Region:Europe

Author(s):Geetanshi

Product Code:KRAA0223

Pages:90

Published On:August 2025

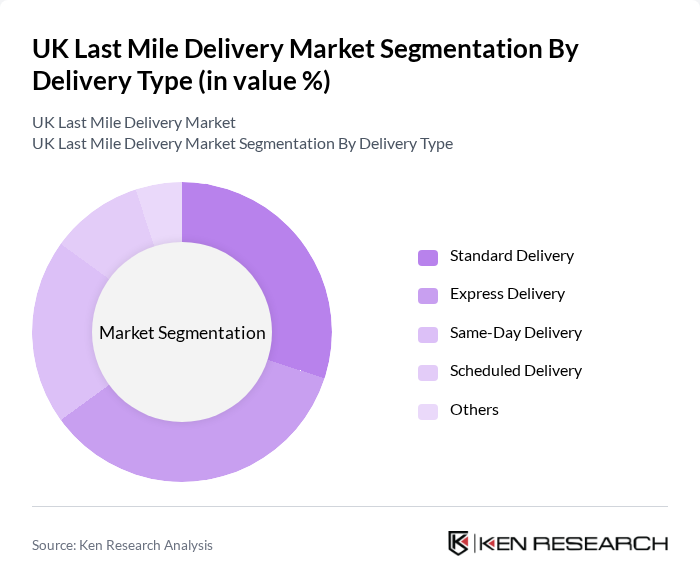

By Delivery Type:The delivery type segmentation includes various methods such as Standard Delivery, Express Delivery, Same-Day Delivery, Scheduled Delivery, and Others. Each of these sub-segments addresses distinct consumer needs and preferences, with Express and Same-Day Delivery gaining significant traction due to the increasing demand for speed and convenience in e-commerce. Standard Delivery remains popular for cost-sensitive consumers, while Scheduled Delivery offers flexibility for those who prefer to choose their delivery times .

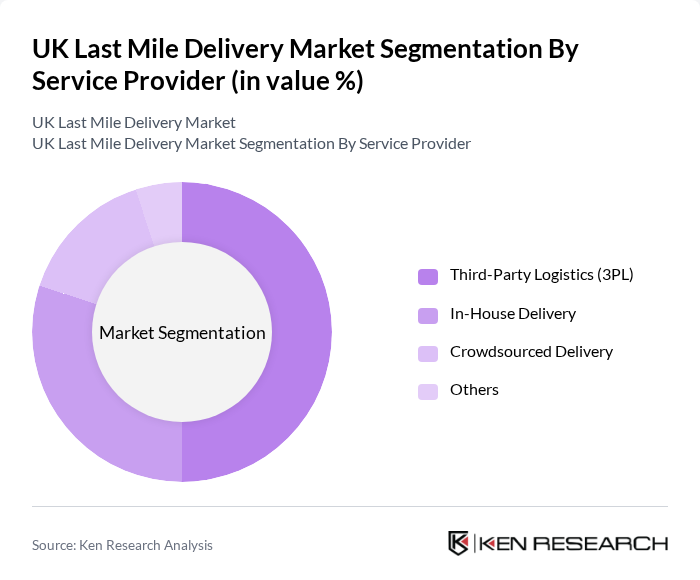

By Service Provider:The service provider segmentation encompasses Third-Party Logistics (3PL), In-House Delivery, Crowdsourced Delivery, and Others. Third-Party Logistics (3PL) is the leading sub-segment, as many businesses prefer outsourcing their delivery needs to specialized providers for efficiency, scalability, and cost-effectiveness. In-House Delivery remains significant, particularly for large retailers seeking greater control and brand consistency in their logistics. Crowdsourced Delivery is emerging as a flexible, technology-enabled option, leveraging local resources to meet dynamic delivery demands .

The UK Last Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DPD Group, Evri (formerly Hermes), Royal Mail, UPS, FedEx, Yodel, Amazon Logistics, DHL, Parcelforce Worldwide, Whistl, Tuffnells, APC Overnight, CitySprint, Stuart, and Gophr contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UK last mile delivery market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As e-commerce continues to expand, companies will increasingly adopt innovative delivery solutions, including electric vehicles and automated systems. Additionally, the focus on sustainability will shape operational strategies, with businesses seeking to reduce their carbon footprint. Collaborations with local businesses and the integration of AI will further enhance efficiency, ensuring that the sector remains responsive to changing market dynamics and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Delivery Type | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery Others |

| By Service Provider | Third-Party Logistics (3PL) In-House Delivery Crowdsourced Delivery Others |

| By Package Size | Small Packages Medium Packages Large Packages Others |

| By Delivery Mode | Road Delivery Bicycle Delivery Drone Delivery Others |

| By Customer Segment | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) Others |

| By Application | Retail & E-commerce Healthcare Food & Beverages Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Payment Method | Prepaid Cash on Delivery Digital Payments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last Mile Delivery | 100 | Logistics Coordinators, Urban Delivery Managers |

| Rural Delivery Challenges | 70 | Operations Managers, Rural Logistics Specialists |

| E-commerce Delivery Preferences | 120 | Online Shoppers, Customer Experience Managers |

| Technology in Last Mile Delivery | 60 | IT Managers, Innovation Leads in Logistics |

| Environmental Impact of Delivery Services | 40 | Sustainability Officers, Policy Makers in Logistics |

The UK Last Mile Delivery Market is valued at approximately USD 6.3 billion, driven by the growth in e-commerce, consumer demand for faster delivery options, and advancements in logistics technology.