Region:Middle East

Author(s):Rebecca

Product Code:KRAB8177

Pages:87

Published On:October 2025

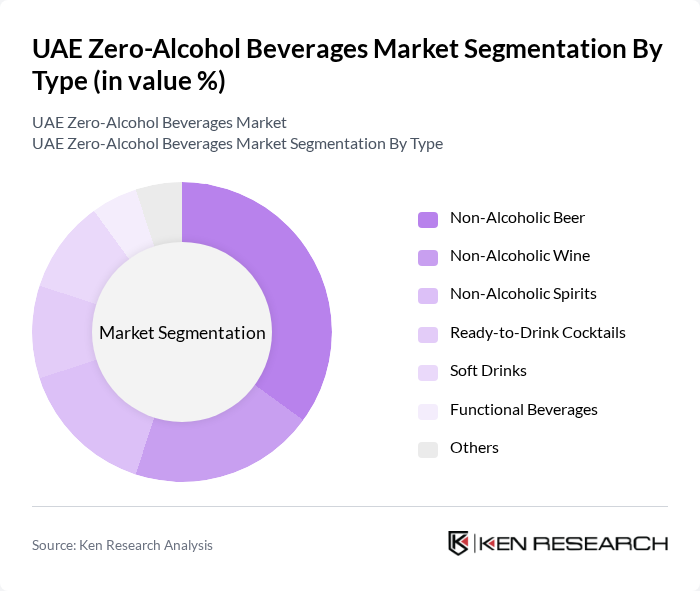

By Type:The market is segmented into various types of zero-alcohol beverages, including Non-Alcoholic Beer, Non-Alcoholic Wine, Non-Alcoholic Spirits, Ready-to-Drink Cocktails, Soft Drinks, Functional Beverages, and Others. Among these, Non-Alcoholic Beer has emerged as a leading sub-segment due to its popularity among consumers seeking a beer-like experience without the effects of alcohol. The increasing variety of flavors and brands has further fueled its growth, making it a preferred choice for social gatherings and events.

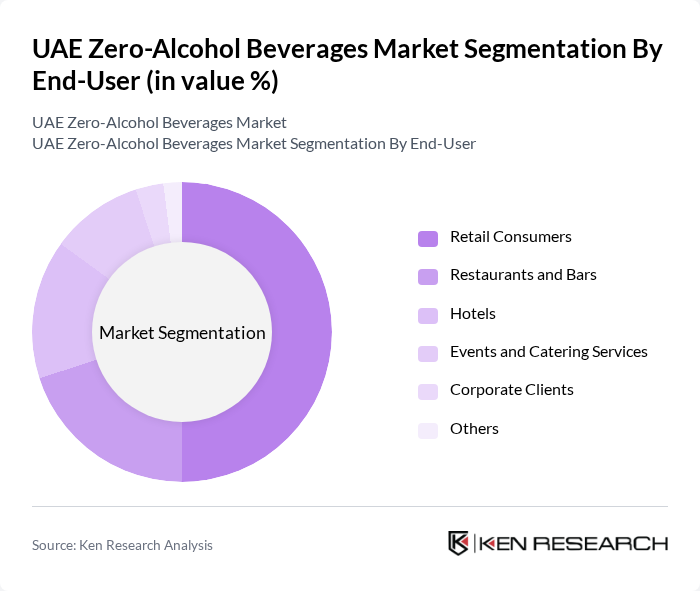

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Bars, Hotels, Events and Catering Services, Corporate Clients, and Others. Retail Consumers dominate the market, driven by the increasing availability of zero-alcohol options in supermarkets and online platforms. The trend towards healthier lifestyles and the growing acceptance of non-alcoholic beverages in social settings have significantly contributed to the rise in retail consumption.

The UAE Zero-Alcohol Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as Heineken N.V., AB InBev, Diageo plc, BrewDog, Carlsberg Group, Coca-Cola Company, PepsiCo, Inc., Mocktail Club, Athletic Brewing Company, Seedlip, Lyre's Non-Alcoholic Spirits, Free Spirits, Ritual Zero Proof, Nix & Kix, Curious Elixirs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE zero-alcohol beverages market appears promising, driven by evolving consumer preferences and increasing health consciousness. As the population becomes more aware of the benefits of moderation, the demand for innovative and flavorful non-alcoholic options is expected to rise. Additionally, the expansion of retail channels and e-commerce platforms will facilitate greater accessibility, allowing brands to reach a broader audience. This dynamic environment presents significant opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Non-Alcoholic Beer Non-Alcoholic Wine Non-Alcoholic Spirits Ready-to-Drink Cocktails Soft Drinks Functional Beverages Others |

| By End-User | Retail Consumers Restaurants and Bars Hotels Events and Catering Services Corporate Clients Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Convenience Stores Specialty Stores Direct Sales Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Packaging Type | Cans Bottles Tetra Packs Others |

| By Occasion | Social Gatherings Family Events Corporate Events Others |

| By Flavor Profile | Fruity Herbal Spicy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Zero-Alcohol Beverages | 150 | Health-conscious Consumers, Young Adults |

| Retail Insights on Non-Alcoholic Beverage Sales | 100 | Retail Managers, Beverage Category Buyers |

| Distribution Channels for Zero-Alcohol Products | 80 | Logistics Managers, Supply Chain Coordinators |

| Market Trends in Health and Wellness | 70 | Nutritionists, Fitness Trainers |

| Impact of Marketing Strategies on Consumer Choices | 90 | Marketing Executives, Brand Managers |

The UAE Zero-Alcohol Beverages Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by changing consumer preferences towards healthier lifestyles and increased demand for non-alcoholic options in social settings.