Region:North America

Author(s):Rebecca

Product Code:KRAB4714

Pages:81

Published On:October 2025

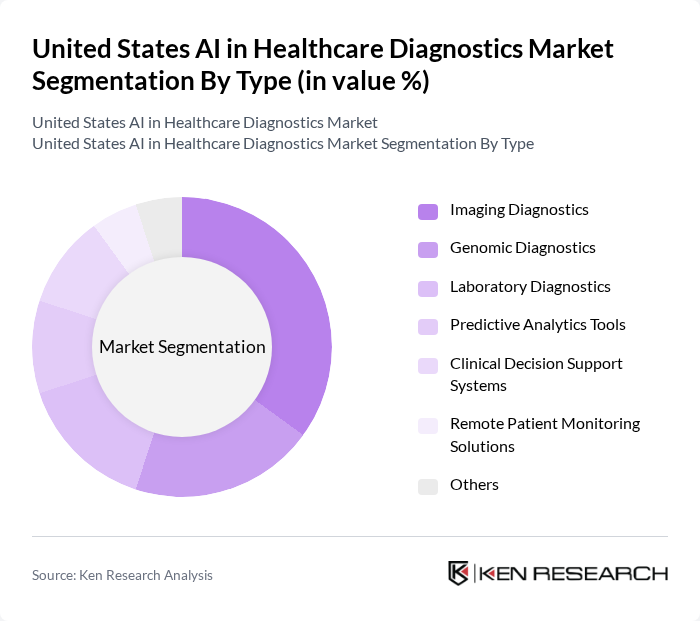

By Type:The market is segmented into Imaging Diagnostics, Genomic Diagnostics, Laboratory Diagnostics, Predictive Analytics Tools, Clinical Decision Support Systems, Remote Patient Monitoring Solutions, and Others. Imaging Diagnostics is the leading sub-segment, driven by the widespread adoption of AI-powered imaging solutions for disease detection and workflow optimization. AI technologies in imaging, such as radiology and pathology, enable faster and more accurate analysis, reducing diagnostic bottlenecks and improving clinical outcomes. Genomic Diagnostics is rapidly expanding, supported by advances in AI-driven genomics and precision medicine. Laboratory Diagnostics, Predictive Analytics Tools, and Clinical Decision Support Systems are also seeing increased integration, particularly in hospital and outpatient settings .

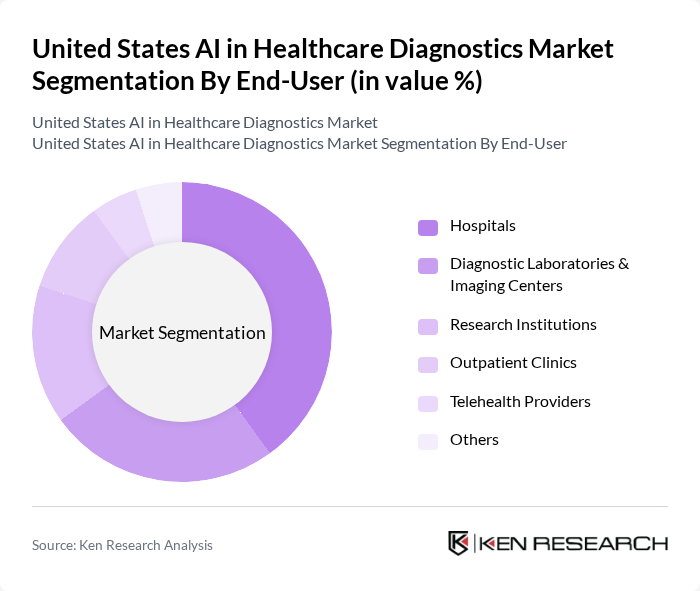

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories & Imaging Centers, Research Institutions, Outpatient Clinics, Telehealth Providers, and Others. Hospitals are the dominant end-user segment, reflecting the increasing integration of AI technologies in clinical settings. The demand for efficient diagnostic solutions in hospitals is rising, as they seek to improve patient care and operational efficiency, leading to a higher adoption rate of AI-driven diagnostic tools. Diagnostic Laboratories & Imaging Centers are also key adopters, leveraging AI for advanced analytics and workflow automation. Research Institutions and Telehealth Providers are expanding their use of AI to support remote diagnostics and population health management .

The United States AI in Healthcare Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Watson Health, Siemens Healthineers, GE Healthcare, Philips Healthcare, Aidoc, Zebra Medical Vision, PathAI, Tempus Labs, Arterys, Google Health (DeepMind), Optum, Nuance Communications, Qure.ai, Butterfly Network, Viz.ai, Caption Health, Freenome, Olive AI, Health Catalyst, Digital Diagnostics, NovaSignal Corporation, Imagene AI, Riverain Technologies, Berkeley Lights, Corti contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in healthcare diagnostics in the United States appears promising, driven by technological advancements and increasing healthcare demands. As telemedicine continues to expand, AI integration will enhance remote diagnostics, improving access to care. Additionally, the collaboration between tech companies and healthcare providers is expected to foster innovation, leading to more effective AI solutions. These trends indicate a transformative shift in how diagnostics are approached, ultimately improving patient outcomes and operational efficiencies across the healthcare landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Imaging Diagnostics Genomic Diagnostics Laboratory Diagnostics Predictive Analytics Tools Clinical Decision Support Systems Remote Patient Monitoring Solutions Others |

| By End-User | Hospitals Diagnostic Laboratories & Imaging Centers Research Institutions Outpatient Clinics Telehealth Providers Others |

| By Application | Oncology Cardiology Neurology Infectious Diseases Chronic Disease Management Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Partnerships with Healthcare Providers Others |

| By Region | Northeast Midwest South West Others |

| By Technology | Machine Learning Natural Language Processing Computer Vision Cloud-Based AI Platforms Robotics Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI in Radiology Diagnostics | 100 | Radiologists, Imaging Center Directors |

| AI in Pathology Diagnostics | 80 | Pathologists, Laboratory Managers |

| AI in Cardiology Diagnostics | 70 | Cardiologists, Health IT Managers |

| AI in Oncology Diagnostics | 90 | Oncologists, Clinical Research Coordinators |

| AI in General Practice Diagnostics | 60 | General Practitioners, Family Medicine Physicians |

The United States AI in Healthcare Diagnostics Market is valued at approximately USD 790 million, driven by advancements in machine learning, increasing demand for personalized medicine, and the rising prevalence of chronic diseases.