Region:Middle East

Author(s):Shubham

Product Code:KRAD6747

Pages:82

Published On:December 2025

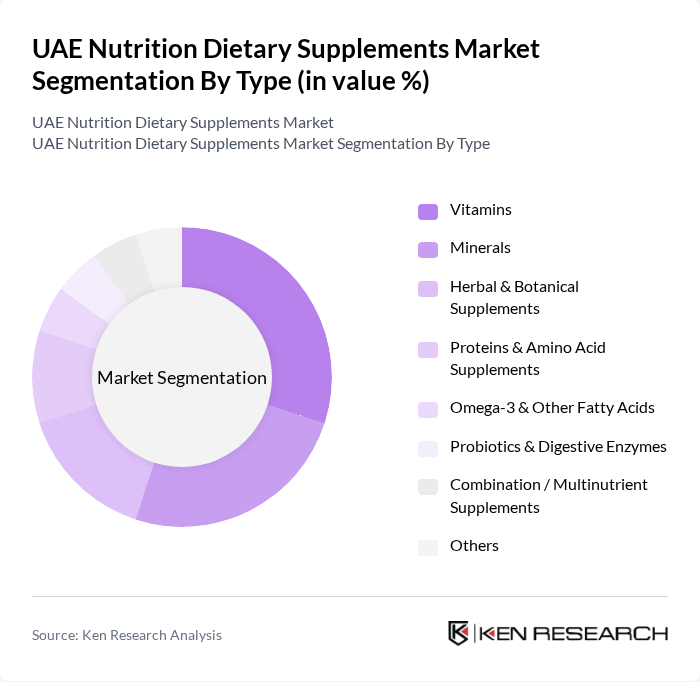

By Type:The market is segmented into various types of dietary supplements, including vitamins, minerals, herbal and botanical supplements, proteins and amino acid supplements, omega-3 and other fatty acids, probiotics and digestive enzymes, combination/multinutrient supplements, and others. Vitamins, minerals, and protein-based supplements are among the most widely used categories in the UAE, reflecting consumer focus on immunity, bone and joint health, and fitness-oriented nutrition. The increasing awareness of the benefits of these supplements, including addressing prevalent micronutrient deficiencies such as vitamin D, has led to a sustained rise in their consumption across both general and niche health-conscious consumer segments.

By End-User:The end-user segmentation includes athletes and sports professionals, fitness enthusiasts/gym-goers, the general adult population, pregnant and lactating women, children and adolescents, the geriatric population, and others. Athletes, sports professionals, and fitness enthusiasts together represent a particularly active consumer base, supported by the rapid expansion of gyms, boutique fitness studios, and organized wellness events across the UAE. At the same time, supplement use is widespread among the general adult population to address nutritional gaps, manage chronic lifestyle conditions, and support healthy ageing, leading to growing demand from adults, elderly consumers, and other health-conscious segments.

The UAE Nutrition Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer Middle East FZE, Nestlé Middle East FZE (including Nestlé Health Science), Abbott Laboratories S.A. (Abbott Nutrition), New Country Healthcare LLC, Quest Vitamins Middle East FZE, Medysinal FZCO, MicroSynergy Pharmaceuticals FZCO, Geltec Pharmacare FZCO, Ultramade Nutrition and Beverages Factory, Pharmatrade LLC, Life Pharmacy Group, Aster Pharmacy (Aster DM Healthcare), Herbalife Nutrition Ltd., Amway Corporation, and GNC Holdings, LLC contribute to innovation, geographic expansion, and service delivery in this space, leveraging extensive product portfolios, strong pharmacy and specialty retail networks, and growing e-commerce channels to reach diverse consumer segments across the UAE.

The UAE nutrition dietary supplements market is poised for dynamic growth, driven by increasing health awareness and a shift towards preventive healthcare. As consumers become more health-conscious, the demand for personalized and organic supplements is expected to rise. Additionally, advancements in technology will facilitate innovative product development, enhancing consumer engagement. The market is likely to see a surge in online sales channels, providing brands with opportunities to reach a wider audience and adapt to evolving consumer preferences effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal & Botanical Supplements Proteins & Amino Acid Supplements Omega-3 & Other Fatty Acids Probiotics & Digestive Enzymes Combination / Multinutrient Supplements Others |

| By End-User | Athletes & Sports Professionals Fitness Enthusiasts / Gym-goers General Adult Population Pregnant & Lactating Women Children & Adolescents Geriatric Population Others |

| By Distribution Channel | Pharmacies & Drug Stores Supermarkets / Hypermarkets Specialty Health & Nutrition Stores Online & E-commerce Platforms Direct Selling / MLM Others |

| By Formulation | Tablets Capsules & Softgels Powders Liquids & Shots Gummies & Chewables Others |

| By Age Group | Infants Children (2–12 Years) Adolescents (13–18 Years) Adults (19–64 Years) Seniors (65+ Years) Others |

| By Health Benefit | Immune Support Digestive & Gut Health Weight Management & Metabolic Health Energy & Vitality Bone, Joint & Muscle Health Heart & Cardiometabolic Health Beauty From Within (Skin, Hair, Nails) Others |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates (Ajman, Umm Al Quwain, Ras Al Khaimah) Fujairah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Dietary Supplements | 120 | Store Managers, Sales Representatives |

| Consumer Preferences in Nutrition | 140 | Health-conscious Consumers, Fitness Enthusiasts |

| Distribution Channels Analysis | 100 | Distributors, Wholesalers |

| Regulatory Compliance Insights | 80 | Regulatory Affairs Specialists, Compliance Officers |

| Market Trends and Innovations | 110 | Product Developers, Marketing Managers |

The UAE Nutrition Dietary Supplements Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by increasing health consciousness and a focus on preventive healthcare among consumers.