Region:North America

Author(s):Shubham

Product Code:KRAD6590

Pages:87

Published On:December 2025

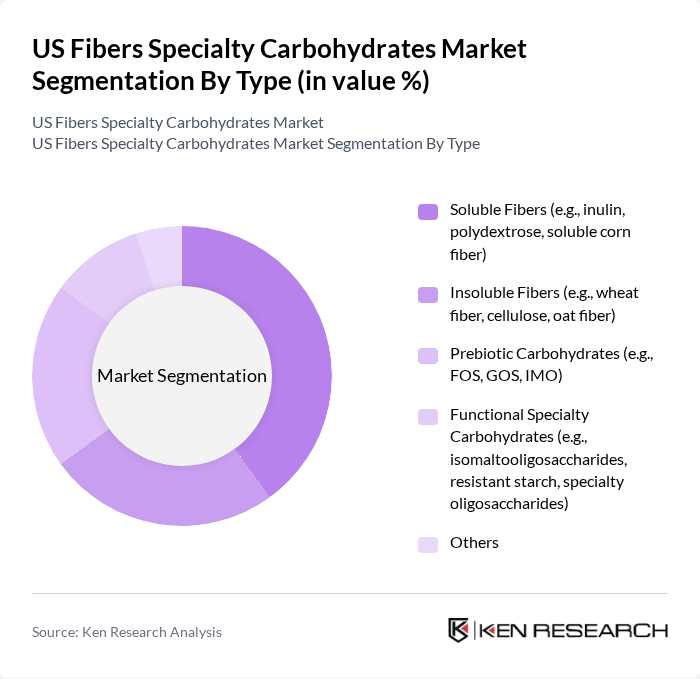

By Type:The market is segmented into various types of fibers specialty carbohydrates, including soluble fibers, insoluble fibers, prebiotic carbohydrates, functional specialty carbohydrates, and others. Among these, soluble fibers, such as inulin and polydextrose, are gaining significant traction due to their health benefits, including improved gut health, support for beneficial microbiota, cholesterol management, and modulation of blood sugar responses. The demand for prebiotic carbohydrates is also on the rise, driven by increasing consumer awareness of gut health, immune support, and the role of prebiotics (such as FOS, GOS, and inulin-type fructans) in supporting digestive health and overall well-being, as well as their incorporation into functional foods, beverages, dietary supplements, and infant nutrition.

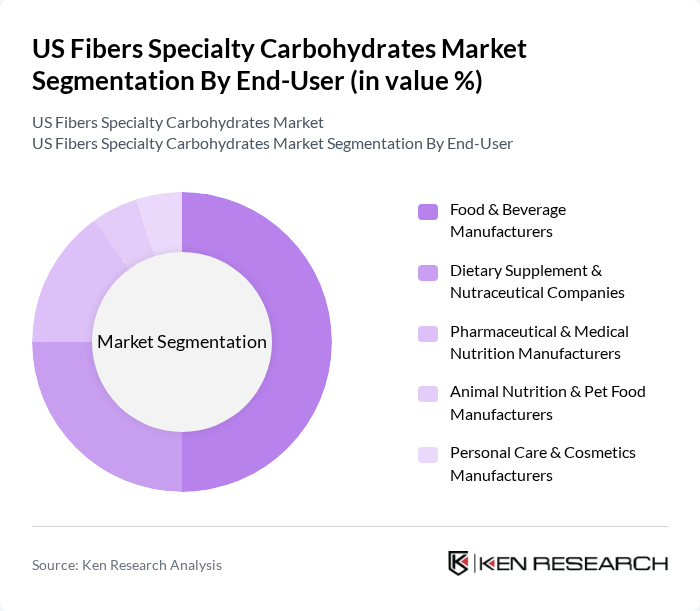

By End-User:The end-user segmentation includes food and beverage manufacturers, dietary supplement and nutraceutical companies, pharmaceutical and medical nutrition manufacturers, animal nutrition and pet food manufacturers, and personal care and cosmetics manufacturers. Food and beverage manufacturers are the leading end-users, driven by the increasing incorporation of fibers and specialty carbohydrates in bakery, cereals, dairy alternatives, beverages, snacks, and sports nutrition to enhance nutritional profiles, deliver digestive and metabolic health benefits, and meet consumer demand for cleaner labels, reduced sugar, and better-for-you formulations.

The US Fibers Specialty Carbohydrates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ingredion Incorporated, Tate & Lyle PLC, DuPont de Nemours, Inc. (including Danisco heritage business), Archer Daniels Midland Company (ADM), Cargill, Incorporated, BENEO GmbH, Roquette Frères, Fiberstar, Inc., Taiyo Kagaku Co., Ltd. (Sunfiber), Nexira, Kerry Group plc, Emsland Group, DSM-Firmenich AG, Ginkgo Bioworks Holdings, Inc., Cargill Health & Nutrition (Cargill’s specialty health ingredients business) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US fibers specialty carbohydrates market appears promising, driven by ongoing trends in health and wellness. As consumers increasingly prioritize natural and functional foods, manufacturers are likely to invest in innovative product formulations that cater to these preferences. Additionally, advancements in production technologies will enhance efficiency and reduce costs, making specialty carbohydrates more accessible. The market is expected to witness a surge in collaborations between food brands and health-focused companies, further expanding the reach and impact of specialty carbohydrates in the food industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Soluble Fibers (e.g., inulin, polydextrose, soluble corn fiber) Insoluble Fibers (e.g., wheat fiber, cellulose, oat fiber) Prebiotic Carbohydrates (e.g., FOS, GOS, IMO) Functional Specialty Carbohydrates (e.g., isomaltooligosaccharides, resistant starch, specialty oligosaccharides) Others |

| By End-User | Food & Beverage Manufacturers Dietary Supplement & Nutraceutical Companies Pharmaceutical & Medical Nutrition Manufacturers Animal Nutrition & Pet Food Manufacturers Personal Care & Cosmetics Manufacturers |

| By Application | Functional Foods & Beverages Dietary Supplements (capsules, powders, gummies) Bakery & Cereals Dairy & Dairy Alternatives Infant Nutrition & Medical Nutrition Animal Nutrition Others |

| By Distribution Channel | Business-to-Business (B2B) Ingredient Sales Direct Sales to Large Food & Beverage Accounts Specialty Distributors & Blenders Online B2B Platforms Others |

| By Source | Cereal Grains (e.g., corn, wheat, oats) Fruits & Vegetables (e.g., chicory root, citrus, apple, potato) Legumes & Pulses Microbial & Fermentation-Derived Synthetic & Chemically Modified Others |

| By Region | Northeast Midwest South West |

| By Product Form | Powder Liquid/Syrup Granules Agglomerates & Compacted Blends Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, Quality Assurance Specialists |

| Nutraceutical Companies | 100 | Research and Development Directors, Regulatory Affairs Managers |

| Health and Wellness Retailers | 80 | Category Managers, Purchasing Agents |

| Dietary Supplement Producers | 70 | Marketing Managers, Sales Directors |

| Food Scientists and Nutritionists | 90 | Registered Dietitians, Food Technologists |

The US Fibers Specialty Carbohydrates Market is valued at approximately USD 3.5 billion, reflecting a robust demand driven by the increasing consumption of functional foods, dietary supplements, and fiber-fortified products.