Region:North America

Author(s):Rebecca

Product Code:KRAB0284

Pages:86

Published On:August 2025

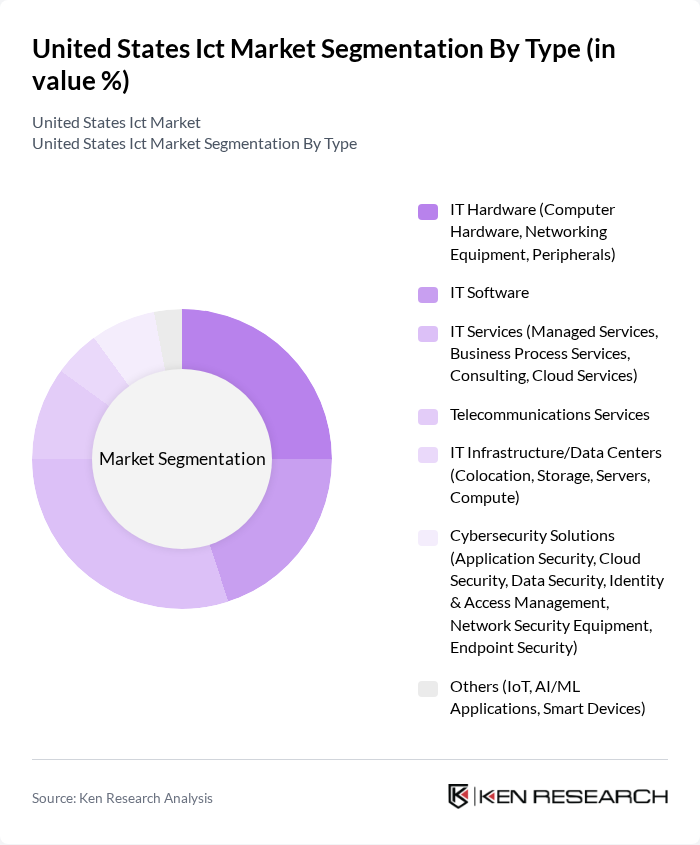

By Type:The ICT market is segmented into IT Hardware, IT Software, IT Services, Telecommunications Services, IT Infrastructure/Data Centers, Cybersecurity Solutions, and Others. IT Hardware includes computer hardware, networking equipment, and peripherals. IT Software covers operating systems, productivity software, and enterprise applications. IT Services encompass managed services, business process services, consulting, and cloud services. Telecommunications Services include fixed and mobile connectivity. IT Infrastructure/Data Centers involve colocation, storage, servers, and compute resources. Cybersecurity Solutions comprise application security, cloud security, data security, identity & access management, network security equipment, and endpoint security. The Others segment includes IoT, AI/ML applications, and smart devices .

By Enterprise Size:The market is segmented by enterprise size into Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs typically seek scalable, cost-effective ICT solutions, while Large Enterprises prioritize advanced, integrated systems for complex operations and security requirements. These segments reflect distinct purchasing behaviors and solution adoption patterns .

The United States ICT market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Cisco Systems, Inc., Oracle Corporation, Dell Technologies Inc., Hewlett Packard Enterprise, Salesforce, Inc., VMware, Inc., ServiceNow, Inc., Palo Alto Networks, Inc., Splunk Inc., Adobe Inc., Red Hat, Inc., Zoom Video Communications, Inc., Atlassian Corporation Plc, Apple Inc., Google LLC (Alphabet Inc.), Amazon Web Services, Inc., Meta Platforms, Inc., Verizon Communications Inc., AT&T Inc., Comcast Corporation, Broadcom Inc., Intel Corporation, Qualcomm Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The U.S. ICT market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As organizations increasingly adopt AI and machine learning, the demand for innovative solutions will rise. Additionally, the push for sustainable practices will shape investment strategies, with companies focusing on green technologies. The integration of edge computing will further enhance data processing capabilities, enabling real-time analytics and improved operational efficiency across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | IT Hardware (Computer Hardware, Networking Equipment, Peripherals) IT Software IT Services (Managed Services, Business Process Services, Consulting, Cloud Services) Telecommunications Services IT Infrastructure/Data Centers (Colocation, Storage, Servers, Compute) Cybersecurity Solutions (Application Security, Cloud Security, Data Security, Identity & Access Management, Network Security Equipment, Endpoint Security) Others (IoT, AI/ML Applications, Smart Devices) |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Industry Vertical | BFSI (Banking, Financial Services & Insurance) IT & Telecom Government Retail & E-commerce Manufacturing Energy & Utilities Healthcare Education Others |

| By Application | Enterprise Resource Planning (ERP) Customer Relationship Management (CRM) Supply Chain Management Data Analytics Network Management E-commerce Platforms Others |

| By Distribution Channel | Direct Sales Online Sales Retail Outlets Value-Added Resellers Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase Freemium Others |

| By Region | Northeast Midwest South West Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Software Adoption | 100 | IT Directors, Software Development Managers |

| Cloud Services Utilization | 90 | Cloud Architects, IT Infrastructure Managers |

| Cybersecurity Solutions | 80 | Chief Information Security Officers, Risk Management Executives |

| Telecommunications Services | 60 | Network Administrators, Telecom Managers |

| Emerging Technologies (AI, IoT) | 50 | Innovation Officers, R&D Managers |

The United States ICT market is valued at approximately USD 1.4 trillion, driven by rapid digital transformation, increased demand for cloud computing, and the proliferation of mobile devices, alongside significant investments in infrastructure and technology innovation.