Region:Middle East

Author(s):Shubham

Product Code:KRAA6651

Pages:92

Published On:January 2026

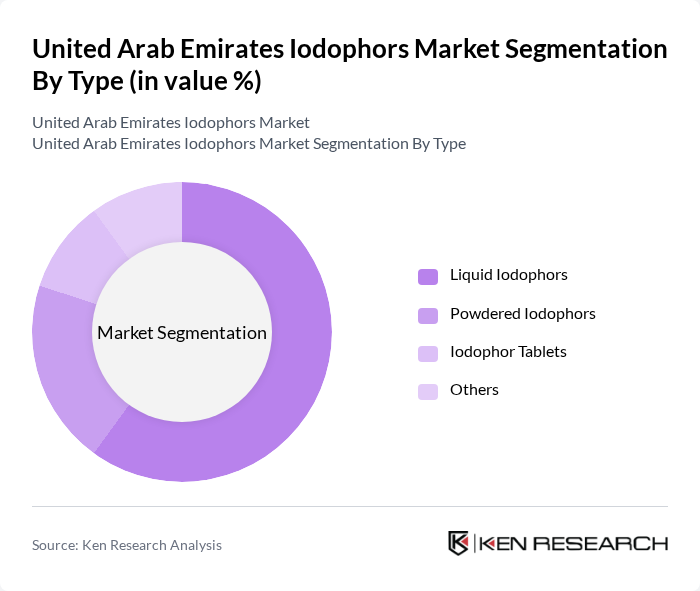

By Type:

The market is segmented into Liquid Iodophors, Powdered Iodophors, Iodophor Tablets, and Others. Among these, Liquid Iodophors dominate the market due to their ease of use and effectiveness in various applications, particularly in healthcare settings for surface disinfection and equipment sanitization. The convenience of liquid formulations allows for quick application, making them a preferred choice for both professional and consumer use. The growing trend towards maintaining high hygiene standards in food processing and healthcare sectors further supports the demand for liquid iodophors.

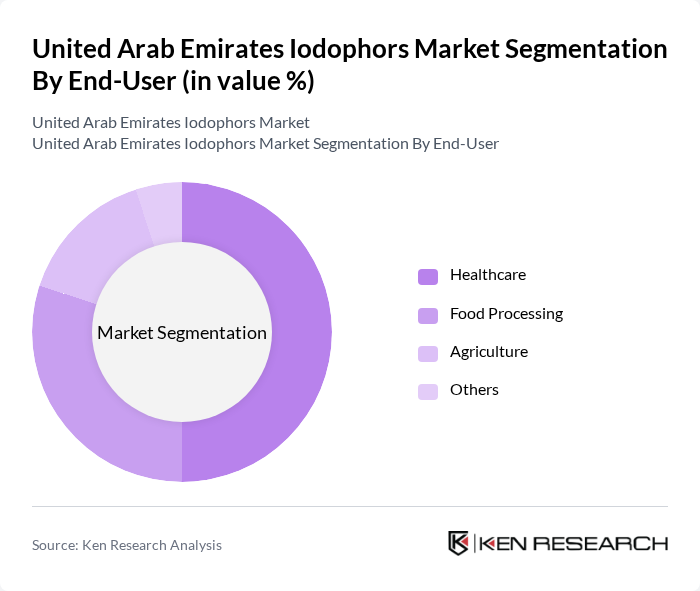

By End-User:

The end-user segmentation includes Healthcare, Food Processing, Agriculture, and Others. The Healthcare sector is the leading end-user, driven by the increasing need for effective disinfectants in hospitals and clinics. The rise in healthcare-associated infections has prompted healthcare facilities to adopt iodophors for their proven efficacy in sterilization and disinfection. Additionally, the food processing industry is also witnessing significant growth due to stringent hygiene regulations and the need for safe food handling practices.

The United Arab Emirates Iodophors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ecolab, Diversey Holdings, Ltd., 3M Company, Johnson & Johnson, Procter & Gamble, Henkel AG & Co. KGaA, Reckitt Benckiser Group plc, Unilever, Clorox Company, STERIS plc, BioSafe Systems, Spartan Chemical Company, Inc., Virox Technologies Inc., Medline Industries, Inc., and others contribute to innovation, geographic expansion, and service delivery in this space.

The future of the iodophors market in the UAE appears promising, driven by increasing health consciousness and regulatory support for effective disinfectants. As the healthcare and food sectors continue to expand, the demand for iodophors is expected to rise. Innovations in product formulations and eco-friendly alternatives will likely shape market dynamics. Additionally, the growth of e-commerce platforms will facilitate wider distribution, making iodophors more accessible to consumers and businesses alike, enhancing overall market potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Iodophors Powdered Iodophors Iodophor Tablets Others |

| By End-User | Healthcare Food Processing Agriculture Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Application | Surface Disinfection Water Treatment Food Equipment Sanitization Others |

| By Packaging Type | Bulk Packaging Retail Packaging Industrial Packaging Others |

| By Formulation | Concentrated Formulations Ready-to-Use Formulations Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing | 45 | Production Managers, Quality Assurance Officers |

| Food Processing Industry | 40 | Food Safety Managers, Operations Directors |

| Healthcare Facilities | 35 | Infection Control Specialists, Facility Managers |

| Distributors and Suppliers | 30 | Sales Managers, Supply Chain Coordinators |

| Regulatory Bodies | 20 | Policy Makers, Compliance Officers |

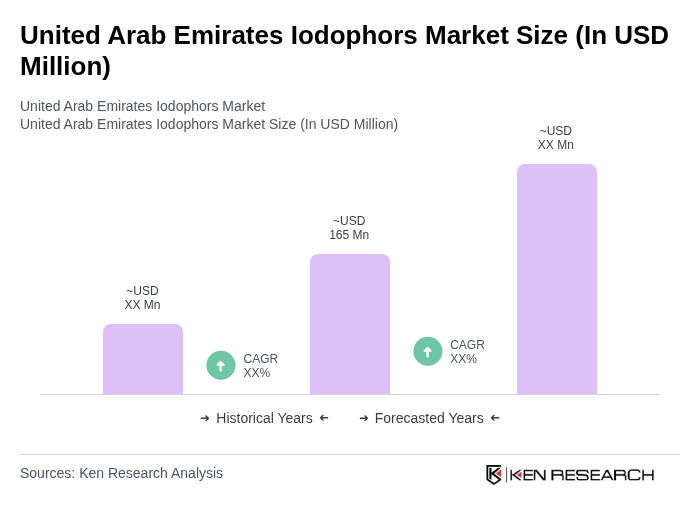

The United Arab Emirates Iodophors Market is valued at approximately USD 165 million, reflecting a significant increase driven by the rising demand for effective disinfectants across healthcare, food processing, and agriculture sectors.