, the State of Qatar introduced the “National Hydrogen Strategy 2023” issued by the Ministry of Energy Affairs. This binding instrument sets out operational targets for green hydrogen production and consumption, mandates compliance with international safety and environmental standards, and provides fiscal incentives for private sector investment in hydrogen technologies. The framework covers licensing requirements for hydrogen projects, minimum renewable energy thresholds for green hydrogen certification, and reporting obligations for producers .

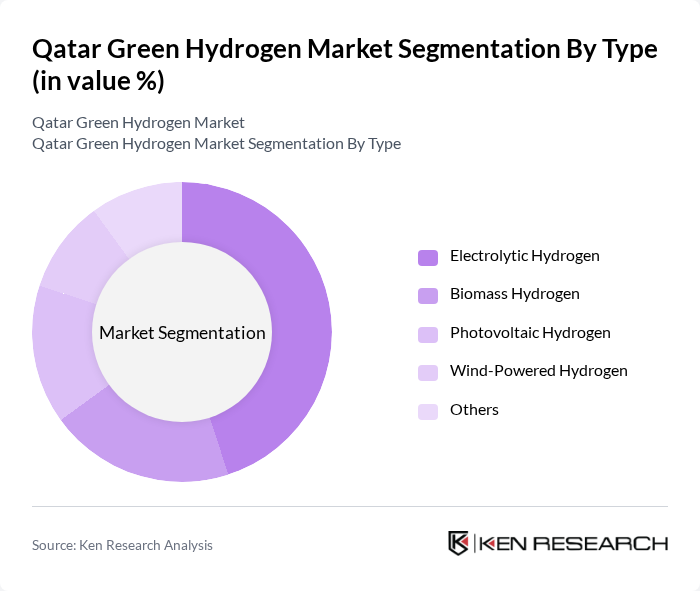

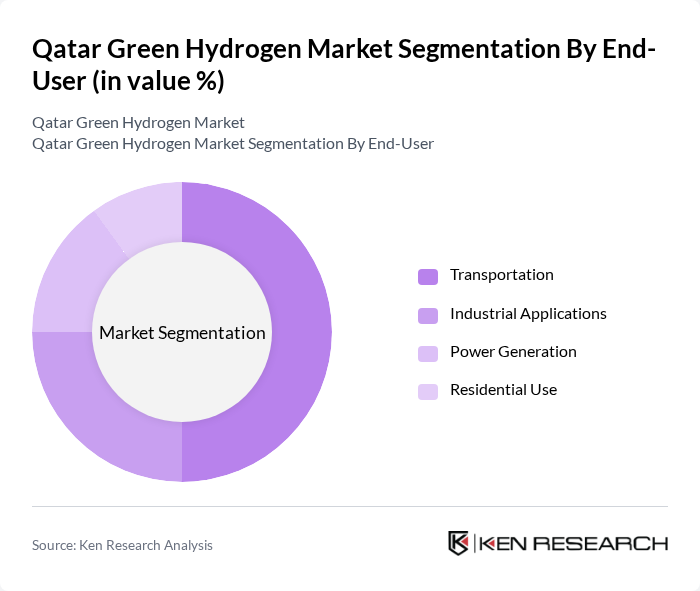

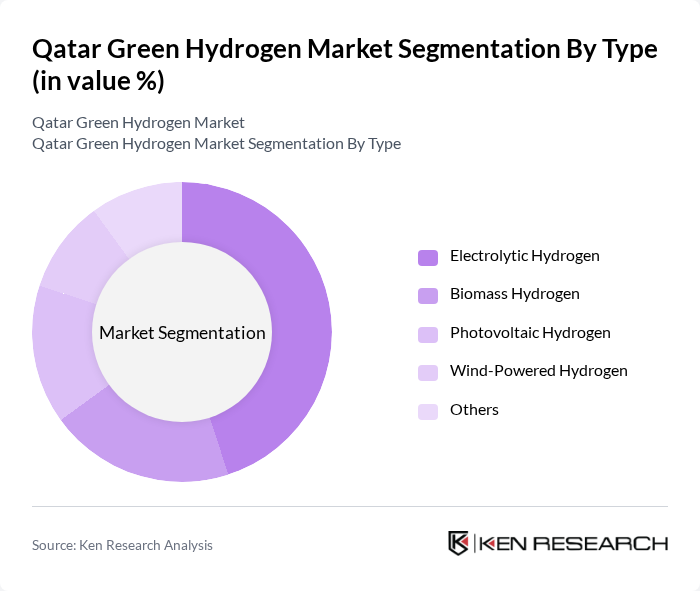

Qatar Green Hydrogen Market Segmentation

By Type:The market is segmented into various types of hydrogen production methods, including Electrolytic Hydrogen, Biomass Hydrogen, Photovoltaic Hydrogen, Wind-Powered Hydrogen, and Others. Among these, Electrolytic Hydrogen is currently the leading sub-segment due to its efficiency and scalability, driven by advancements in electrolyzer technology and increasing investments in renewable energy sources. The growing demand for clean energy solutions in industrial and transport sectors further supports the dominance of this sub-segment .

