Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4155

Pages:89

Published On:December 2025

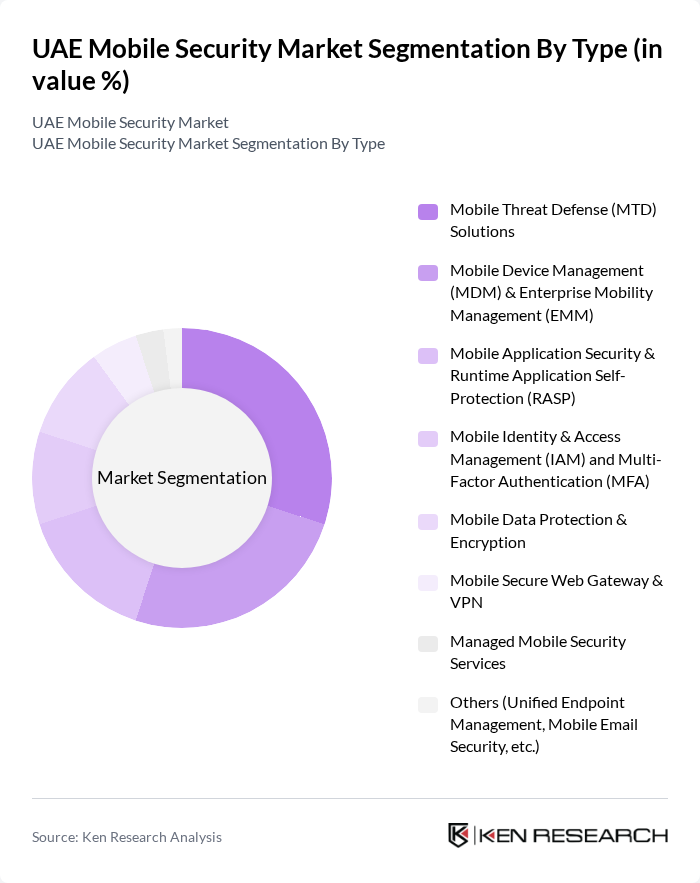

By Type:The mobile security market is segmented into various types, including Mobile Threat Defense (MTD) Solutions, Mobile Device Management (MDM) & Enterprise Mobility Management (EMM), Mobile Application Security & Runtime Application Self-Protection (RASP), Mobile Identity & Access Management (IAM) and Multi-Factor Authentication (MFA), Mobile Data Protection & Encryption, Mobile Secure Web Gateway & VPN, Managed Mobile Security Services, and Others (Unified Endpoint Management, Mobile Email Security, etc.). This segmentation is consistent with global mobile security and mobile device security taxonomies that group solutions around threat protection, device management, application protection, identity, and data security. Among these, Mobile Threat Defense (MTD) Solutions is currently the leading sub-segment in enterprise adoption in the UAE, supported by growing use of advanced endpoint protection, mobile threat analytics, and real?time detection against malware, phishing, and device compromise, alongside strong demand for MDM/EMM and identity?centric controls.

