Region:Africa

Author(s):Geetanshi

Product Code:KRAB1669

Pages:96

Published On:October 2025

By Type:The market is segmented into various types of dietary supplements, including vitamins, minerals, herbal/botanical supplements, protein & amino acid supplements, omega fatty acids, probiotics, enzyme supplements, functional foods, functional beverages, and others. Among these, vitamins and minerals are the most popular due to their essential role in maintaining health and preventing deficiencies, particularly given the prevalence of micronutrient deficiencies in the population. The increasing awareness of the benefits of these supplements has led to a surge in their consumption. Probiotics are the fastest-growing segment, reflecting rising interest in gut health and immunity. Functional beverages are also gaining traction due to their convenience and alignment with active lifestyles.

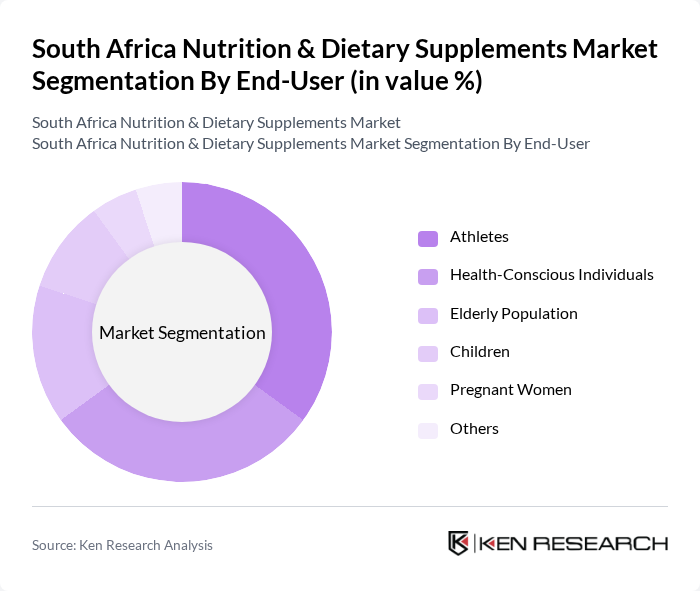

By End-User:The end-user segmentation includes athletes, health-conscious individuals, the elderly population, children, pregnant women, and others. Athletes and health-conscious individuals are the primary consumers, driven by the need for enhanced performance and overall health. The growing trend of fitness and wellness among the general population has also contributed to the increasing demand for dietary supplements. The elderly population is a significant segment due to age-related health concerns, while prenatal supplements are crucial for maternal and infant health, ideally taken before and during pregnancy.

The South Africa Nutrition & Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway South Africa (Pty) Ltd., Nestlé South Africa (Pty) Ltd., GlaxoSmithKline South Africa (Pty) Ltd., DSM Nutritional Products South Africa, Pharma Dynamics (Pty) Ltd., NutriLife (Pty) Ltd., USN (Ultimate Sports Nutrition) South Africa, Vital Health Foods (Pty) Ltd., Solal Technologies (Pty) Ltd., Nature's Way South Africa, Biogen (Pty) Ltd., Clicks Group Limited, Dis-Chem Pharmacies Limited, Health Connection Wholefoods, Nutritional Solutions, Forever Living Products South Africa, GNC South Africa, Swanson Health Products South Africa, Solgar South Africa, Tiffany's Gourmet Foods contribute to innovation, geographic expansion, and service delivery in this space.

The South African nutrition and dietary supplements market is poised for significant evolution, driven by increasing health awareness and technological advancements. As consumers demand personalized nutrition solutions, companies are likely to invest in innovative product formulations. Additionally, the expansion of e-commerce platforms will facilitate greater access to supplements, particularly in underserved rural areas. This dynamic landscape presents opportunities for brands to engage with health-conscious consumers and adapt to changing market demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal/Botanical Supplements Protein & Amino Acid Supplements Omega Fatty Acids Probiotics Enzyme Supplements Functional Foods Functional Beverages Others |

| By End-User | Athletes Health-Conscious Individuals Elderly Population Children Pregnant Women Others |

| By Distribution Channel | Supermarkets/Hypermarkets Health Food Stores Pharmacies/Drug Stores Online Retail Stores Convenience Stores Direct Sales Others |

| By Formulation | Tablets Capsules Powders Liquids Gummies Others |

| By Price Range | Economy Mid-Range Premium Luxury |

| By Packaging Type | Bottles Blister Packs Pouches Jars Others |

| By Brand Type | National Brands Private Labels Generic Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Dietary Supplements | 120 | Store Managers, Product Buyers |

| Consumer Attitudes towards Nutrition | 140 | Health-conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Insights | 100 | Nutritionists, General Practitioners |

| Market Trends in Herbal Supplements | 80 | Herbal Product Retailers, Alternative Medicine Practitioners |

| Impact of Regulatory Changes | 40 | Regulatory Affairs Specialists, Compliance Officers |

The South Africa Nutrition & Dietary Supplements Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing health awareness and a rise in lifestyle-related diseases among consumers.