Region:Asia

Author(s):Dev

Product Code:KRAC8694

Pages:95

Published On:November 2025

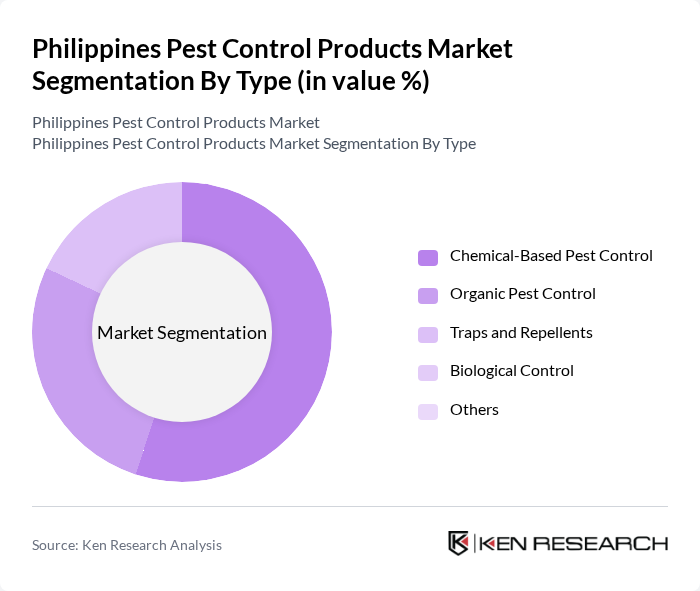

By Type:The pest control products market can be segmented into various types, including Chemical-Based Pest Control, Organic Pest Control, Traps and Repellents, Biological Control, and Others. Among these, Chemical-Based Pest Control is the most dominant segment due to its effectiveness and widespread availability. However, there is a growing trend towards Organic Pest Control as consumers become more environmentally conscious. The demand for Traps and Repellents is also increasing, particularly in urban areas where quick and effective solutions are needed. Chemical-based methods held a 55% share, organic methods 27%, and mechanical traps 18% .

By End-User:The market can also be segmented by end-user categories, including Residential, Commercial/Industrial, Agriculture, Public Health & Government, and Environment. The Residential segment is the largest due to the increasing number of households seeking pest control solutions for health and safety reasons. The Commercial/Industrial segment is also significant, driven by businesses that require pest management to maintain hygiene standards and protect their assets. Agriculture contributed 33%, households 28%, commercial/industrial 22%, public health 10%, and environment 7% .

The Philippines Pest Control Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rentokil Initial Philippines, Inc., Orkin Philippines (subsidiary of Orkin LLC), PestBusters Philippines, Pest Science Corporation, Bayer CropScience Philippines, Inc., Syngenta Philippines, Inc., BASF Philippines, Inc., FMC Philippines, Inc., ADAMA Philippines, Inc., Ecolab Philippines, Inc., Anticimex Philippines, EcoSmart Pest Solutions, Clarke Pest Control Philippines, Terminix Philippines, Mapecon Philippines, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the pest control products market in the Philippines appears promising, driven by increasing urbanization and health awareness. As the population continues to grow in urban areas, the demand for effective pest management solutions will likely rise. Additionally, the trend towards eco-friendly products and integrated pest management practices will shape the market landscape, encouraging innovation and collaboration among stakeholders. Companies that adapt to these trends will be well-positioned to capture emerging opportunities in this evolving market.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical-Based Pest Control Organic Pest Control Traps and Repellents Biological Control Others |

| By End-User | Residential Commercial/Industrial Agriculture Public Health & Government Environment |

| By Application | Agriculture Household Commercial/Industrial Public Health Environment |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Product Formulation | Liquid Granular Aerosol Bait Others |

| By Packaging Type | Bottles Cans Pouches Bulk Packaging Others |

| By Brand Positioning | Premium Mid-range Economy Private Label Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Sector Pest Control | 100 | Farmers, Agricultural Extension Workers |

| Urban Pest Management Services | 80 | Pest Control Operators, Facility Managers |

| Commercial Property Pest Control | 60 | Property Managers, Building Maintenance Supervisors |

| Household Pest Control Products | 90 | Homeowners, Retail Store Managers |

| Regulatory Compliance in Pest Control | 40 | Regulatory Affairs Specialists, Environmental Consultants |

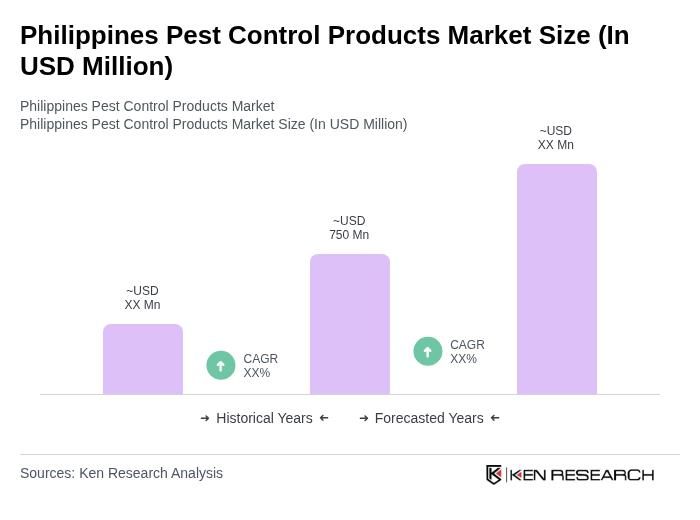

The Philippines Pest Control Products Market is valued at approximately USD 750 million, driven by urbanization, health awareness, and agricultural expansion. This market is expected to grow further as demand for effective pest management solutions increases.