Region:Middle East

Author(s):Shubham

Product Code:KRAB7831

Pages:97

Published On:October 2025

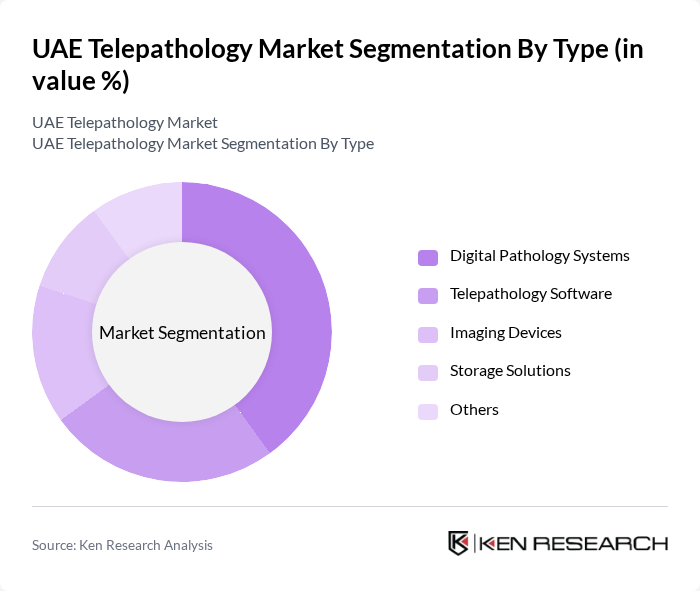

By Type:The segmentation by type includes various subsegments such as Digital Pathology Systems, Telepathology Software, Imaging Devices, Storage Solutions, and Others. Among these, Digital Pathology Systems are leading the market due to their ability to provide high-resolution images and facilitate remote consultations, which are increasingly preferred by healthcare providers for efficient diagnosis and treatment planning.

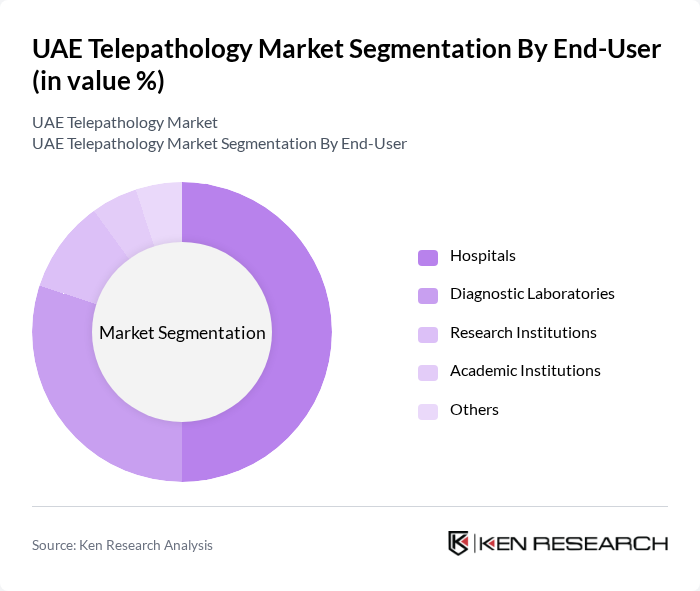

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Research Institutions, Academic Institutions, and Others. Hospitals are the leading end-users in the telepathology market, driven by the need for rapid and accurate diagnostic services, which are essential for patient management and treatment decisions.

The UAE Telepathology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Leica Biosystems, Hamamatsu Photonics, 3DHISTECH, Sectra AB, PathAI, Proscia, Visiopharm, Aperio (Leica Biosystems), Xifin, Digital Pathology Solutions, Glencoe Software, Indica Labs, QIAGEN, Bio-Rad Laboratories contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE telepathology market appears promising, driven by technological advancements and increasing healthcare demands. The integration of artificial intelligence in diagnostic processes is expected to enhance accuracy and efficiency, while the shift towards cloud-based solutions will facilitate easier access to pathology services. As the government continues to support telehealth initiatives, the market is likely to see significant growth, fostering innovation and improving patient outcomes in the near future.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Pathology Systems Telepathology Software Imaging Devices Storage Solutions Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Academic Institutions Others |

| By Application | Cancer Diagnosis Infectious Disease Diagnosis Genetic Testing Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Technology | Whole Slide Imaging Virtual Microscopy Image Analysis Software Others |

| By Pricing Model | Subscription-Based One-Time Purchase Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Telepathology Services | 100 | Pathologists, Hospital Administrators |

| Laboratory Technology Providers | 75 | Product Managers, Technical Support Staff |

| Healthcare IT Solutions | 80 | IT Managers, System Integrators |

| Telemedicine Adoption in Clinics | 90 | Clinic Owners, Healthcare Practitioners |

| Regulatory Impact on Telepathology | 60 | Healthcare Policy Makers, Regulatory Affairs Specialists |

The UAE Telepathology Market is valued at approximately USD 150 million, reflecting a significant growth driven by the increasing demand for remote diagnostics and advancements in digital pathology technologies.