Region:Middle East

Author(s):Rebecca

Product Code:KRAE2788

Pages:92

Published On:February 2026

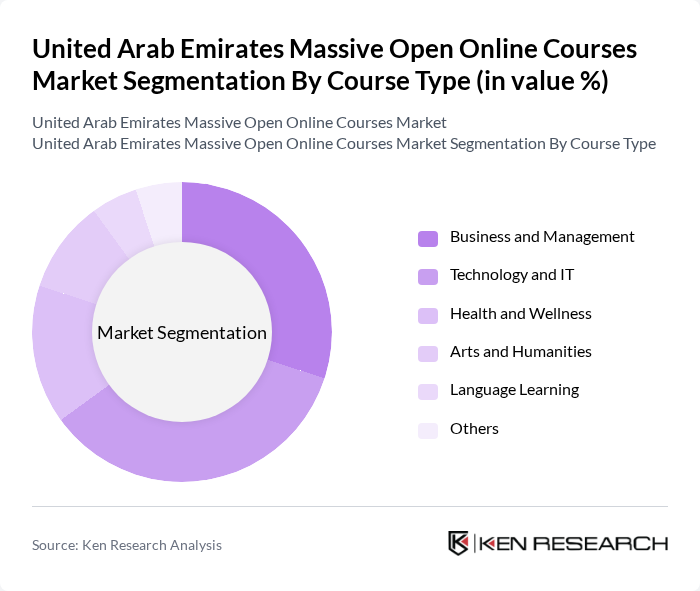

By Course Type:The market is segmented into various course types, including Business and Management, Technology and IT, Health and Wellness, Arts and Humanities, Language Learning, and Others. Each of these segments caters to different learner needs and preferences, with specific trends influencing their popularity. Business and Management courses are particularly favored due to the growing demand for leadership and management skills in the corporate sector, while Technology and IT courses are gaining traction as digital transformation accelerates across industries.

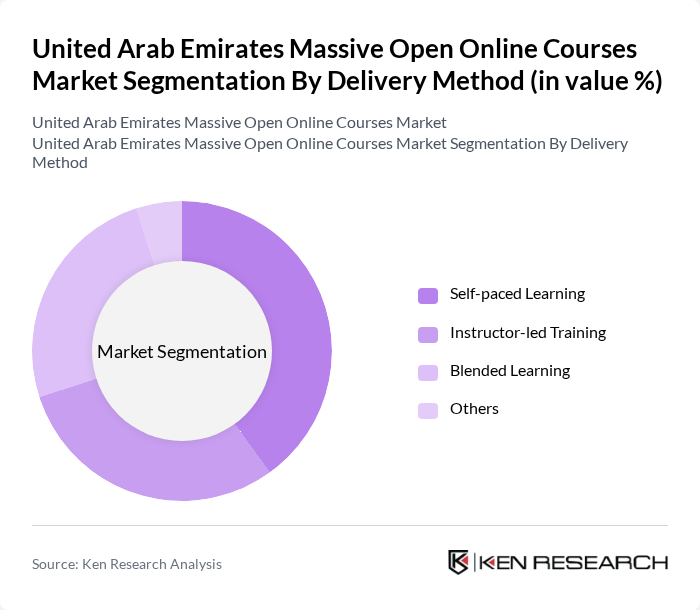

By Delivery Method:The delivery methods for online courses include Self-paced Learning, Instructor-led Training, Blended Learning, and Others. Self-paced Learning is particularly popular among learners who prefer flexibility in their study schedules, while Instructor-led Training appeals to those seeking structured guidance. Blended Learning, which combines online and face-to-face instruction, is gaining traction as it offers the best of both worlds, catering to diverse learning preferences.

The United Arab Emirates Massive Open Online Courses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera, edX, Udacity, FutureLearn, Skillshare, Khan Academy, LinkedIn Learning, Pluralsight, Udemy, Alison, OpenClassrooms, Teachable, MasterClass, Codecademy, Simplilearn contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE's Massive Open Online Courses market appears promising, driven by ongoing technological advancements and increasing acceptance of online learning. As educational institutions continue to collaborate with MOOC providers, the integration of innovative technologies such as artificial intelligence and virtual reality will enhance the learning experience. Furthermore, the government's commitment to digital education will likely lead to more funding and resources, fostering an environment conducive to growth and innovation in the online education sector.

| Segment | Sub-Segments |

|---|---|

| By Course Type | Business and Management Technology and IT Health and Wellness Arts and Humanities Language Learning Others |

| By Delivery Method | Self-paced Learning Instructor-led Training Blended Learning Others |

| By Target Audience | Students Professionals Corporates Others |

| By Certification Type | Accredited Certifications Non-accredited Certifications Micro-credentials Others |

| By Duration | Short Courses Long-term Programs Bootcamps Others |

| By Pricing Model | Subscription-based Pay-per-course Freemium Others |

| By Language of Instruction | English Arabic Bilingual Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| University MOOC Offerings | 100 | University Administrators, Course Designers |

| Corporate Training Programs | 80 | HR Managers, Training Coordinators |

| Student Engagement in MOOCs | 150 | Current MOOC Users, Recent Graduates |

| Industry Demand for Skills | 70 | Hiring Managers, Industry Experts |

| Government Educational Initiatives | 60 | Policy Makers, Educational Consultants |

The United Arab Emirates Massive Open Online Courses market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for flexible learning solutions and government initiatives aimed at enhancing educational accessibility and quality.