Region:Middle East

Author(s):Rebecca

Product Code:KRAB7048

Pages:100

Published On:October 2025

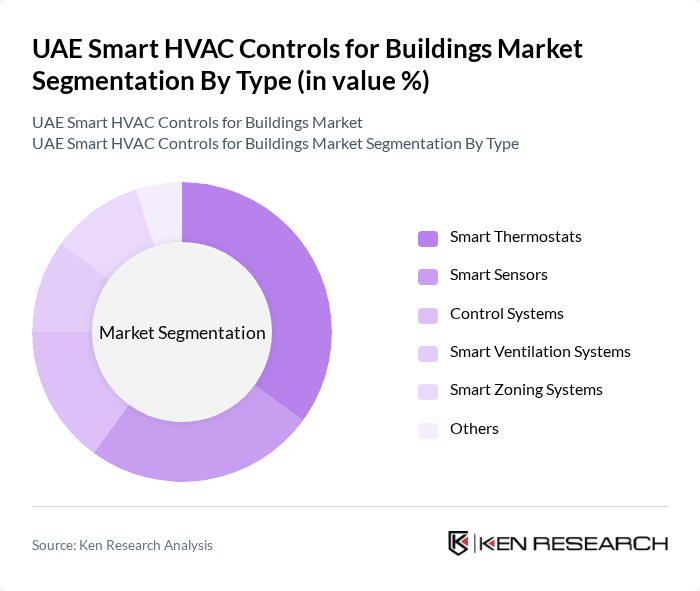

By Type:The market is segmented into various types, including Smart Thermostats, Smart Sensors, Control Systems, Smart Ventilation Systems, Smart Zoning Systems, and Others. Among these, Smart Thermostats are leading the market due to their user-friendly interfaces and energy-saving capabilities. Consumers are increasingly adopting these devices for their ability to optimize heating and cooling based on occupancy patterns, thus enhancing energy efficiency.

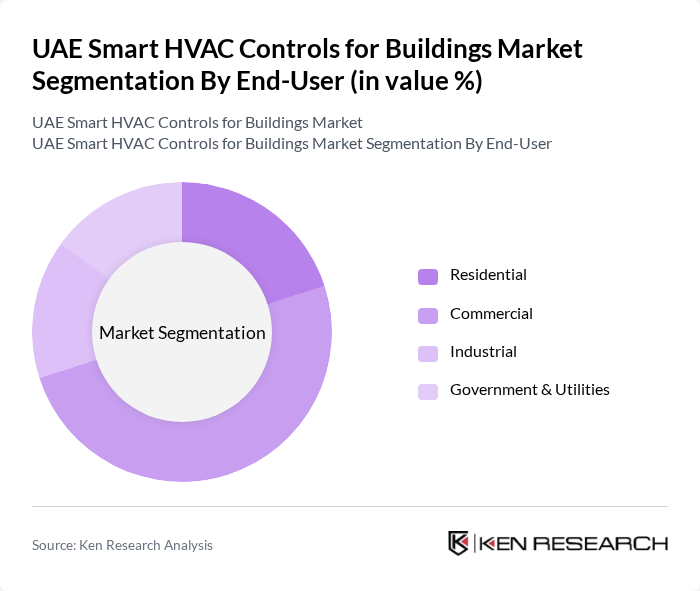

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities. The Commercial segment dominates the market, driven by the increasing need for energy-efficient solutions in office buildings, shopping malls, and hotels. Businesses are investing in smart HVAC controls to reduce operational costs and comply with sustainability regulations, making this segment a key focus for manufacturers.

The UAE Smart HVAC Controls for Buildings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Johnson Controls International plc, Siemens AG, Schneider Electric SE, Trane Technologies plc, Daikin Industries, Ltd., Lennox International Inc., Mitsubishi Electric Corporation, Carrier Global Corporation, Emerson Electric Co., Bosch Thermotechnology, Rheem Manufacturing Company, Aermec S.p.A., LG Electronics Inc., Panasonic Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE smart HVAC controls market appears promising, driven by technological advancements and increasing regulatory support for energy efficiency. As the government continues to promote smart building initiatives, the integration of IoT and AI technologies will enhance system performance and user experience. Furthermore, the growing emphasis on sustainability and indoor air quality will likely lead to increased investments in smart HVAC solutions, positioning the market for significant growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Thermostats Smart Sensors Control Systems Smart Ventilation Systems Smart Zoning Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Heating Cooling Ventilation Energy Management |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Operators | 100 | Facility Managers, Building Owners |

| HVAC Technology Providers | 80 | Product Managers, Sales Directors |

| Energy Efficiency Consultants | 60 | Energy Auditors, Sustainability Consultants |

| Residential HVAC Users | 75 | Homeowners, Property Managers |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Managers |

The UAE Smart HVAC Controls for Buildings Market is valued at approximately USD 1.2 billion, driven by the demand for energy-efficient solutions, urbanization, and government sustainability initiatives.