Region:Asia

Author(s):Dev

Product Code:KRAC8750

Pages:84

Published On:November 2025

By Product Category:The product categories in the consumer-to-consumer e-commerce market are diverse, including fashion and apparel, electronics and gadgets, home and living, health and beauty, food and beverage, books, toys & hobbies, automotive parts & accessories, sports & fitness equipment, and others. Among these,fashion and appareldominate the market, driven by the increasing trend of online shopping for clothing and accessories, strong social media influence, and the convenience of home delivery. Electronics and gadgets, as well as home and living products, also represent significant segments due to rising consumer demand for technology and lifestyle upgrades .

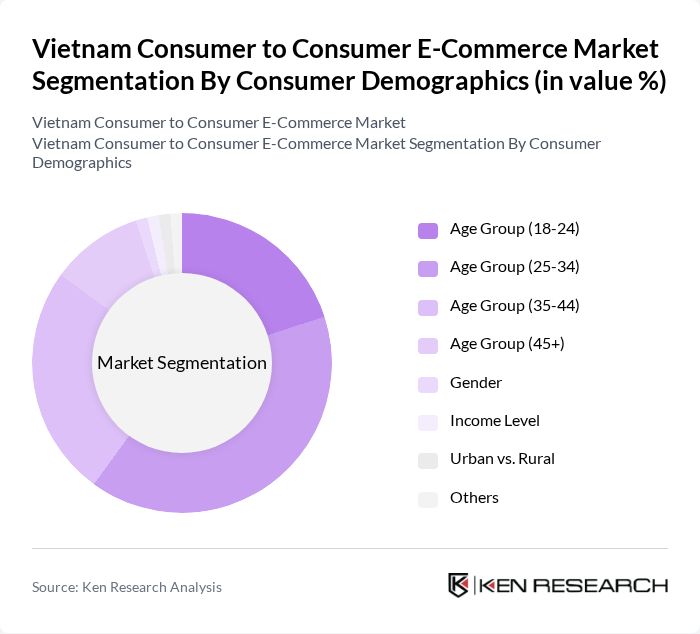

By Consumer Demographics:The consumer demographics in the Vietnam Consumer to Consumer E-Commerce Market are segmented by age group, gender, income level, urban vs. rural distribution, and others. Theage group of 25-34 yearsis the most active demographic, as this segment is more inclined towards online shopping and is comfortable with digital payment methods, making them a key driver of market growth. Urban consumers, particularly in major cities, account for the majority of online transactions, while rural adoption is rising as internet access expands and logistics improve .

The Vietnam Consumer to Consumer E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tiki.vn, Shopee Vietnam, Lazada Vietnam, Sendo.vn, Chotot.vn, Fado.vn, Yes24.vn, Dienmayxanh.com, Thegioididong.com, VinID, Muachung.vn, Zalora Vietnam, Lotte.vn, Beyeu.com, Boshop.vn, Facebook Marketplace, Zalo, TikTok Shop Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's consumer-to-consumer e-commerce market appears promising, driven by technological advancements and changing consumer behaviors. As internet penetration continues to rise, more individuals will engage in online shopping, particularly through mobile devices. Additionally, the integration of advanced payment solutions and enhanced security measures will likely foster consumer trust. The market is expected to evolve with innovative platforms catering to niche markets, further diversifying the e-commerce landscape and enhancing user experiences.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Fashion and Apparel Electronics and Gadgets Home and Living Health and Beauty Food and Beverage Books, Toys & Hobbies Automotive Parts & Accessories Sports & Fitness Equipment Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Urban vs. Rural Others |

| By Payment Method | Credit/Debit Cards E-Wallets Cash on Delivery Bank Transfers Buy Now, Pay Later (BNPL) Others |

| By Delivery Method | Standard Delivery Express Delivery Click and Collect Others |

| By Platform Type | Mobile Apps Websites Social Media Platforms (e.g., Facebook Marketplace, Zalo, TikTok Shop) Others |

| By Geographic Distribution | Ho Chi Minh City Hanoi Tier-2 Cities (e.g., Da Nang, Can Tho, Hai Phong, Nha Trang) Rural Areas Others |

| By Customer Loyalty Programs | Membership Programs Reward Points Referral Discounts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General C2C E-commerce Users | 120 | Active buyers and sellers on C2C platforms |

| Mobile App Users | 85 | Consumers using mobile applications for C2C transactions |

| Social Media Marketplace Participants | 65 | Users engaged in buying/selling via social media platforms |

| Frequent Online Shoppers | 95 | Consumers who regularly purchase goods online |

| First-time C2C Users | 55 | Individuals who have recently engaged in C2C transactions |

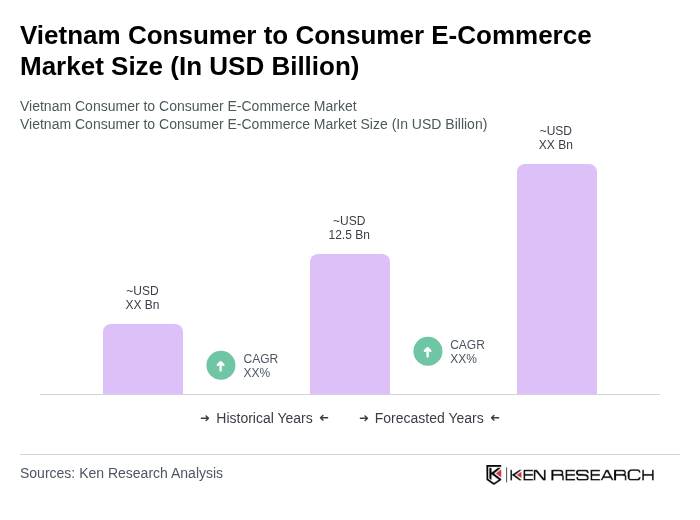

The Vietnam Consumer to Consumer E-Commerce Market is valued at approximately USD 12.5 billion, reflecting significant growth driven by increased smartphone penetration, internet access, and a shift towards online shopping and digital payment solutions.