Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2445

Pages:91

Published On:October 2025

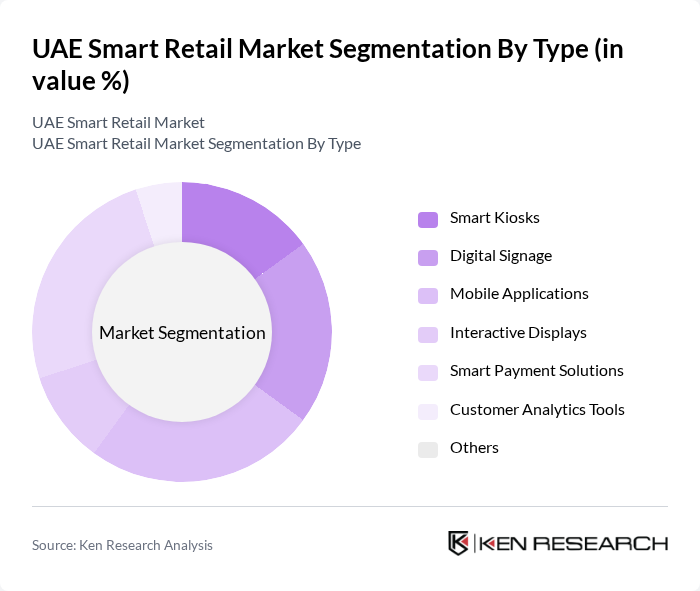

By Type:The segmentation of the market by type includes various innovative solutions that enhance retail operations. The subsegments are Smart Kiosks, Digital Signage, Mobile Applications, Interactive Displays, Smart Payment Solutions, Customer Analytics Tools, and Others. Among these, Smart Payment Solutions and Mobile Applications are leading the market due to the increasing consumer preference for contactless transactions, the growing adoption of mobile wallets and digital payment platforms, and the demand for seamless omnichannel shopping experiences .

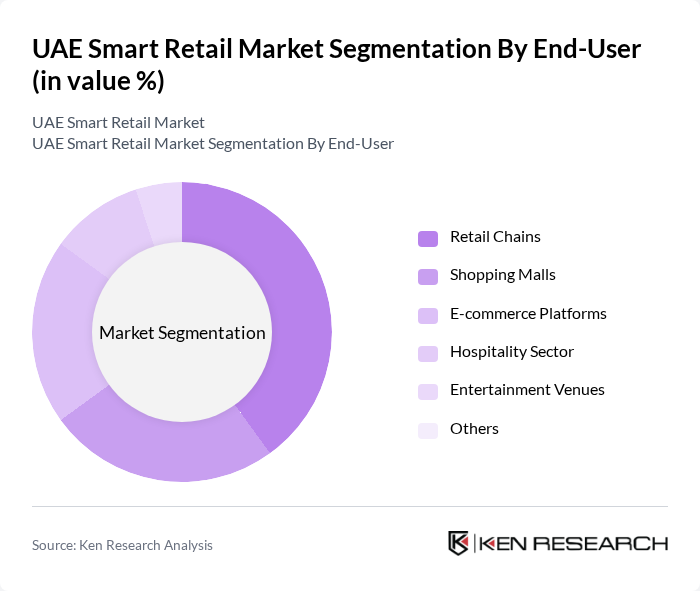

By End-User:The market segmentation by end-user includes Retail Chains, Shopping Malls, E-commerce Platforms, Hospitality Sector, Entertainment Venues, and Others. Retail Chains dominate this segment as they are increasingly adopting smart retail technologies to enhance customer engagement and streamline operations, driven by the need for competitive differentiation in a rapidly evolving retail landscape. E-commerce platforms are also experiencing significant growth, supported by high internet penetration and digital transformation initiatives .

The UAE Smart Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Majid Al Futtaim, Emaar Properties, Al-Futtaim Group, Landmark Group, Al Habtoor Group, Dubai Mall, Mall of the Emirates, Abu Dhabi Mall, Al Ain Mall, Sharjah City Centre, Yas Mall, The Galleria Al Maryah Island, City Centre Mirdif, Ibn Battuta Mall contribute to innovation, geographic expansion, and service delivery in this space.

The UAE smart retail market is poised for significant evolution, driven by ongoing technological advancements and changing consumer preferences. As retailers increasingly adopt AI and machine learning, personalized shopping experiences will become the norm, enhancing customer satisfaction. Additionally, the integration of sustainable practices will likely gain traction, aligning with global trends. The government's continued support for smart city initiatives will further bolster innovation, creating a dynamic environment for growth and development in the retail sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Kiosks Digital Signage Mobile Applications Interactive Displays Smart Payment Solutions Customer Analytics Tools Others |

| By End-User | Retail Chains Shopping Malls E-commerce Platforms Hospitality Sector Entertainment Venues Others |

| By Application | Customer Engagement Inventory Management Sales Optimization Data Analytics Security Solutions Others |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Partnerships Others |

| By Distribution Mode | Online Distribution Offline Distribution Hybrid Distribution Others |

| By Customer Segment | Large Enterprises SMEs Startups Others |

| By Price Range | Budget Solutions Mid-Range Solutions Premium Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Payment Solutions | 50 | Retail Managers, IT Directors |

| IoT in Retail Operations | 45 | Operations Managers, Technology Officers |

| AI-driven Customer Engagement | 40 | Marketing Managers, Customer Experience Heads |

| Mobile Shopping Trends | 50 | Consumer Insights Analysts, E-commerce Managers |

| Supply Chain Innovations | 45 | Supply Chain Managers, Logistics Coordinators |

The UAE Smart Retail Market is valued at approximately USD 820 million, driven by technological advancements, consumer demand for personalized experiences, and the integration of AI and analytics in retail operations.