Region:Middle East

Author(s):Dev

Product Code:KRAA7102

Pages:93

Published On:January 2026

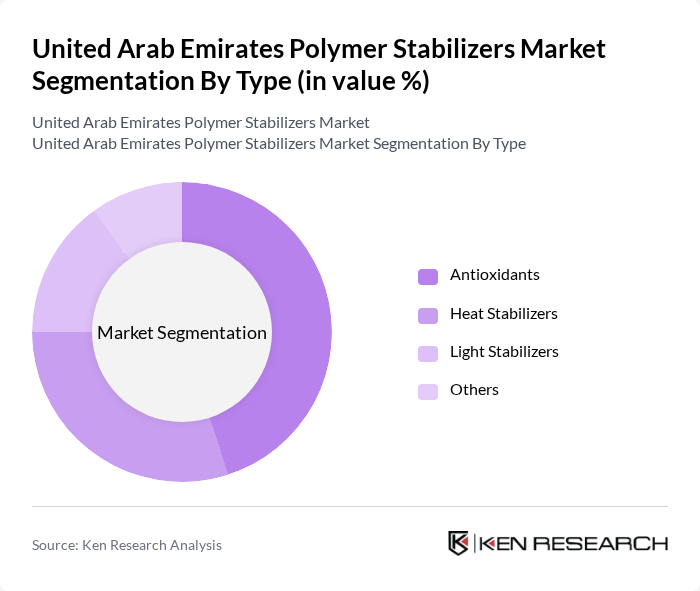

By Type:The market is segmented into various types of polymer stabilizers, including Antioxidants, Heat Stabilizers, Light Stabilizers, and Others. Among these, Heat Stabilizers are the most dominant due to their critical role in enhancing the thermal stability and longevity of polymers. The increasing demand for durable and high-performance materials in industries such as automotive and packaging drives the growth of this sub-segment. Antioxidants also play a significant role, particularly in applications requiring protection from oxidation.

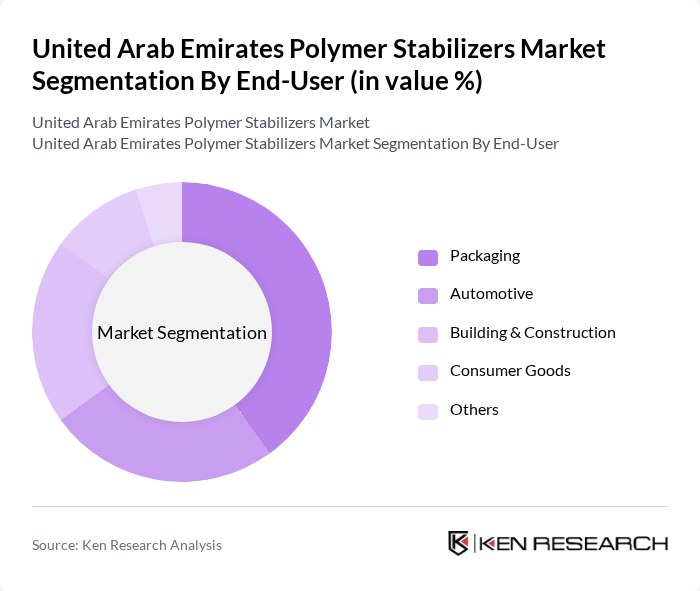

By End-User:The polymer stabilizers market is further segmented by end-user industries, including Packaging, Automotive, Building & Construction, Consumer Goods, and Others. The Packaging sector leads the market, driven by the increasing demand for flexible and durable packaging solutions. The automotive industry follows closely, as manufacturers seek to enhance the performance and longevity of automotive components. The Building & Construction sector is also significant, with a growing need for materials that can withstand harsh environmental conditions.

The United Arab Emirates Polymer Stabilizers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Evonik Industries AG, Solvay S.A., Lanxess AG, Dow Chemical Company, Eastman Chemical Company, Huntsman Corporation, A. Schulman, Inc., Croda International Plc, Mitsubishi Chemical Corporation, SABIC, LyondellBasell Industries N.V., INEOS Group, Arkema S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polymer stabilizers market in the UAE appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt smart polymers and bio-based stabilizers, the market is likely to witness significant innovation. Additionally, the ongoing expansion of the construction and automotive sectors will further bolster demand. Companies that invest in research and development to create eco-friendly products will be well-positioned to capitalize on emerging trends and regulatory incentives aimed at promoting sustainable practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Antioxidants Heat Stabilizers Light Stabilizers Others |

| By End-User | Packaging Automotive Building & Construction Consumer Goods Others |

| By Region | Dubai Abu Dhabi Sharjah Rest of UAE |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Polymer Manufacturing Sector | 75 | Production Managers, R&D Directors |

| Distribution and Supply Chain | 60 | Supply Chain Managers, Logistics Coordinators |

| End-User Industries (Automotive, Construction) | 55 | Procurement Managers, Product Development Engineers |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Analysts |

| Research and Development Institutions | 45 | Research Scientists, Technical Consultants |

The United Arab Emirates Polymer Stabilizers Market is valued at approximately USD 25 million, reflecting a five-year historical analysis. This valuation highlights the growing demand for high-performance polymers across various industries, including automotive, packaging, and construction.