By End-User:The end-user segmentation includes Transportation, Industrial Applications, Power Generation, and Residential Use. The Transportation sector is the most significant end-user of green hydrogen, driven by the increasing adoption of hydrogen fuel cell vehicles, government initiatives to decarbonize public and commercial transport, and the global push for sustainable mobility solutions. Industrial applications are also a major segment, with hydrogen being used for refining, chemical production, and heavy industry .

Qatar Green Hydrogen Market Competitive Landscape

The Qatar Green Hydrogen Market is characterized by a dynamic mix of regional and international players. Leading participants such as QatarEnergy, Qatargas, Qatar Solar Technologies, Qatar University, Air Products and Chemicals, Inc., Linde plc, Siemens Energy, TotalEnergies, ENGIE, Thyssenkrupp, Masdar, ACWA Power, Shell, BP, ADNOC / Fertiglobe contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Green Hydrogen Market Industry Analysis

Growth Drivers

- Increasing Demand for Renewable Energy:The global shift towards renewable energy sources is driving Qatar's green hydrogen market. In future, Qatar aims to increase its renewable energy capacity to approximately 20% of its total energy mix, translating to around 3,600 MW. This demand is fueled by international commitments to reduce carbon emissions, with Qatar's National Vision 2030 emphasizing sustainability and energy diversification, positioning green hydrogen as a key player in meeting these targets.

- Government Initiatives and Investments:The Qatari government has committed over $1.5 billion to develop green hydrogen projects in future, aiming to establish Qatar as a leading hydrogen producer. This includes the implementation of the National Hydrogen Strategy, which outlines plans for infrastructure development and regulatory frameworks. Such initiatives are expected to attract foreign investments, with projections indicating that the hydrogen sector could create around 15,000 jobs in the next five years, bolstering economic growth.

- Technological Advancements in Hydrogen Production:Qatar is investing in cutting-edge technologies for hydrogen production, particularly electrolysis, which is projected to reduce production costs by 25% in future. The integration of renewable energy sources, such as solar and wind, into hydrogen production processes is expected to enhance efficiency. With a focus on innovation, Qatar aims to leverage its technological capabilities to become a competitive player in the global hydrogen market, potentially producing 2 million tons of green hydrogen annually.

Market Challenges

- High Initial Investment Costs:The high capital expenditure required for green hydrogen projects poses a significant challenge. Initial investments for establishing hydrogen production facilities can exceed $600 million, which may deter potential investors. Additionally, the cost of renewable energy technologies and infrastructure development further complicates financial viability. As a result, securing funding and achieving cost competitiveness remain critical hurdles for the market's growth in Qatar.

- Limited Infrastructure for Hydrogen Distribution:Qatar currently lacks a comprehensive infrastructure for hydrogen distribution, which hampers market development. The absence of pipelines and refueling stations limits the accessibility of green hydrogen for end-users, particularly in transportation and industrial applications. To address this challenge, significant investments in infrastructure are necessary, with estimates suggesting that an additional $400 million will be required to establish a robust hydrogen distribution network in future.

Qatar Green Hydrogen Market Future Outlook

The future of Qatar's green hydrogen market appears promising, driven by increasing global demand for clean energy solutions and the country's strategic investments in renewable technologies. In future, Qatar is expected to enhance its hydrogen production capabilities significantly, positioning itself as a key exporter in the global market. Continued collaboration with international energy firms and advancements in hydrogen technologies will further solidify Qatar's role in the transition to a sustainable energy landscape, fostering economic growth and job creation.

Market Opportunities

- Export Potential to Global Markets:Qatar's strategic location and abundant renewable resources present significant export opportunities for green hydrogen. In future, the country aims to export up to 1.5 million tons of hydrogen annually, targeting markets in Europe and Asia, where demand for clean energy is surging. This potential can enhance Qatar's trade balance and establish it as a global hydrogen hub.

- Collaboration with International Energy Firms:Partnerships with global energy companies can accelerate the development of Qatar's hydrogen sector. Collaborations are expected to bring in advanced technologies and expertise, facilitating the establishment of efficient production and distribution systems. In future, such alliances could lead to joint ventures worth over $600 million, enhancing Qatar's competitiveness in the international hydrogen market.