Region:Global

Author(s):Shubham

Product Code:KRAC2259

Pages:99

Published On:October 2025

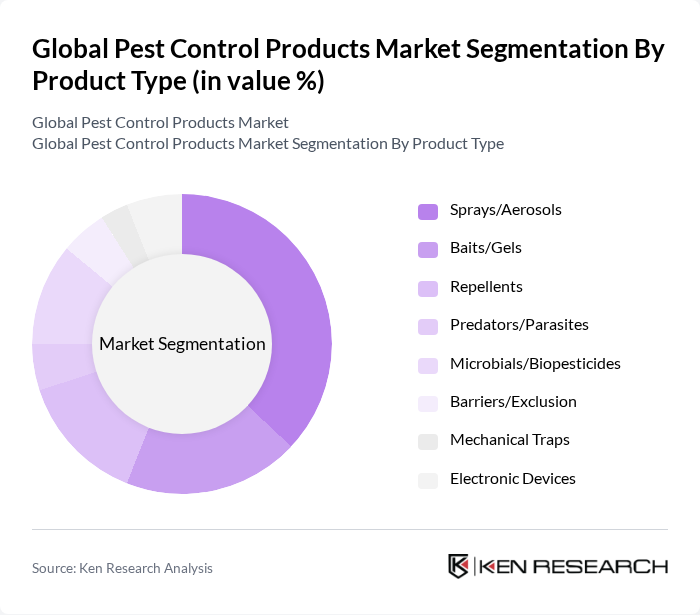

By Product Type:The product type segmentation includes sprays/aerosols, baits/gels, repellents, predators/parasites, microbials/biopesticides, barriers/exclusion, mechanical traps, and electronic devices. Among these, sprays/aerosols are the most widely used due to their convenience and immediate efficacy in pest control. The growing consumer preference for easy-to-use and quick-acting products has led to a significant market share for this sub-segment .

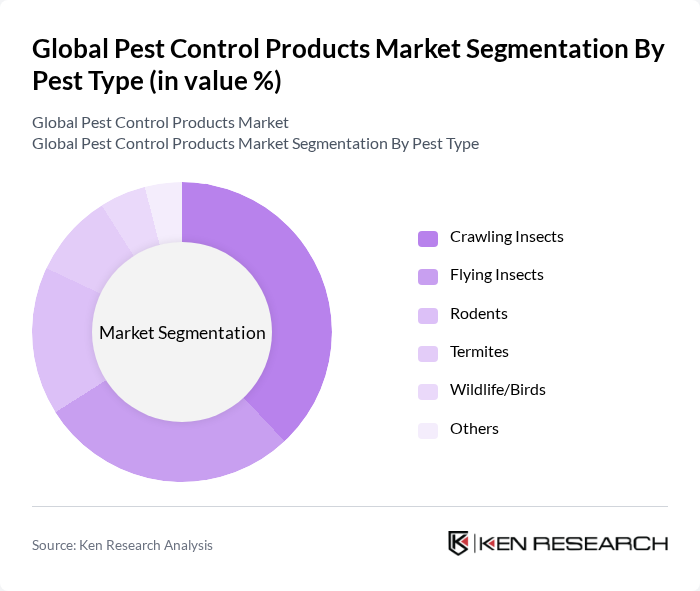

By Pest Type:The pest type segmentation encompasses flying insects, crawling insects, rodents, termites, wildlife/birds, and others. Crawling insects, including cockroaches and ants, currently hold the largest share due to their prevalence in both residential and commercial settings. However, flying insects such as mosquitoes and flies remain a critical focus due to their role in spreading vector-borne diseases, sustaining high demand for targeted solutions .

The Global Pest Control Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG, Syngenta AG, BASF SE, Rentokil Initial plc, Terminix Global Holdings, Inc., Rollins, Inc., FMC Corporation, Ecolab Inc., Anticimex Group, SC Johnson Professional, Clarke Pest Control, Truly Nolen of America, Inc., Rentokil PCI, Dodson Pest Control, Arrow Exterminators contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pest control products market appears promising, driven by technological advancements and a shift towards sustainable practices. As consumers increasingly demand eco-friendly solutions, companies are likely to invest in research and development to create innovative products. Additionally, the integration of smart technologies, such as IoT devices, will enhance pest management efficiency. In future, the market is expected to witness significant growth in organic and biopesticide segments, reflecting a broader trend towards sustainability and health-conscious consumer choices.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sprays/Aerosols Baits/Gels Repellents Predators/Parasites Microbials/Biopesticides Barriers/Exclusion Mechanical Traps Electronic Devices |

| By Pest Type | Flying Insects Crawling Insects Rodents Termites Wildlife/Birds Others |

| By Control Mechanism | Chemical Physical/Mechanical Biological |

| By End-Use | Residential Commercial Industrial Agricultural Government & Utilities Others |

| By Distribution Channel | Supermarkets and Hypermarkets Pharmacies & Drugstores Home Improvement & Hardware Stores E-commerce/Online Direct Sales Distributors & Wholesalers Agricultural Supply Stores & Co-operatives Commercial & Institutional E-procurement Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bottles Pouches Cans Others |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Pest Control Services | 100 | Pest Control Technicians, Service Managers |

| Commercial Pest Management Solutions | 80 | Facility Managers, Procurement Officers |

| Agricultural Pest Control Products | 60 | Agronomists, Farm Managers |

| Industrial Pest Control Applications | 50 | Safety Officers, Operations Managers |

| Retail Pest Control Product Sales | 40 | Store Managers, Product Buyers |

The Global Pest Control Products Market is valued at approximately USD 15 billion, driven by factors such as urbanization, public health awareness, and the agricultural sector's growth, which necessitates effective pest management solutions.