Region:Asia

Author(s):Shubham

Product Code:KRAB1088

Pages:100

Published On:October 2025

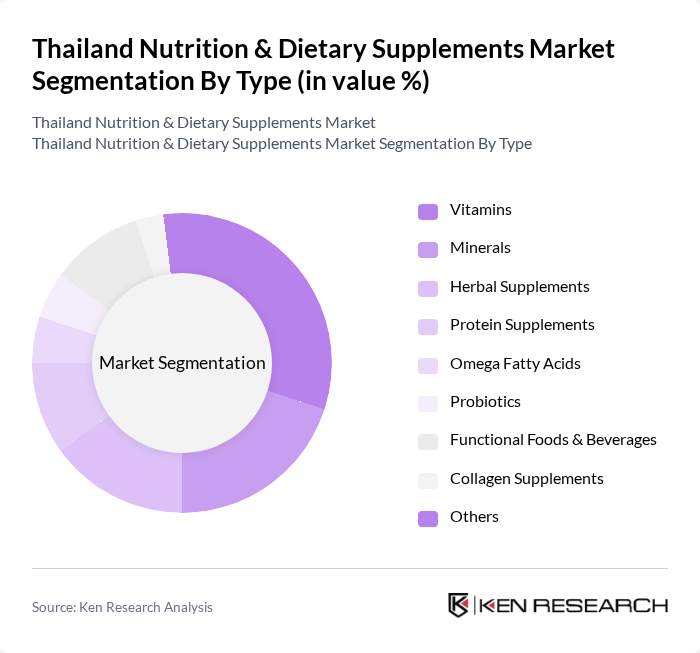

By Type:The market is segmented into various types of dietary supplements, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, functional foods & beverages, collagen supplements, and others. Each of these sub-segments caters to specific consumer needs and preferences, with functional foods and beverages now representing the largest revenue-generating segment, followed by vitamins and minerals, due to their essential role in daily nutrition and preventive health .

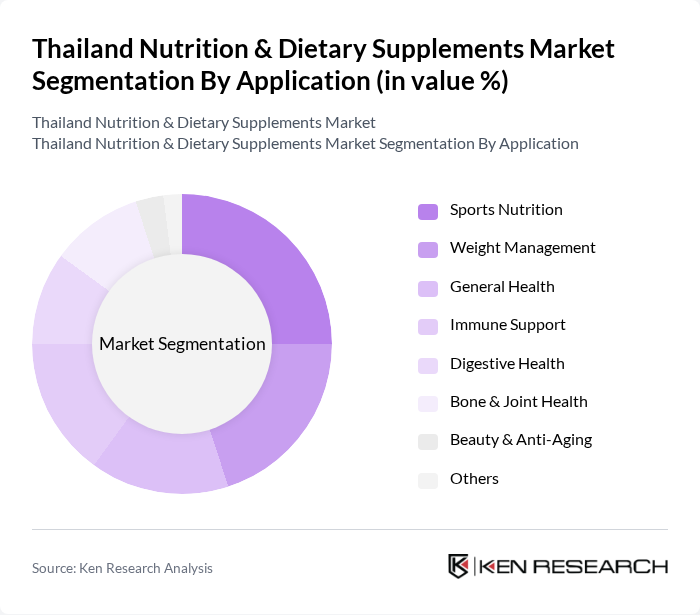

By Application:The application segment includes sports nutrition, weight management, general health, immune support, digestive health, bone & joint health, beauty & anti-aging, and others. Sports nutrition and weight management are particularly popular among the younger demographic, while general health and immune support are gaining traction among older consumers seeking to maintain their health. Bone and joint health supplements are also seeing increased demand, driven by Thailand’s aging population and rising awareness of age-related health issues .

The Thailand Nutrition & Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, Blackmores Limited, GNC Holdings, Inc., Nestlé S.A., Abbott Laboratories, DSM Nutritional Products, Swisse Wellness Pty Ltd., Nature's Way Products, LLC, USANA Health Sciences, Inc., Mega Lifesciences Public Company Limited, Thai Union Ingredients Co., Ltd., Vistra (Osotspa Public Company Limited), DHC Corporation, Suntory Wellness (Thailand) Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand nutrition and dietary supplements market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The integration of digital health solutions is expected to enhance consumer engagement, with an estimated 25% of consumers utilizing health apps in the future. Additionally, the trend towards personalized nutrition will likely gain momentum, as consumers seek tailored solutions to meet their specific health needs, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Functional Foods & Beverages Collagen Supplements Others |

| By Application | Sports Nutrition Weight Management General Health Immune Support Digestive Health Bone & Joint Health Beauty & Anti-Aging Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies Health Food Stores Direct Sales Specialty Stores Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) |

| By Packaging Type | Bottles Sachets Blister Packs Bulk Packaging |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Established Brands New Entrants Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Dietary Supplements | 120 | Store Managers, Sales Representatives |

| Consumer Attitudes towards Nutrition | 100 | Health-conscious Consumers, Fitness Enthusiasts |

| Healthcare Professionals' Insights | 80 | Nutritionists, General Practitioners |

| Market Trends in Herbal Supplements | 60 | Herbal Product Retailers, Alternative Medicine Practitioners |

| Online Sales Channels for Supplements | 80 | E-commerce Managers, Digital Marketing Specialists |

The Thailand Nutrition & Dietary Supplements Market is valued at approximately USD 4.1 billion, reflecting significant growth driven by increasing health consciousness, rising disposable incomes, and a growing aging population seeking preventive healthcare solutions.