Region:North America

Author(s):Dev

Product Code:KRAA0390

Pages:93

Published On:August 2025

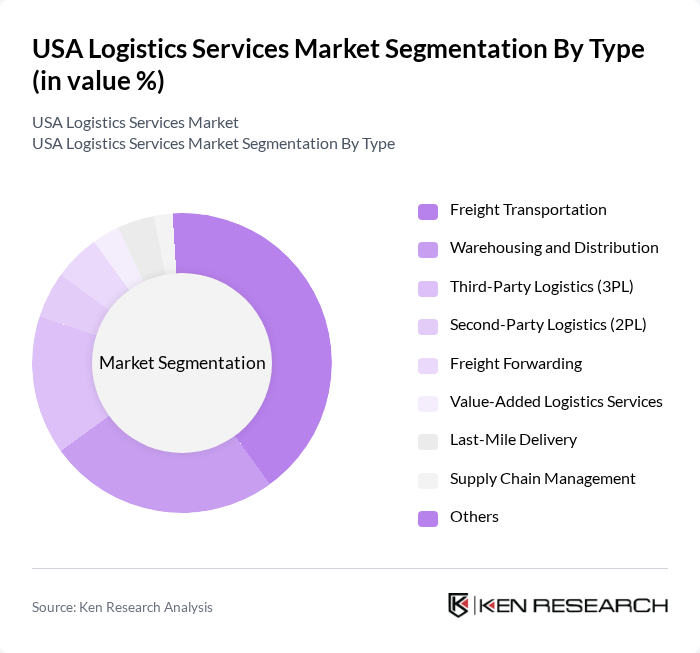

By Type:The logistics services market is segmented into various types, including Freight Transportation, Warehousing and Distribution, Third-Party Logistics (3PL), Second-Party Logistics (2PL), Freight Forwarding, Value-Added Logistics Services, Last-Mile Delivery, Supply Chain Management, and Others. Among these, Freight Transportation is the leading sub-segment, driven by the increasing demand for efficient and timely delivery of goods across the country. The surge in e-commerce and consumer expectations for rapid delivery have significantly boosted the need for reliable freight services, making it a critical component of the logistics ecosystem .

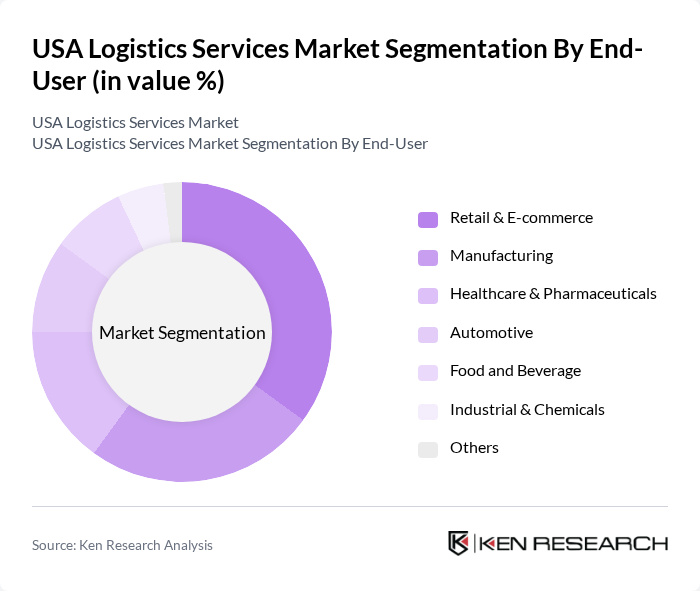

By End-User:The logistics services market is also segmented by end-user industries, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food and Beverage, Industrial & Chemicals, and Others. The Retail & E-commerce sector is the dominant end-user, fueled by the rapid growth of online shopping and consumer demand for fast delivery services. This segment's expansion has led to increased investments in logistics capabilities, automation, and last-mile delivery solutions to meet customer expectations for speed and reliability .

The USA Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as FedEx Corporation, United Parcel Service (UPS), XPO Logistics, J.B. Hunt Transport Services, C.H. Robinson Worldwide, DHL Supply Chain, Schneider National, Ryder System, Inc., Expeditors International, Kuehne + Nagel, DB Schenker, Geodis, TQL (Total Quality Logistics), Coyote Logistics, Hub Group, Penske Logistics, DSV A/S contribute to innovation, geographic expansion, and service delivery in this space.

The USA logistics services market is poised for transformative growth, driven by the integration of advanced technologies and evolving consumer expectations. As companies increasingly adopt automation and data analytics, operational efficiencies will improve, enabling faster and more reliable service delivery. Additionally, sustainability initiatives will shape logistics strategies, with a focus on reducing carbon footprints. The market will likely see a shift towards more localized distribution networks, enhancing responsiveness to consumer demands while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transportation Warehousing and Distribution Third-Party Logistics (3PL) Second-Party Logistics (2PL) Freight Forwarding Value-Added Logistics Services Last-Mile Delivery Supply Chain Management Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food and Beverage Industrial & Chemicals Others |

| By Service Mode | Road Transport (Trucking) Rail Transport Air Transport Maritime/Sea Transport Intermodal Transport Express & Parcel Services Others |

| By Technology | Transportation Management Systems (TMS) Warehouse Management Systems (WMS) Fleet Management Solutions Tracking and Visibility Solutions Automated Guided Vehicles (AGVs) & Robotics IoT and Real-Time Data Analytics Others |

| By Delivery Type | Standard Delivery Expedited Delivery Same-Day Delivery Scheduled Delivery Others |

| By Customer Type | B2B B2C C2C Government Others |

| By Geographic Coverage | National Regional Local International Coastal States Inland States Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Third-Party Logistics Providers | 100 | Operations Managers, Business Development Executives |

| Freight Forwarding Services | 60 | Logistics Coordinators, Supply Chain Analysts |

| Warehouse Management Systems | 50 | IT Managers, Warehouse Supervisors |

| Last-Mile Delivery Solutions | 70 | Delivery Managers, Customer Experience Leads |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Supply Chain Directors |

The USA Logistics Services Market is valued at approximately USD 2 trillion, driven by the increasing demand for efficient supply chain solutions, e-commerce growth, and advancements in automation and artificial intelligence.