Region:Asia

Author(s):Dev

Product Code:KRAC8687

Pages:87

Published On:November 2025

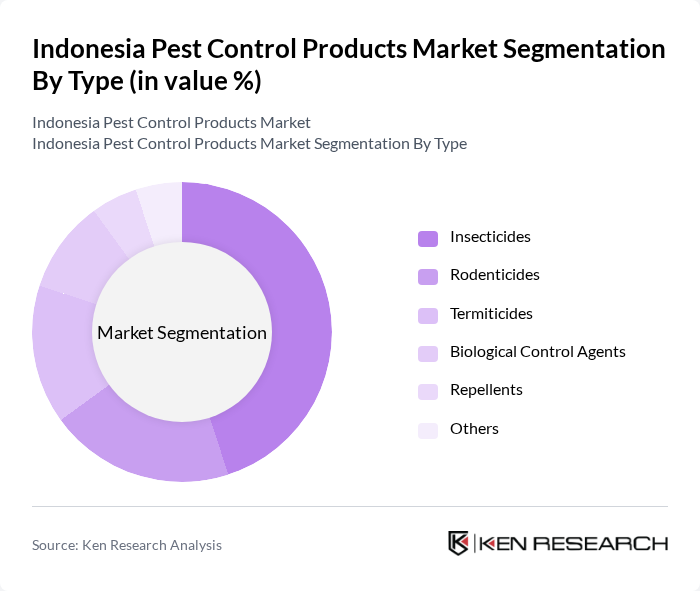

By Type:The pest control products market can be segmented into various types, including insecticides, rodenticides, termiticides, biological control agents, repellents, and others. Among these, insecticides are the most widely used due to their effectiveness in controlling a broad range of pests, particularly in agricultural and residential settings. The increasing prevalence of pests and the need for effective pest management solutions have led to a higher demand for insecticides, making them the dominant sub-segment in the market. The market share for insecticides is supported by ongoing pest pressure in irrigated rice and vegetable systems, as well as the expansion of commercial crops such as oil palm and rubber .

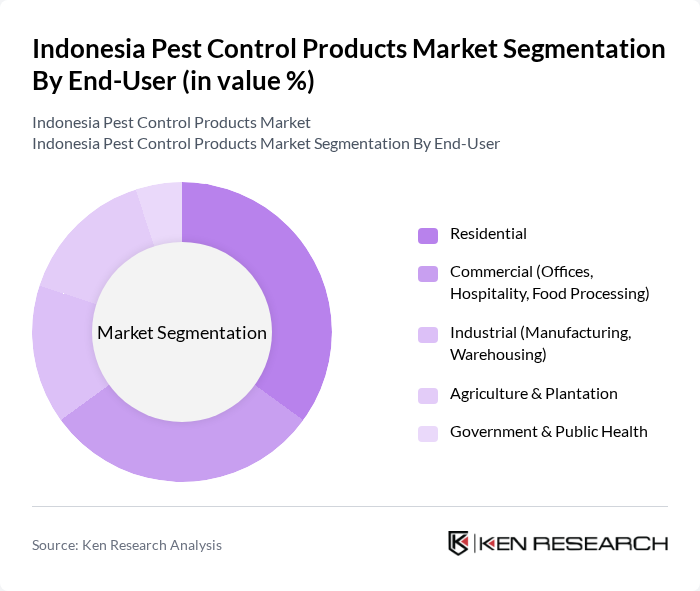

By End-User:The market can also be segmented based on end-users, including residential, commercial (offices, hospitality, food processing), industrial (manufacturing, warehousing), agriculture & plantation, and government & public health. The residential segment is witnessing significant growth due to increasing awareness of pest-related health risks and the rising demand for pest control services in urban households. This segment's focus on maintaining hygiene and safety in living spaces has made it a leading sub-segment in the market. The commercial and industrial segments are also expanding, driven by stricter hygiene standards in food processing and manufacturing facilities .

The Indonesia Pest Control Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Bayer Indonesia, PT Syngenta Indonesia, PT BASF Indonesia, PT FMC Indonesia, PT UPL Indonesia, PT Corteva Agriscience Indonesia, PT Petrokimia Gresik, PT Agricon, PT Sari Bumi Sukses, PT Citra Pestindo, PT Mitra Pesticides, PT Pupuk Kaltim, PT Bina Agri Sejahtera, PT Tunas Sumber Rejeki, PT Sumber Makmur contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pest control products market in Indonesia appears promising, driven by urbanization and health awareness. As the population continues to migrate to urban areas, the demand for effective pest management solutions will likely increase. Additionally, the government's commitment to pest control initiatives will further support market growth. Companies that adapt to consumer preferences for eco-friendly products and invest in technology will be well-positioned to capitalize on emerging opportunities in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Insecticides Rodenticides Termiticides Biological Control Agents Repellents Others |

| By End-User | Residential Commercial (Offices, Hospitality, Food Processing) Industrial (Manufacturing, Warehousing) Agriculture & Plantation Government & Public Health |

| By Region | Java Sumatra Bali & Nusa Tenggara Kalimantan Sulawesi & Eastern Indonesia |

| By Application | Crop Protection (Agriculture) Structural Pest Control (Buildings, Homes) Vector Control (Mosquitoes, Public Health) Stored Product Pest Control Livestock Pest Control Others |

| By Distribution Channel | Online Retail Agrochemical Stores Modern Trade (Supermarkets, Hypermarkets) Direct Sales Distributors/Dealers |

| By Product Formulation | Liquid Formulations Granular Formulations Aerosol/Spray Baits Dusts & Powders Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Pest Control Services | 85 | Pest Control Operators, Business Owners |

| Agricultural Pest Management | 72 | Agronomists, Farm Managers |

| Residential Pest Control Products | 68 | Homeowners, DIY Enthusiasts |

| Regulatory Compliance Insights | 45 | Environmental Compliance Officers, Regulatory Affairs Managers |

| Distribution Channel Analysis | 80 | Distributors, Retail Managers |

The Indonesia Pest Control Products Market is valued at approximately USD 1.25 billion, reflecting significant growth driven by urbanization, agricultural expansion, and increased awareness of pest-related health issues.