Region:Middle East

Author(s):Dev

Product Code:KRAB1695

Pages:96

Published On:January 2026

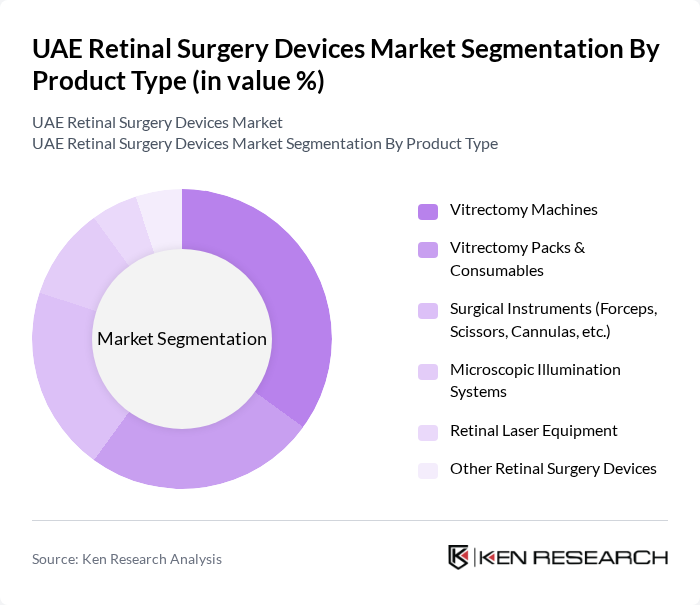

By Product Type:The product type segmentation includes various devices essential for retinal surgeries. The leading sub-segment is Vitrectomy Machines, which are crucial for performing vitrectomy procedures and are identified globally and in the Middle East as the core capital equipment within vitreoretinal surgery setups. This segment is followed by Vitrectomy Packs & Consumables, which are necessary for the surgical process and form the largest revenue share in the UAE retinal surgery devices market according to recent country-level data. Surgical Instruments, including forceps and cannulas, also play a significant role in the market as part of the broader surgical instruments category highlighted in global retinal surgery device and vitreoretinal surgery device reports. Microscopic Illumination Systems and Retinal Laser Equipment are gaining traction due to technological advancements that enhance visualization and enable precise photocoagulation or other laser-based therapies, while Other Retinal Surgery Devices cater to niche requirements such as specialized cutters, cryoprobes, and adjunct tools used in complex procedures.

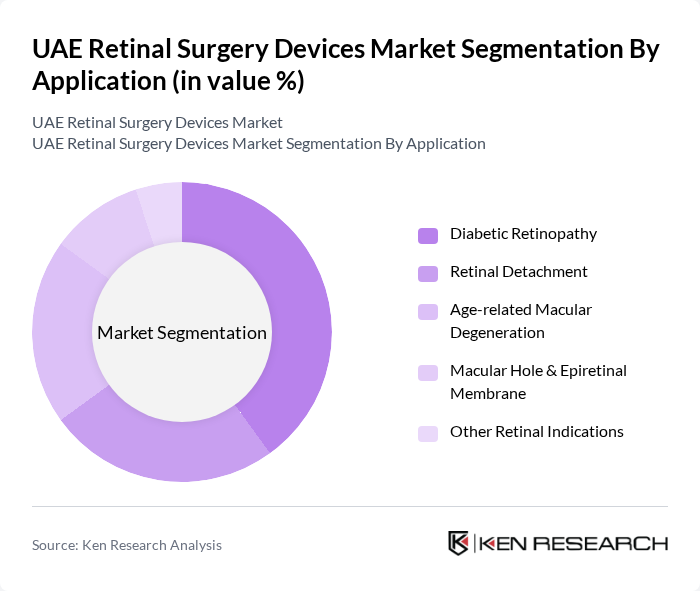

By Application:The application segmentation highlights the various conditions treated using retinal surgery devices. Diabetic Retinopathy is the leading application, driven by the high prevalence of diabetes in the UAE and the documented rise in diabetic retinopathy cases as a key driver of ophthalmic and retinal device demand. Retinal Detachment and Age-related Macular Degeneration are also significant contributors to the market, as they require specialized vitreoretinal surgical interventions and are core indications referenced across global retinal surgery and vitreoretinal surgery device analyses. Macular Hole & Epiretinal Membrane treatments are gaining attention as surgical techniques and instrumentation for macular procedures continue to advance, while Other Retinal Indications encompass a range of less common conditions such as retinitis pigmentosa complications, proliferative vitreoretinopathy, and other complex posterior segment pathologies that may require surgical management.

The UAE Retinal Surgery Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon Inc., Bausch + Lomb Corporation, Johnson & Johnson Vision Care, Inc., Carl Zeiss Meditec AG, Topcon Corporation, Heidelberg Engineering GmbH, Optos plc, NIDEK Co., Ltd., Canon Inc., Santen Pharmaceutical Co., Ltd., Medtronic plc, IRIDEX Corporation, Visionix (Luneau Technology Group), Oculentis GmbH, Lumenis Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The UAE retinal surgery devices market is poised for significant growth, driven by technological advancements and an increasing patient population. The integration of telemedicine and artificial intelligence in surgical procedures is expected to enhance patient care and operational efficiency. Additionally, the shift towards outpatient surgical procedures will likely reduce healthcare costs and improve accessibility. As healthcare infrastructure expands, the market will see increased investments in research and development, fostering innovation and improving treatment outcomes for retinal diseases.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Vitrectomy Machines Vitrectomy Packs & Consumables Surgical Instruments (Forceps, Scissors, Cannulas, etc.) Microscopic Illumination Systems Retinal Laser Equipment Other Retinal Surgery Devices |

| By Application | Diabetic Retinopathy Retinal Detachment Age-related Macular Degeneration Macular Hole & Epiretinal Membrane Other Retinal Indications |

| By End-Use | Hospitals Specialty Ophthalmic Clinics Ambulatory Surgery Centers Other End-Users |

| By Distribution Channel | Direct Sales (Manufacturers to Providers) Local Distributors & Importers Group Purchasing Organizations & Tender-based Procurement E-procurement & Other Channels |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| By Technology | Laser-based Systems Optical Coherence Tomography–Integrated Systems Wide-field & Fundus Imaging Systems D Visualization & Digital Surgery Platforms Other Technologies |

| By Patient Demographics | Pediatric Adult Geriatric Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmology Clinics | 90 | Ophthalmologists, Clinic Managers |

| Hospitals with Eye Care Departments | 70 | Surgeons, Department Heads |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

| Healthcare Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Managers |

| Patient Advocacy Groups | 40 | Patient Representatives, Health Educators |

The UAE Retinal Surgery Devices Market is valued at approximately USD 18 million, driven by the increasing prevalence of retinal diseases and advancements in surgical technologies. This market is expected to grow further due to rising healthcare expenditures in the region.