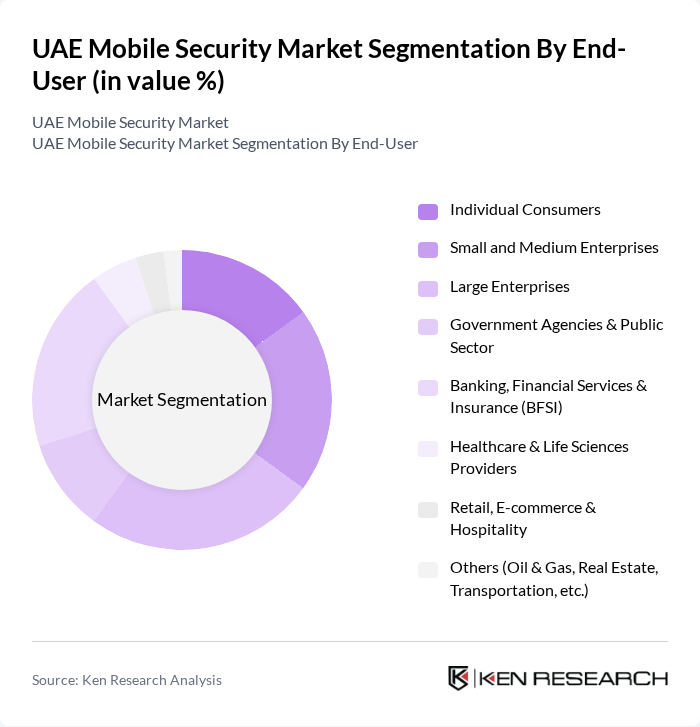

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises, Large Enterprises, Government Agencies & Public Sector, Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences Providers, Retail, E-commerce & Hospitality, and Others (Oil & Gas, Real Estate, Transportation, etc.). This structure aligns with typical mobile security demand patterns, where BFSI, government, IT & telecom, healthcare, and retail/e?commerce are among the highest?spending verticals on mobile and application security. The BFSI sector is the dominant end-user segment in the UAE, driven by stringent regulatory expectations on data protection, secure remote banking, digital identity verification, and fraud prevention, along with rapid growth in mobile banking, fintech, and digital payment services.

The UAE Mobile Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as e& (etisalat by e&), du (Emirates Integrated Telecommunications Company), UAE Cybersecurity Council, DarkMatter Group, Help AG (An e& Enterprise Company), Paladion Networks (Atos Digital Security), CPX Holding, Huawei Technologies (UAE), Cisco Systems, Palo Alto Networks, Fortinet, Check Point Software Technologies, Kaspersky, Trend Micro, IBM Security, Sophos, McAfee, Bitdefender contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE mobile security market appears promising, driven by technological advancements and increasing regulatory pressures. As mobile device usage continues to rise, the demand for innovative security solutions will likely escalate. Additionally, the integration of artificial intelligence and machine learning in security applications is expected to enhance threat detection capabilities. The government's ongoing commitment to cybersecurity will further foster a secure digital environment, encouraging businesses to invest in mobile security infrastructure.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Threat Defense (MTD) Solutions Mobile Device Management (MDM) & Enterprise Mobility Management (EMM) Mobile Application Security & Runtime Application Self-Protection (RASP) Mobile Identity & Access Management (IAM) and Multi-Factor Authentication (MFA) Mobile Data Protection & Encryption Mobile Secure Web Gateway & VPN Managed Mobile Security Services Others (Unified Endpoint Management, Mobile Email Security, etc.) |

| By End-User | Individual Consumers Small and Medium Enterprises Large Enterprises Government Agencies & Public Sector Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Providers Retail, E-commerce & Hospitality Others (Oil & Gas, Real Estate, Transportation, etc.) |

| By Industry Vertical | Banking, Financial Services and Insurance (BFSI) IT & Telecommunications Government & Defense Healthcare & Life Sciences Retail, E-commerce & Hospitality Transportation and Logistics Energy and Utilities (including Oil & Gas) Others (Education, Media & Entertainment, Manufacturing, etc.) |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain & Others |

| By Customer Size | Micro & Small Enterprises (1–49 employees) Medium Enterprises (50–249 employees) Large Enterprises (250+ employees) Public Sector & Critical National Infrastructure |

| By Security Features | Malware & Ransomware Protection Data Loss Prevention (DLP) & Information Rights Management Network & Secure Access (Zero Trust, ZTNA, VPN) Endpoint & Unified Endpoint Security Mobile Application Control & Containerization Compliance, Monitoring & Security Analytics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Mobile Security Solutions | 120 | IT Security Managers, Chief Information Officers |

| Mobile Application Security | 90 | App Developers, Product Managers |

| Consumer Mobile Security Awareness | 75 | General Consumers, Tech-Savvy Users |

| Mobile Payment Security | 65 | Finance Executives, Payment Solution Providers |

| Regulatory Compliance in Mobile Security | 55 | Compliance Officers, Legal Advisors |

The UAE Mobile Security Market is valued at approximately USD 1.1 billion, driven by the increasing adoption of mobile devices, rising cyber threats, and the demand for enhanced security measures across various sectors, including BFSI, government, and healthcare.