Region:North America

Author(s):Rebecca

Product Code:KRAD8457

Pages:84

Published On:December 2025

Film Sheet Market.png)

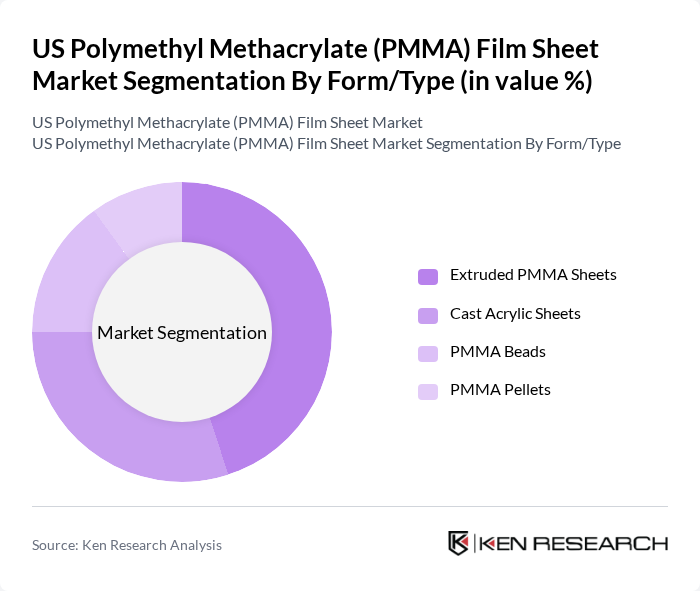

By Form/Type:The PMMA film sheet market can be segmented into various forms, including extruded PMMA sheets, cast acrylic sheets, PMMA beads, and PMMA pellets. Among these, extruded PMMA sheets are the most dominant due to their widespread use in signage and display applications. The ease of manufacturing and cost-effectiveness of extruded sheets make them a preferred choice for many industries. Cast acrylic sheets also hold a significant share, particularly in applications requiring optical clarity and durability.

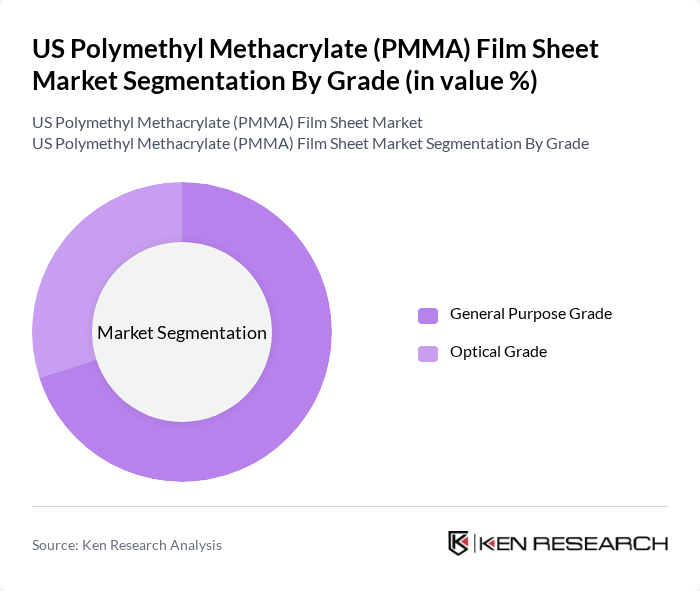

By Grade:The market can also be segmented by grade into general purpose grade and optical grade. The general purpose grade is the most widely used due to its versatility and cost-effectiveness, making it suitable for a variety of applications. Optical grade PMMA is gaining traction in sectors requiring high clarity and light transmission, such as lighting and display applications, but it remains a smaller segment compared to general purpose grade.

The US Polymethyl Methacrylate (PMMA) Film Sheet Market is characterized by a dynamic mix of regional and international players. Leading participants such as Evonik Industries AG, Arkema Group, Lucite International, Mitsubishi Chemical Corporation, Plaskolite, LLC, Röhm GmbH, Covestro AG, Altuglas International, KURARAY Co., Ltd., Trinseo S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US PMMA film sheet market appears promising, driven by increasing environmental awareness and technological advancements. As industries prioritize sustainability, the demand for eco-friendly PMMA products is expected to rise in future. Additionally, the integration of smart technologies into PMMA applications will likely enhance product functionality, appealing to a broader consumer base. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Form/Type | Extruded PMMA Sheets Cast Acrylic Sheets PMMA Beads PMMA Pellets |

| By Grade | General Purpose Grade Optical Grade |

| By End-Use Application | Signs & Displays Automotive Parts Building & Construction Lighting Fixtures Electrical & Electronics Healthcare & Medical Marine Applications Consumer Goods |

| By Region | New England Mideast Great Lakes Plains Southeast Southwest Rocky Mountain Far West |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive PMMA Applications | 100 | Product Engineers, Procurement Managers |

| Construction Industry Usage | 80 | Architects, Project Managers |

| Healthcare PMMA Products | 70 | Medical Device Developers, Quality Assurance Managers |

| Signage and Display Solutions | 60 | Marketing Managers, Signage Designers |

| Consumer Goods Packaging | 90 | Packaging Engineers, Brand Managers |

The US Polymethyl Methacrylate (PMMA) Film Sheet Market is valued at approximately USD 910 million, reflecting a robust growth trajectory driven by demand across various industries such as automotive, construction, and healthcare.