Region:Middle East

Author(s):Shubham

Product Code:KRAC4345

Pages:90

Published On:October 2025

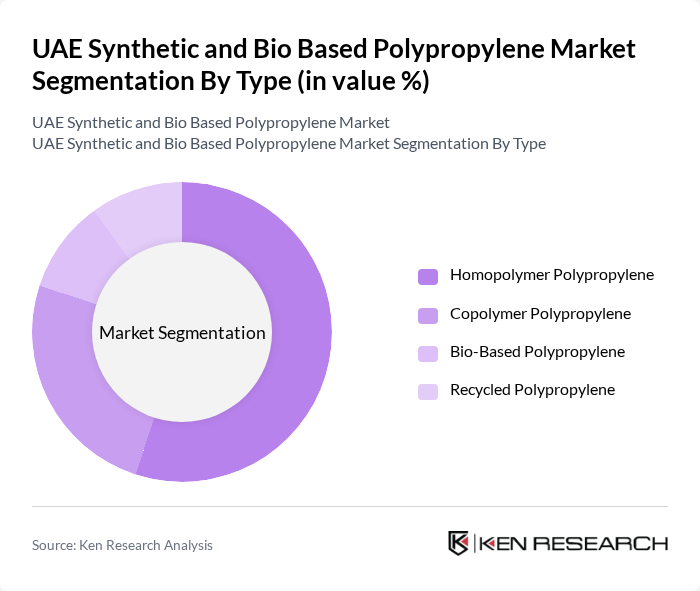

By Type:The market is segmented into four main types: Homopolymer Polypropylene, Copolymer Polypropylene, Bio-Based Polypropylene, and Recycled Polypropylene. Among these, Homopolymer Polypropylene is the leading sub-segment due to its widespread use in packaging and automotive applications, driven by its excellent mechanical properties and cost-effectiveness. The increasing focus on sustainability has also led to a rise in the adoption of Bio-Based Polypropylene, although it currently holds a smaller market share compared to Homopolymer Polypropylene. Recycled Polypropylene is gaining traction as the UAE invests in localized recycling hubs and closed-loop supply chains.

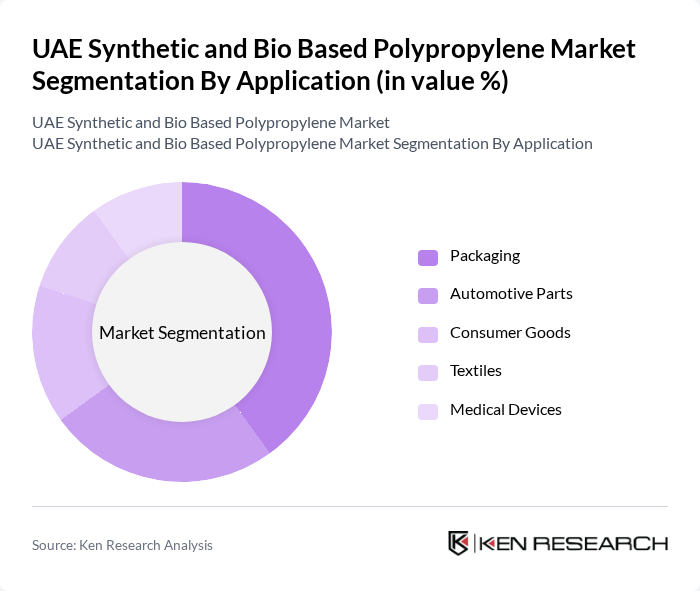

By Application:The applications of polypropylene are diverse, including Packaging, Automotive Parts, Consumer Goods, Textiles, and Medical Devices. The Packaging segment dominates the market due to the increasing demand for lightweight and durable packaging solutions across various industries, especially with the rise of e-commerce and retail sectors. Automotive applications are the fastest-growing segment, driven by the need for lightweight components and the expansion of the regional automotive industry. Medical devices and textiles also represent important, though smaller, segments as polypropylene’s versatility supports innovation in these areas.

The UAE Synthetic and Bio Based Polypropylene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Borouge (Abu Dhabi Polymers Company), SABIC, LyondellBasell Industries, Mitsui Chemicals Inc., Braskem S.A., Gulf Plastic Industries, Al Watania Plastics, Emirates Plastic Industries, National Petrochemical Company (NPC), Al Ghurair Investment Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE synthetic and bio-based polypropylene market appears promising, driven by increasing consumer demand for sustainable products and government support for eco-friendly initiatives. As industries adapt to circular economy practices, investments in research and development are expected to rise, fostering innovation in bio-based materials. Additionally, the expansion of e-commerce and packaging sectors will further enhance market dynamics, creating a conducive environment for growth and collaboration among stakeholders in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Homopolymer Polypropylene Copolymer Polypropylene Bio-Based Polypropylene Recycled Polypropylene |

| By Application | Packaging Automotive Parts Consumer Goods Textiles Medical Devices |

| By End-User | Food and Beverage Healthcare and Medical Construction Electronics Automotive |

| By Distribution Channel | Direct Sales Distributors and Wholesalers Online Retail Specialty Retailers |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Rigid Packaging Flexible Packaging Films and Sheets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Polypropylene Manufacturers | 60 | Production Managers, Operations Directors |

| End-User Industries (Packaging) | 50 | Procurement Managers, Product Development Heads |

| Research Institutions | 40 | Research Scientists, Academic Professors |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Trade Associations | 40 | Industry Analysts, Market Researchers |

The UAE Synthetic and Bio Based Polypropylene Market is valued at approximately USD 1.9 billion, reflecting a significant growth trend driven by the demand for lightweight and durable materials across various industries, including packaging and automotive.