Region:Europe

Author(s):Dev

Product Code:KRAB5482

Pages:95

Published On:October 2025

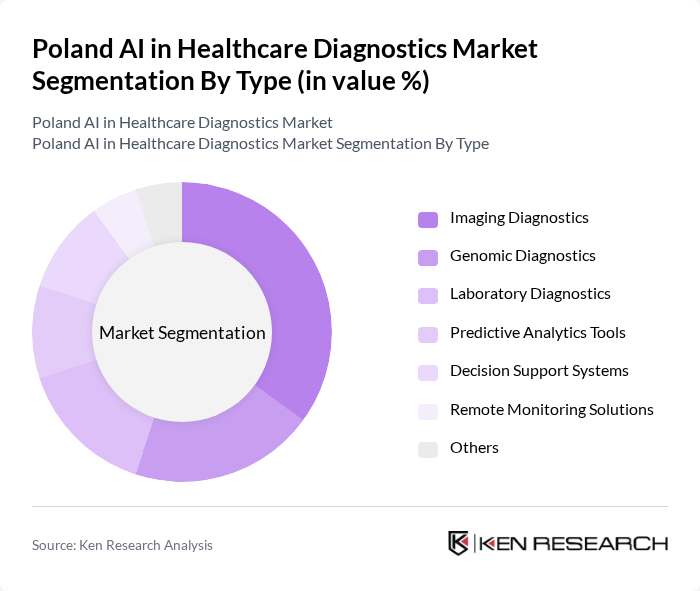

By Type:The market is segmented into various types, including Imaging Diagnostics, Genomic Diagnostics, Laboratory Diagnostics, Predictive Analytics Tools, Decision Support Systems, Remote Monitoring Solutions, and Others. Among these, Imaging Diagnostics is currently the leading sub-segment due to its widespread application in detecting diseases such as cancer and cardiovascular conditions. The increasing demand for early diagnosis and the integration of AI technologies in imaging processes are driving this segment's growth.

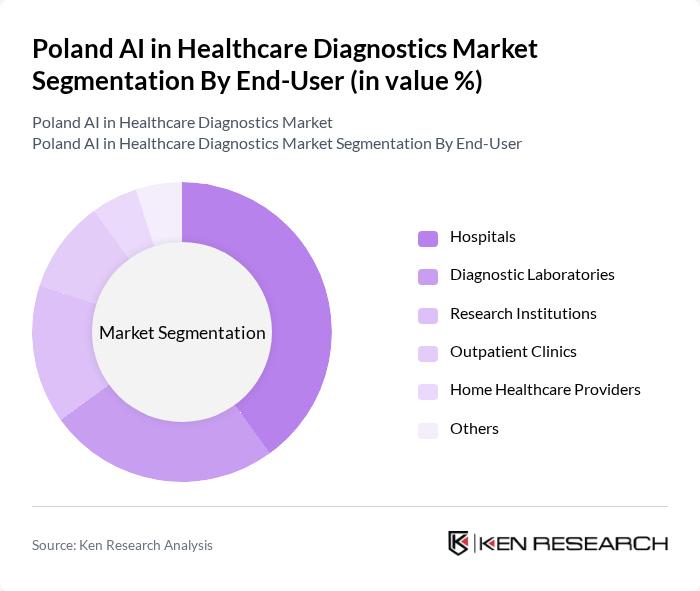

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Research Institutions, Outpatient Clinics, Home Healthcare Providers, and Others. Hospitals are the dominant end-user segment, driven by the increasing adoption of AI technologies to enhance diagnostic accuracy and improve patient care. The growing number of hospitals investing in AI solutions for diagnostics is a key factor contributing to this segment's leadership.

The Poland AI in Healthcare Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Philips Healthcare, GE Healthcare, IBM Watson Health, Cerner Corporation, Medtronic, Roche Diagnostics, Abbott Laboratories, Siemens AG, Optum, LabCorp, Quest Diagnostics, Bio-Rad Laboratories, Hologic, Inc., Illumina, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI in healthcare diagnostics market in Poland appears promising, driven by technological advancements and increasing healthcare investments. As the demand for personalized medicine grows, AI's role in tailoring treatments to individual patients will expand. Additionally, the integration of AI with telemedicine is expected to enhance remote diagnostics, making healthcare more accessible. These trends indicate a shift towards more efficient, patient-centered care, positioning AI as a cornerstone of future healthcare strategies in Poland.

| Segment | Sub-Segments |

|---|---|

| By Type | Imaging Diagnostics Genomic Diagnostics Laboratory Diagnostics Predictive Analytics Tools Decision Support Systems Remote Monitoring Solutions Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Outpatient Clinics Home Healthcare Providers Others |

| By Application | Cancer Detection Cardiovascular Diagnostics Neurological Disorders Infectious Diseases Chronic Disease Management Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Partnerships with Healthcare Providers Others |

| By Region | Central Poland Northern Poland Southern Poland Eastern Poland Western Poland Others |

| By Customer Type | Public Sector Private Sector Non-Profit Organizations Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI in Radiology Diagnostics | 100 | Radiologists, Imaging Center Directors |

| AI in Pathology | 80 | Pathologists, Laboratory Managers |

| AI in Cardiology Diagnostics | 70 | Cardiologists, Health IT Specialists |

| AI in Oncology | 60 | Oncologists, Clinical Research Coordinators |

| AI in General Practice | 90 | General Practitioners, Family Medicine Physicians |

The Poland AI in Healthcare Diagnostics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of advanced technologies, personalized medicine, and efficient diagnostic solutions that enhance patient outcomes and reduce healthcare costs.