Region:North America

Author(s):Geetanshi

Product Code:KRAA3233

Pages:85

Published On:September 2025

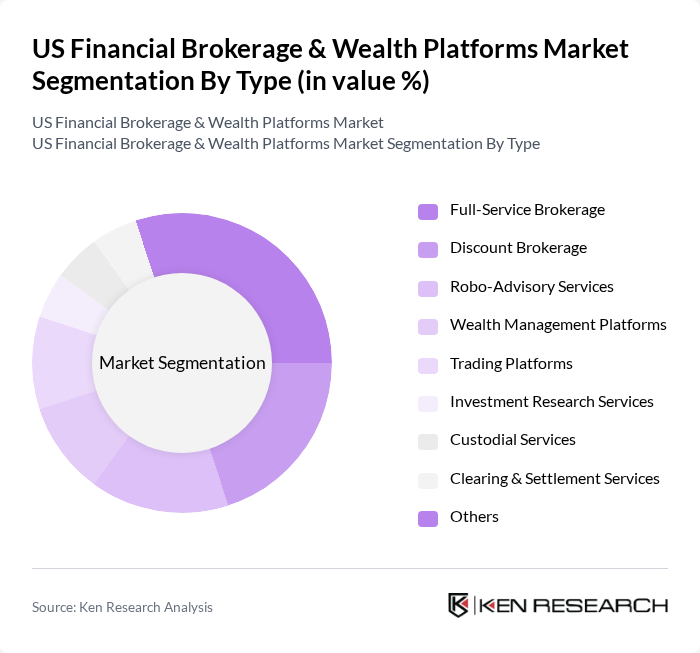

By Type:The market is segmented into Full-Service Brokerage, Discount Brokerage, Robo-Advisory Services, Wealth Management Platforms, Trading Platforms, Investment Research Services, Custodial Services, Clearing & Settlement Services, and Others. Full-Service Brokerage firms offer comprehensive financial advice, portfolio management, and personalized services. Discount Brokerage platforms focus on low-cost trading and self-directed investing. Robo-Advisory Services utilize algorithms and automation to deliver personalized investment strategies at scale. Wealth Management Platforms integrate portfolio management, compliance, and reporting tools for advisors and institutions. Trading Platforms provide real-time access to securities markets and advanced analytics. Investment Research Services deliver market insights and analytics. Custodial Services ensure secure asset holding and transaction processing. Clearing & Settlement Services facilitate the finalization of trades and fund transfers. The "Others" segment includes emerging fintech solutions and niche advisory services .

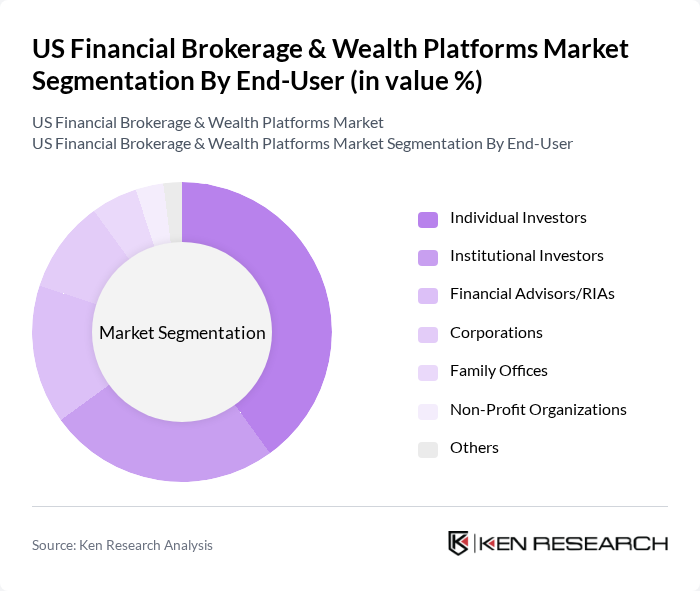

By End-User:The market is segmented by end-users, including Individual Investors, Institutional Investors, Financial Advisors/RIAs, Corporations, Family Offices, Non-Profit Organizations, and Others. Individual Investors utilize platforms for self-directed trading, portfolio management, and access to financial education. Institutional Investors leverage advanced analytics, research, and trading capabilities to manage large-scale portfolios. Financial Advisors and Registered Investment Advisers (RIAs) rely on integrated platforms for client management, compliance, and reporting. Corporations use wealth platforms for treasury management and employee benefit plans. Family Offices seek bespoke investment solutions and multi-generational wealth planning. Non-Profit Organizations utilize platforms for endowment management and responsible investing. The "Others" segment includes government entities and emerging investor categories .

The US Financial Brokerage & Wealth Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Charles Schwab Corporation, Fidelity Investments, E*TRADE Financial Corporation, TD Ameritrade (now part of Charles Schwab), Robinhood Markets, Inc., Interactive Brokers Group, Inc., Vanguard Group, Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated (Bank of America Merrill Lynch), Ameriprise Financial, Inc., Wealthfront Corporation, SoFi Invest (Social Finance, Inc.), Acorns Grow Incorporated, Betterment LLC, M1 Finance LLC, Personal Capital Corporation (Empower Personal Wealth) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US financial brokerage and wealth platforms market is poised for transformative growth, driven by technological advancements and evolving investor preferences. As digital solutions become more integrated into everyday financial activities, platforms will increasingly leverage artificial intelligence to enhance user experience and investment strategies. Additionally, the focus on sustainable investing will likely reshape product offerings, catering to a growing demographic of socially conscious investors seeking to align their portfolios with their values.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Brokerage Discount Brokerage Robo-Advisory Services Wealth Management Platforms Trading Platforms Investment Research Services Custodial Services Clearing & Settlement Services Others |

| By End-User | Individual Investors Institutional Investors Financial Advisors/RIAs Corporations Family Offices Non-Profit Organizations Others |

| By Investment Type | Equities Fixed Income Mutual Funds ETFs Options & Derivatives Alternative Investments Others |

| By Service Model | Subscription-Based Commission-Based Fee-Only Hybrid Models Others |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Financial Advisors/Wealth Managers Third-Party Integrators Others |

| By Customer Segment | Retail Investors High-Net-Worth Individuals (HNWIs) Ultra-High-Net-Worth Individuals (UHNWIs) Family Offices Small and Medium Enterprises (SMEs) Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Brokerage Users | 100 | Individual Investors, Retail Traders |

| Wealth Management Clients | 60 | High-Net-Worth Individuals, Family Offices |

| Financial Advisors | 40 | Independent Advisors, Wealth Managers |

| Institutional Investors | 50 | Pension Fund Managers, Institutional Asset Managers |

| Fintech Platform Users | 70 | Millennial Investors, Tech-Savvy Traders |

The US Financial Brokerage & Wealth Platforms Market is valued at approximately USD 1.1 trillion, reflecting the total assets managed across various brokerage, wealth management, and digital advisory platforms in the country.