Region:Middle East

Author(s):Rebecca

Product Code:KRAE0860

Pages:83

Published On:December 2025

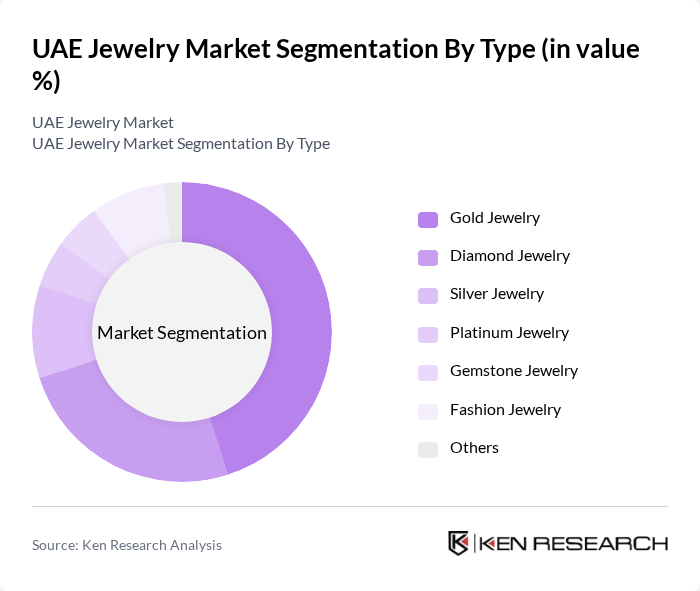

By Type:The jewelry market is segmented into various types, including Gold Jewelry, Diamond Jewelry, Silver Jewelry, Platinum Jewelry, Gemstone Jewelry, Fashion Jewelry, and Others. Among these, Gold Jewelry remains the dominant segment due to its cultural significance and investment value in the UAE. The preference for gold is deeply rooted in local traditions, making it a staple for both personal adornment and gifting during special occasions.

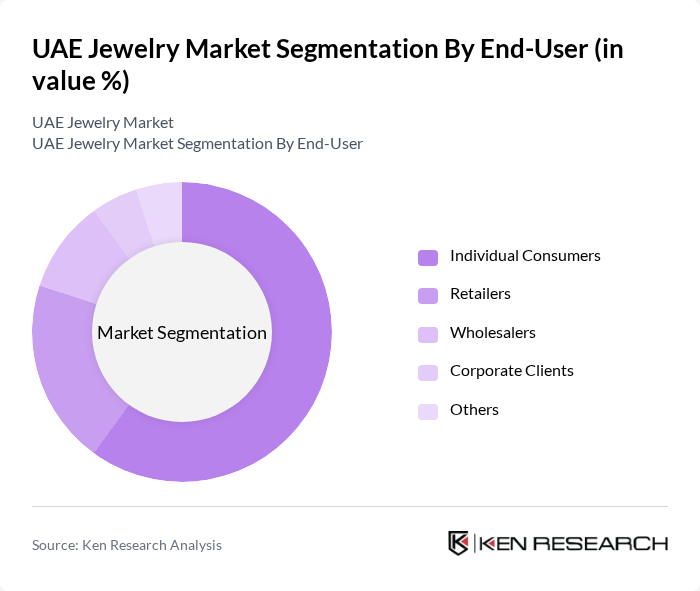

By End-User:The end-user segmentation includes Individual Consumers, Retailers, Wholesalers, Corporate Clients, and Others. Individual Consumers dominate the market, driven by personal purchases for adornment and gifting. The growing trend of online shopping has also empowered individual consumers, allowing them to access a wider range of products and brands, thus enhancing their purchasing power and preferences.

The UAE Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Jewelry, Damas Jewelry, Joyalukkas, Malabar Gold & Diamonds, Pure Gold Jewellers, Tiffany & Co., Cartier, Van Cleef & Arpels, Chopard, Bvlgari, Gold & Diamond Park, Al Zain Jewelry, Liali Jewelry, Samra Jewelry, and Al Khaimah Jewelry contribute to innovation, geographic expansion, and service delivery in this space.

The UAE jewelry market is poised for continued growth, driven by rising disposable incomes and a thriving tourism sector. As consumer preferences evolve, brands are expected to adapt by incorporating sustainable practices and innovative designs. The increasing integration of technology in retail, such as augmented reality for virtual try-ons, will enhance customer experiences. Additionally, the demand for personalized jewelry is likely to rise, reflecting a shift towards unique, custom pieces that resonate with individual consumer identities.

| Segment | Sub-Segments |

|---|---|

| By Type | Gold Jewelry Diamond Jewelry Silver Jewelry Platinum Jewelry Gemstone Jewelry Fashion Jewelry Others |

| By End-User | Individual Consumers Retailers Wholesalers Corporate Clients Others |

| By Occasion | Weddings Festivals Corporate Events Everyday Wear Others |

| By Material | Precious Metals Semi-Precious Stones Synthetic Materials Others |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Trade Shows Direct Sales Others |

| By Price Range | Luxury Segment Mid-Range Segment Budget Segment Others |

| By Consumer Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Jewelry Sales | 150 | Store Managers, Sales Executives |

| Consumer Jewelry Preferences | 200 | Jewelry Buyers, Fashion Enthusiasts |

| Wholesale Jewelry Distribution | 100 | Wholesale Distributors, Importers |

| Jewelry Manufacturing Insights | 80 | Manufacturers, Production Managers |

| Market Trends and Innovations | 70 | Jewelry Designers, Trend Analysts |

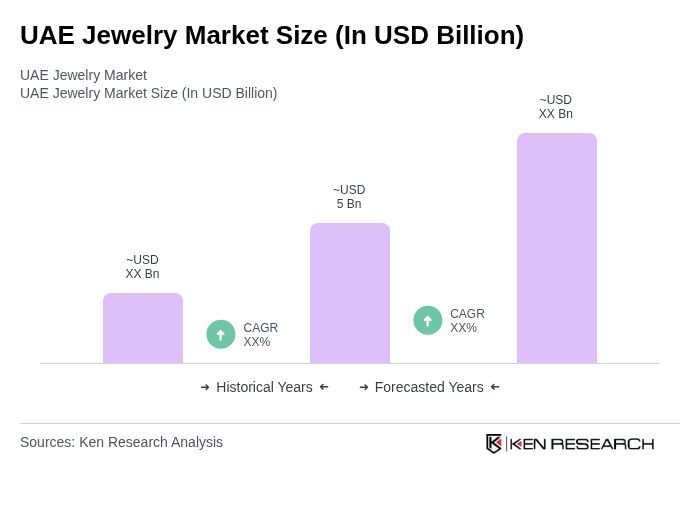

The UAE Jewelry Market is valued at approximately USD 5 billion, driven by factors such as tourism, a growing expatriate population, and rising disposable incomes. This market is characterized by a strong demand for both luxury and culturally significant jewelry.