Region:North America

Author(s):Dev

Product Code:KRAC8691

Pages:95

Published On:November 2025

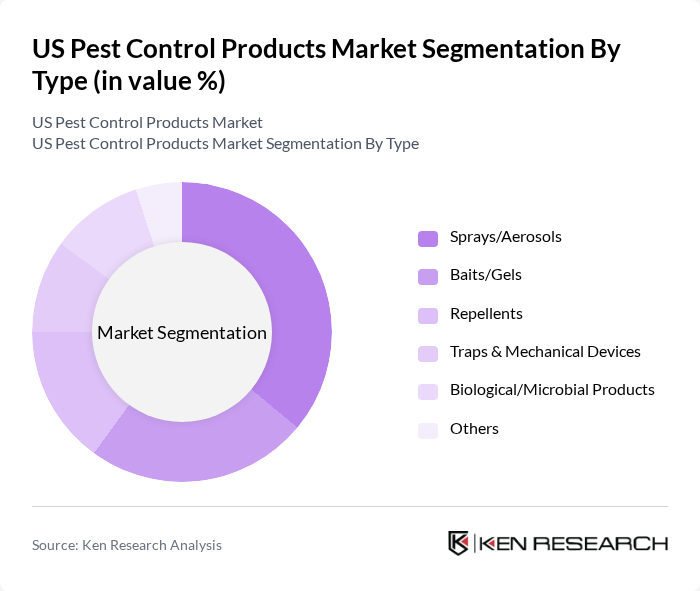

By Type:The pest control products market can be segmented into various types, including sprays/aerosols, baits/gels, repellents, traps & mechanical devices, biological/microbial products, and others. Among these, sprays/aerosols are the most widely used due to their convenience and effectiveness in targeting a variety of pests. Baits and gels are also gaining traction, particularly in residential settings, as they offer targeted solutions for specific pest problems. The increasing trend towards biological and microbial products reflects a growing consumer preference for environmentally friendly options .

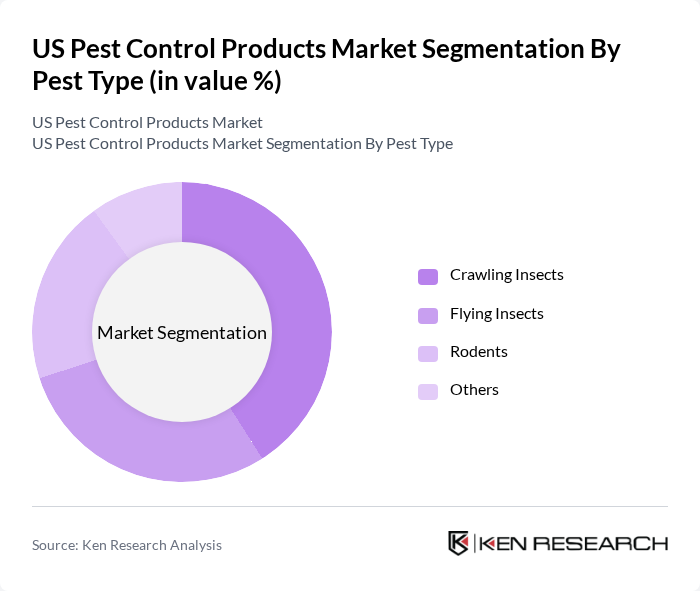

By Pest Type:The market can also be segmented based on the type of pests, including crawling insects (such as ants, cockroaches, and bedbugs), flying insects (like mosquitoes, flies, and moths), rodents (including mice and rats), and others (such as birds and wildlife). Crawling insects represent the largest segment due to their prevalence in urban areas and the associated health risks they pose. The flying insect segment is also significant, particularly in warmer climates where mosquitoes are a major concern. The demand for effective rodent control solutions is driven by the increasing awareness of the health hazards associated with rodent infestations .

The US Pest Control Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Bayer AG, FMC Corporation, Syngenta Group, Corteva Agriscience, Bell Laboratories, Inc., Woodstream Corporation, Control Solutions, Inc., Rentokil Initial plc, Ecolab Inc., Target Specialty Products, Univar Solutions, ADAMA Agricultural Solutions, Nufarm, EcoSMART Technologies contribute to innovation, geographic expansion, and service delivery in this space .

The US pest control products market is poised for significant evolution, driven by increasing consumer demand for sustainable solutions and technological integration. As urbanization continues, pest control services will likely expand, focusing on eco-friendly products and integrated pest management strategies. Additionally, the rise of e-commerce platforms will facilitate easier access to pest control solutions, enhancing market reach. Companies that invest in research and development will be better positioned to innovate and meet the changing needs of consumers, ensuring long-term growth and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Sprays/Aerosols Baits/Gels Repellents Traps & Mechanical Devices Biological/Microbial Products Others |

| By Pest Type | Crawling Insects (e.g., ants, cockroaches, bedbugs) Flying Insects (e.g., mosquitoes, flies, moths) Rodents (e.g., mice, rats) Others (e.g., birds, wildlife) |

| By Control Mechanism | Chemical Biological Mechanical Integrated Pest Management (IPM) |

| By End-Use | Residential Commercial Industrial Agricultural Others |

| By Distribution Channel | Online Retail Offline Retail (Supermarkets, Hardware Stores, Specialty Stores) Direct Sales Others |

| By Region | Northeast Midwest South West |

| By Customer Type | DIY Consumers Professional Pest Control Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Pest Control Users | 120 | Homeowners, Renters |

| Commercial Pest Control Clients | 90 | Facility Managers, Property Owners |

| Pest Control Product Retailers | 60 | Store Managers, Purchasing Agents |

| Industry Experts and Consultants | 40 | Pest Control Specialists, Regulatory Advisors |

| Environmental and Regulatory Bodies | 40 | Policy Makers, Environmental Scientists |

The US Pest Control Products Market is valued at approximately USD 4.7 billion. This growth is driven by factors such as urbanization, public health concerns regarding pest-related diseases, and an increasing demand for sustainable pest management solutions.