Region:Middle East

Author(s):Dev

Product Code:KRAE0118

Pages:97

Published On:December 2025

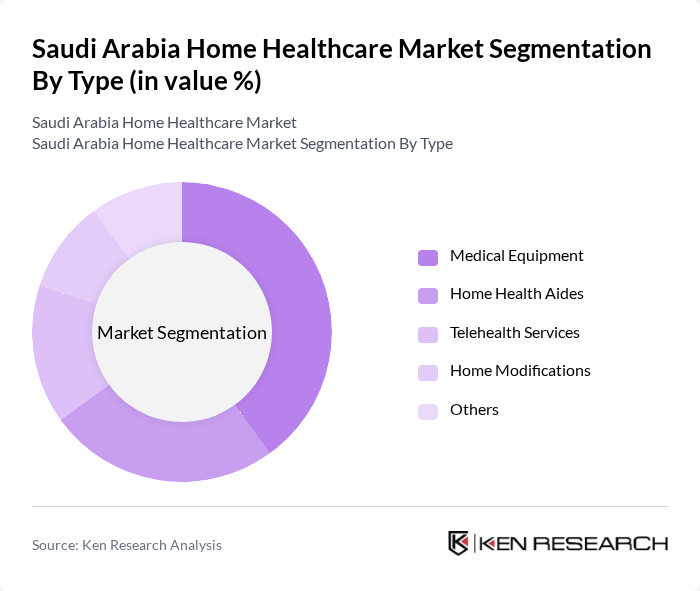

By Type:The home healthcare market in Saudi Arabia is segmented into various types, including Medical Equipment, Home Health Aides, Telehealth Services, Home Modifications, and Others. Among these, Medical Equipment is the leading subsegment, driven by the increasing demand for advanced medical devices and monitoring systems that facilitate at-home care. The growing elderly population and the rise in chronic diseases further bolster the need for effective medical equipment in home settings.

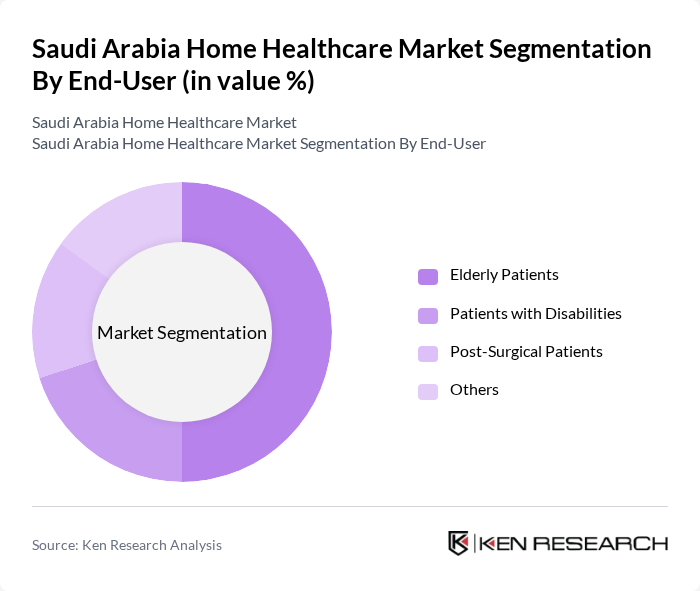

By End-User:The end-user segmentation of the home healthcare market includes Elderly Patients, Patients with Disabilities, Post-Surgical Patients, and Others. The Elderly Patients segment dominates the market, primarily due to the increasing aging population in Saudi Arabia. This demographic shift necessitates more personalized and accessible healthcare solutions, leading to a higher demand for home healthcare services tailored to the needs of elderly individuals.

The Saudi Arabia Home Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Home Healthcare Saudi Arabia, Al Nahdi Medical Company, Dallah Healthcare Company, Al-Faisal Holding, Saudi German Hospital, Al-Muhaidib Group, Al-Hokair Group, Al-Jazeera Healthcare, Al-Mawashi Company, Al-Salam International Hospital, Al-Muhaidib Medical Company, Al-Mansour Medical Company, Al-Muhaidib Healthcare, Al-Muhaidib Home Care, Al-Muhaidib Telehealth Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the home healthcare market in Saudi Arabia appears promising, driven by demographic changes and technological advancements. As the population ages and chronic diseases become more prevalent, the demand for home healthcare services is expected to rise significantly. Additionally, the integration of telehealth and AI technologies will enhance service delivery, making healthcare more accessible. The government's commitment to improving healthcare infrastructure will further support market growth, ensuring that home healthcare becomes a vital component of the national health strategy.

| Segment | Sub-Segments |

|---|---|

| By Type | Medical Equipment Home Health Aides Telehealth Services Home Modifications Others |

| By End-User | Elderly Patients Patients with Disabilities Post-Surgical Patients Others |

| By Service Type | Skilled Nursing Care Physical Therapy Occupational Therapy Others |

| By Technology | Remote Patient Monitoring Mobile Health Applications Wearable Health Devices Others |

| By Payment Model | Private Pay Insurance Reimbursement Government Funding Others |

| By Geographic Distribution | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Subsidies for Home Healthcare Services Tax Incentives for Providers Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Healthcare Service Providers | 100 | Healthcare Administrators, Service Managers |

| Patients Receiving Home Care | 150 | Patients, Family Caregivers |

| Healthcare Professionals (Nurses, Therapists) | 80 | Nurses, Physical Therapists, Occupational Therapists |

| Insurance Companies Offering Home Care Coverage | 60 | Insurance Underwriters, Claims Adjusters |

| Policy Makers in Healthcare | 50 | Health Policy Analysts, Government Officials |

The Saudi Arabia Home Healthcare Market is valued at approximately USD 4,215 million. This growth is attributed to the rising prevalence of chronic diseases, an increasing elderly population, and advancements in telehealth and remote monitoring technologies.