Region:North America

Author(s):Rebecca

Product Code:KRAD7480

Pages:80

Published On:December 2025

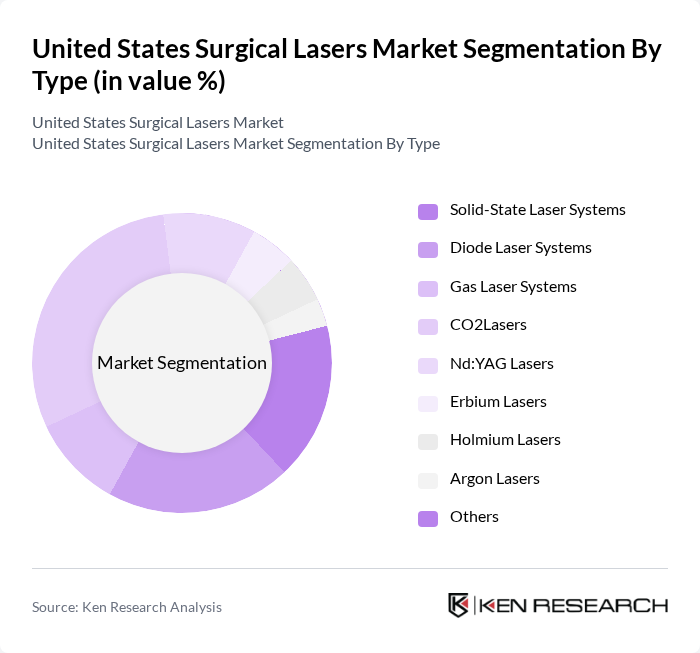

By Type:The market is segmented into various types of surgical lasers, including Solid-State Laser Systems, Diode Laser Systems, Gas Laser Systems, COLasers, Nd:YAG Lasers, Erbium Lasers, Holmium Lasers, Argon Lasers, and Others. Among these, **Solid-State Laser Systems** dominate due to their largest revenue share, with **Diode Laser Systems** exhibiting the fastest growth owing to their precision in minimally invasive and aesthetic applications. The increasing preference for minimally invasive procedures has further propelled the demand for these laser systems, making them a preferred choice in various surgical settings.

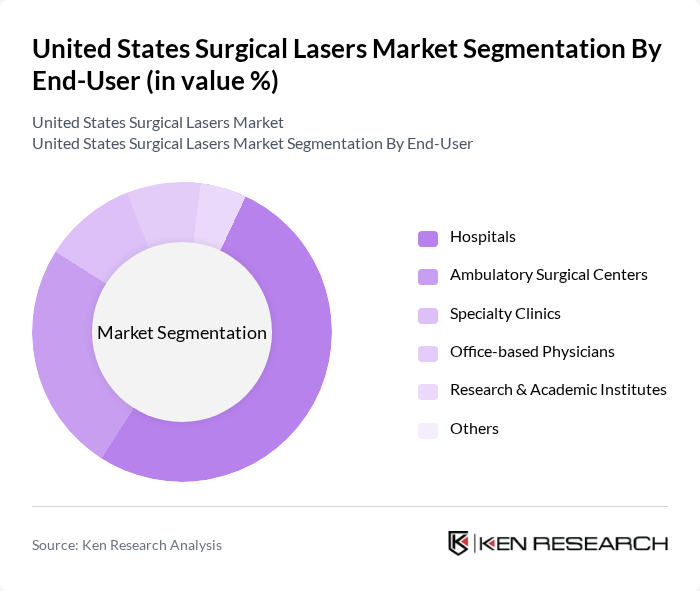

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Office-based Physicians, Research & Academic Institutes, and Others. Hospitals are the leading end-users of surgical lasers, driven by their capacity to perform a wide range of surgical procedures and their access to advanced medical technologies. The increasing number of surgical procedures performed in hospitals, coupled with the growing trend of outpatient surgeries, has significantly contributed to the demand for surgical lasers in this segment.

The United States Surgical Lasers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lumenis Ltd., Boston Scientific Corporation, Johnson & Johnson MedTech (including Ethicon), Medtronic plc, Stryker Corporation, Bausch & Lomb Corporation, Alcon Inc., AngioDynamics, Inc., Biolase, Inc., Cynosure, LLC, Cutera, Inc., Candela Corporation, Fotona d.o.o., Alma Lasers Ltd., Sciton, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States surgical lasers market appears promising, driven by ongoing innovations and an increasing focus on patient-centered care. As healthcare providers continue to adopt advanced laser technologies, the integration of artificial intelligence and robotics is expected to enhance surgical precision and outcomes. Additionally, the expansion of outpatient surgical centers will likely facilitate greater access to laser treatments, further propelling market growth and improving patient experiences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid-State Laser Systems Diode Laser Systems Gas Laser Systems CO2 Lasers Nd:YAG Lasers Erbium Lasers Holmium Lasers Argon Lasers Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Office-based Physicians Research & Academic Institutes Others |

| By Application | Ophthalmology (e.g., LASIK, cataract, retinal procedures) Dermatology & Aesthetics (e.g., resurfacing, vascular, hair removal) Urology (e.g., BPH, lithotripsy) Gynecology Cardiovascular & Peripheral Vascular Surgery Dentistry & Oral Surgery General & Laparoscopic Surgery Oncology and Other Surgical Applications |

| By Procedure Type | Open Surgery Laparoscopic / Minimally Invasive Surgery Percutaneous and Endoscopic Procedures |

| By Region | Northeast Midwest South West |

| By Distribution Channel | Direct Sales (Manufacturers to End Users) Authorized Distributors & Dealers Group Purchasing Organizations (GPOs) Online & E-Procurement Platforms Others |

| By Commercial Model | Capital Equipment Sales Operating Lease / Rental Models Managed Service & Pay-Per-Use Models Consumables & Service Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Surgical Departments | 120 | Surgeons, Department Heads |

| Outpatient Surgical Centers | 90 | Clinical Directors, Procurement Managers |

| Medical Device Distributors | 70 | Sales Representatives, Product Managers |

| Healthcare Technology Consultants | 60 | Consultants, Analysts |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

The United States Surgical Lasers Market is valued at approximately USD 3.4 billion, reflecting significant growth driven by advancements in laser technology and increasing demand for minimally invasive surgical procedures.