Region:Asia

Author(s):Dev

Product Code:KRAC8822

Pages:88

Published On:November 2025

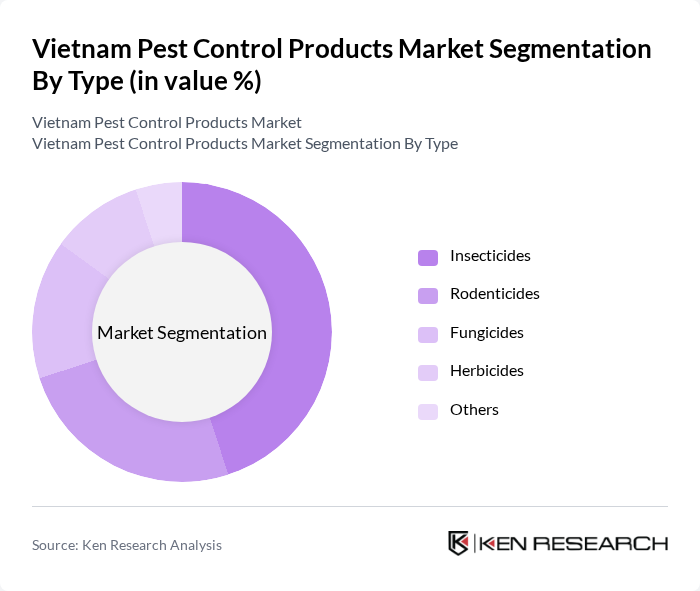

By Type:The pest control products market is segmented into various types, including insecticides, rodenticides, fungicides, herbicides, and others. Among these, insecticides are the most dominant due to their widespread use in both agricultural and residential settings. The increasing prevalence of pests and the need for effective pest management solutions have led to a higher demand for insecticides. Rodenticides and fungicides also hold significant market shares, driven by urbanization and agricultural practices that require pest control measures. The market is also witnessing a gradual increase in the adoption of biopesticides and integrated pest management solutions, reflecting a shift toward sustainable practices .

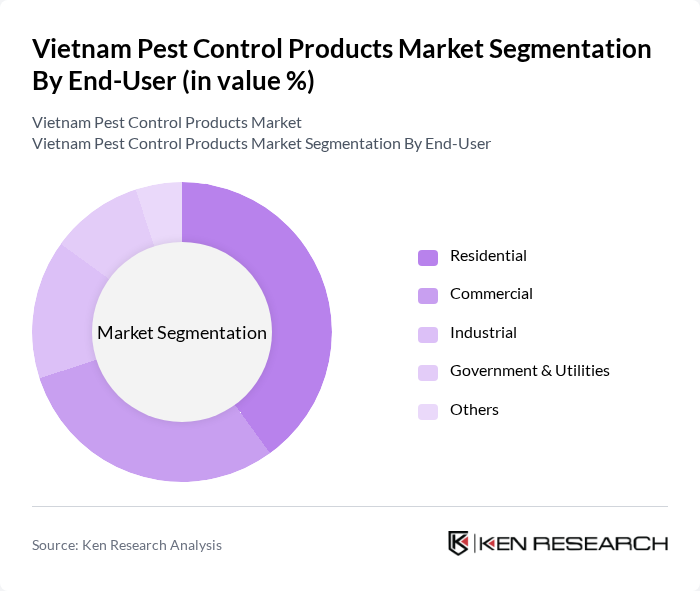

By End-User:The market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment is the largest due to the increasing awareness of pest-related health risks and the growing trend of home gardening. Commercial establishments, including restaurants and hotels, also contribute significantly to the market as they require pest control services to maintain hygiene and safety standards. The industrial sector is witnessing growth as well, driven by the need for pest management in manufacturing and storage facilities. The adoption of advanced pest control technologies and stricter regulatory compliance in commercial and industrial settings are also fueling segment growth .

The Vietnam Pest Control Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rentokil Initial, Terminix International, Orkin (Rollins, Inc.), Bayer CropScience, Syngenta, BASF, FMC Corporation, ADAMA Agricultural Solutions, Sumitomo Chemical, UPL Limited, Ecolab, Anticimex, SC Johnson Professional, EcoSMART Technologies, Pest Control Services (Vietnam), Corteva Agriscience, PI Industries, Wynca Group, Vinaconex Pest Control, Saigon Pest Control contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam pest control products market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The adoption of smart pest control solutions, such as IoT devices, is expected to enhance efficiency and effectiveness in pest management. Additionally, the shift towards organic and eco-friendly products will likely reshape the competitive landscape, as consumers increasingly prioritize sustainability. As the market evolves, companies that innovate and adapt to these trends will be well-positioned for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Insecticides Rodenticides Fungicides Herbicides Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | Agriculture Public Health Household Commercial Facilities Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| By Product Formulation | Liquid Granular Aerosol Others |

| By Packaging Type | Bottles Pouches Cans Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Pest Control Products | 100 | Farm Owners, Agricultural Extension Officers |

| Residential Pest Control Solutions | 80 | Homeowners, Pest Control Service Providers |

| Commercial Pest Management | 60 | Facility Managers, Hotel Operations Managers |

| Organic Pest Control Products | 50 | Organic Farmers, Environmental Consultants |

| Regulatory Compliance in Pest Control | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Vietnam Pest Control Products Market is valued at approximately USD 1.7 billion, driven by urbanization, agricultural expansion, and increased awareness of public health issues related to pest infestations.