Region:Europe

Author(s):Dev

Product Code:KRAA5174

Pages:86

Published On:September 2025

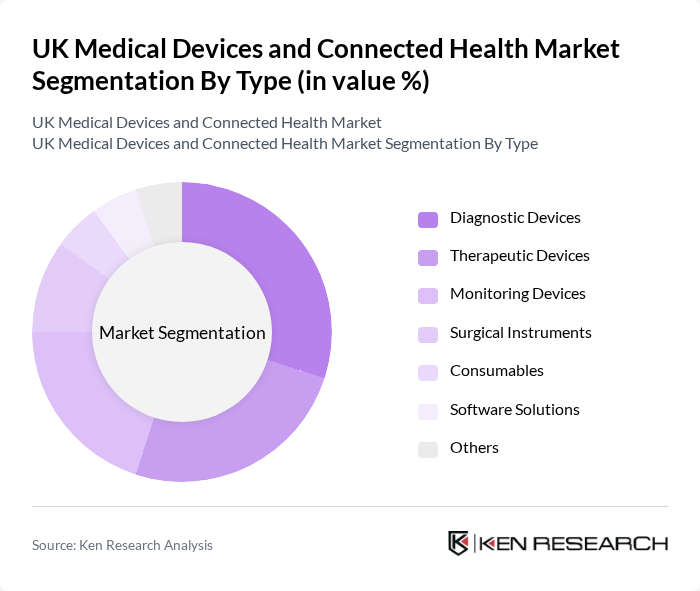

By Type:The market is segmented into various types of medical devices, including diagnostic devices, therapeutic devices, monitoring devices, surgical instruments, consumables, software solutions, and others. Among these, diagnostic devices are currently leading the market due to the rising prevalence of chronic diseases and the increasing demand for early detection and diagnosis. The trend towards personalized medicine and home diagnostics is also contributing to the growth of this segment.

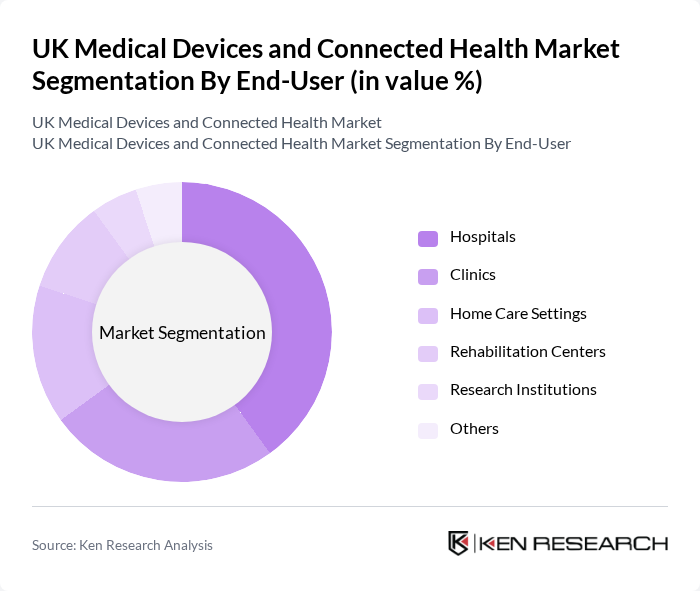

By End-User:The end-user segmentation includes hospitals, clinics, home care settings, rehabilitation centers, research institutions, and others. Hospitals are the dominant end-user segment, driven by the increasing number of surgical procedures and the demand for advanced medical technologies. The trend towards outpatient care and home healthcare solutions is also gaining traction, leading to growth in the home care settings segment.

The UK Medical Devices and Connected Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Siemens Healthineers, Philips Healthcare, GE Healthcare, Johnson & Johnson, Abbott Laboratories, B. Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, Zimmer Biomet Holdings, Inc., Canon Medical Systems Corporation, Olympus Corporation, Roche Diagnostics, Hologic, Inc., Terumo Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The UK medical devices and connected health market is poised for transformative growth, driven by technological advancements and demographic shifts. The integration of artificial intelligence and IoT in healthcare devices is expected to enhance diagnostic accuracy and patient monitoring capabilities. Additionally, the increasing focus on preventive healthcare will likely lead to greater investment in wearable technologies. As the NHS continues to prioritize digital health initiatives, collaboration between healthcare providers and technology firms will be crucial in shaping the future landscape of this market.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Devices Therapeutic Devices Monitoring Devices Surgical Instruments Consumables Software Solutions Others |

| By End-User | Hospitals Clinics Home Care Settings Rehabilitation Centers Research Institutions Others |

| By Application | Cardiovascular Orthopedic Neurology Diabetes Management Respiratory Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Regulatory Approval Type | CE Marking FDA Approval ISO Certification Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Technology Integration | Standalone Devices Connected Devices Integrated Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 150 | Procurement Managers, Supply Chain Directors |

| Healthcare Technology Adoption | 100 | IT Managers, Clinical Technology Officers |

| Patient Experience with Connected Devices | 80 | Patients, Caregivers, Health Advocates |

| Regulatory Compliance in Medical Devices | 70 | Regulatory Affairs Specialists, Quality Assurance Managers |

| Telehealth Implementation Strategies | 90 | Telehealth Coordinators, Healthcare Administrators |

The UK Medical Devices and Connected Health Market is valued at approximately USD 12.5 billion, driven by technological advancements, an aging population, and increased healthcare expenditure, particularly accelerated by the COVID-19 pandemic.