Region:North America

Author(s):Dev

Product Code:KRAA4910

Pages:97

Published On:September 2025

By Type:The market is segmented into various types, including Imaging Diagnostics, Predictive Analytics, Clinical Decision Support Systems, Natural Language Processing, Remote Patient Monitoring, AI-Driven Laboratory Diagnostics, and Others. Among these, Imaging Diagnostics is currently the leading sub-segment due to its critical role in early disease detection and treatment planning. The increasing adoption of advanced imaging technologies, such as MRI and CT scans, integrated with AI algorithms, enhances diagnostic accuracy and efficiency, making it a preferred choice for healthcare providers.

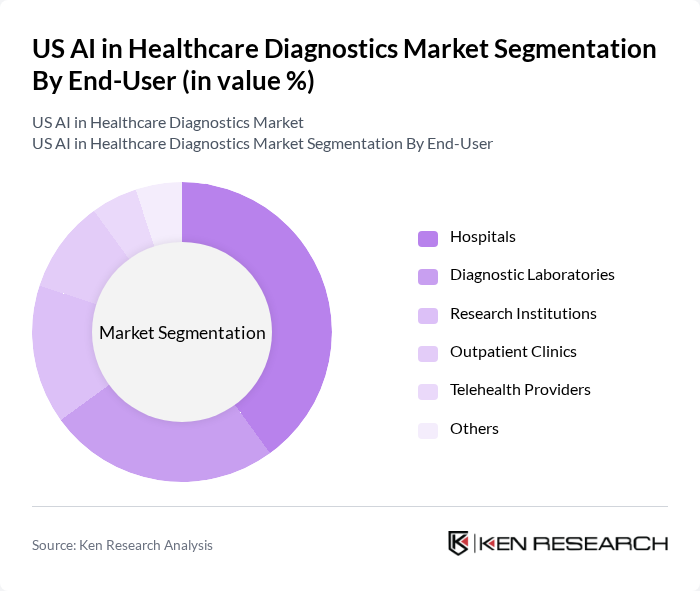

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Research Institutions, Outpatient Clinics, Telehealth Providers, and Others. Hospitals are the dominant end-user segment, driven by the increasing integration of AI technologies in clinical workflows to enhance diagnostic accuracy and operational efficiency. The growing focus on patient-centered care and the need for timely diagnostics in hospital settings further contribute to the rising adoption of AI solutions.

The US AI in Healthcare Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Watson Health, Siemens Healthineers, GE Healthcare, Philips Healthcare, Aidoc, Zebra Medical Vision, PathAI, Tempus, Google Health, Microsoft Healthcare, Nuance Communications, Qure.ai, Biofourmis, eClinicalWorks, Optum contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US AI in healthcare diagnostics market appears promising, driven by technological advancements and increasing healthcare demands. As telemedicine continues to expand, AI integration will enhance remote diagnostics, improving patient access to care. Additionally, the rise of personalized medicine will create opportunities for AI to tailor diagnostic approaches based on individual patient data, fostering better health outcomes. Collaborations between tech firms and healthcare providers will further accelerate innovation, ensuring that AI solutions are effectively implemented in clinical settings.

| Segment | Sub-Segments |

|---|---|

| By Type | Imaging Diagnostics Predictive Analytics Clinical Decision Support Systems Natural Language Processing Remote Patient Monitoring AI-Driven Laboratory Diagnostics Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Outpatient Clinics Telehealth Providers Others |

| By Application | Oncology Diagnostics Cardiovascular Diagnostics Neurological Diagnostics Infectious Disease Diagnostics Chronic Disease Management Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Partnerships with Healthcare Providers Others |

| By Region | Northeast Midwest South West Others |

| By Customer Segment | Individual Patients Healthcare Providers Insurance Companies Government Agencies Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Licensing Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI in Radiology Diagnostics | 100 | Radiologists, Imaging Center Directors |

| AI in Pathology Diagnostics | 80 | Pathologists, Laboratory Managers |

| AI in Cardiology Diagnostics | 70 | Cardiologists, Cardiac Care Unit Managers |

| AI in Oncology Diagnostics | 90 | Oncologists, Cancer Center Administrators |

| AI in General Practice Diagnostics | 60 | General Practitioners, Family Medicine Directors |

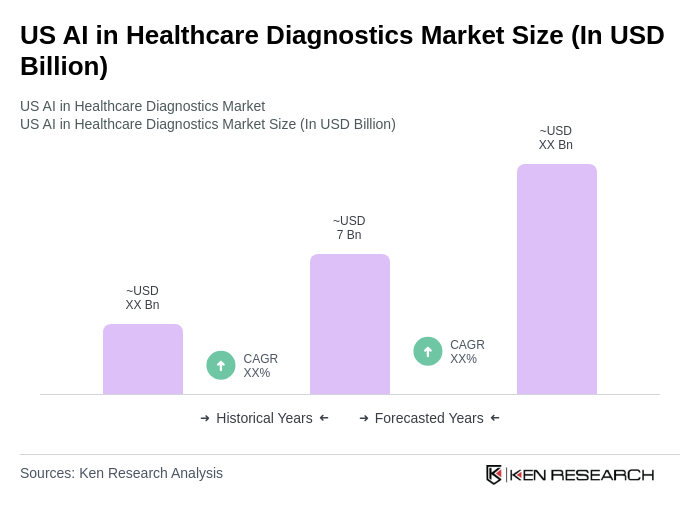

The US AI in Healthcare Diagnostics Market is valued at approximately USD 7 billion, driven by advancements in machine learning, personalized medicine demand, and the rising prevalence of chronic diseases, enhancing diagnostic accuracy and efficiency.