Region:Asia

Author(s):Geetanshi

Product Code:KRAA3250

Pages:96

Published On:September 2025

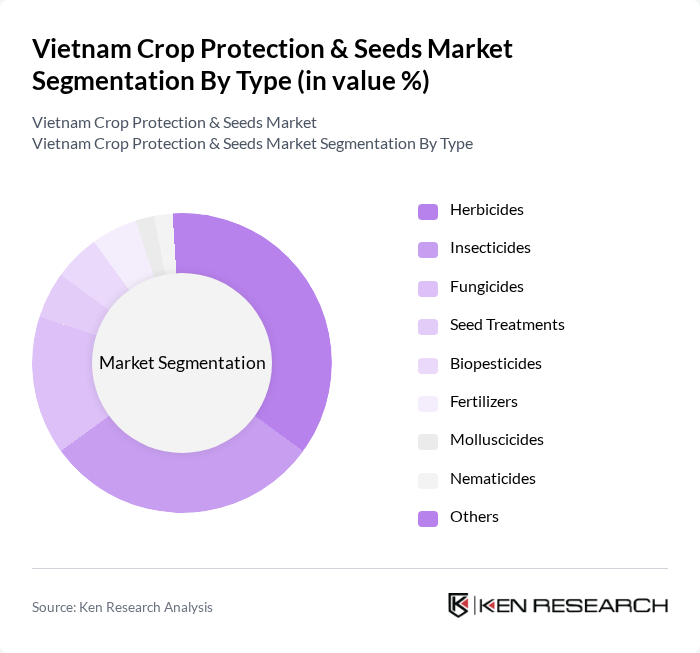

By Type:The market is segmented into various types, including herbicides, insecticides, fungicides, seed treatments, biopesticides, fertilizers, molluscicides, nematicides, and others. Among these, herbicides and insecticides are the most widely used due to their effectiveness in controlling weeds and pests, which are significant threats to crop yields. The increasing focus on sustainable agriculture is also driving the adoption of biopesticides, which are gaining popularity among environmentally conscious farmers.

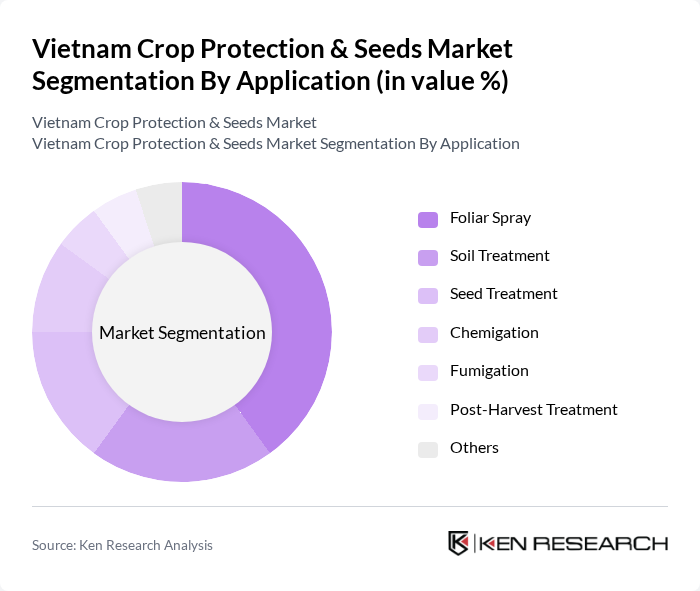

By Application:The applications of crop protection products include foliar spray, soil treatment, seed treatment, chemigation, fumigation, post-harvest treatment, and others. Foliar spray is the most common application method due to its effectiveness in delivering nutrients and protection directly to the plant leaves. The increasing adoption of precision agriculture techniques is also driving the growth of chemigation, which allows for the efficient application of fertilizers and pesticides through irrigation systems.

The Vietnam Crop Protection & Seeds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta Vietnam, Bayer Vietnam Ltd., BASF Vietnam Co., Ltd., Corteva Agriscience Vietnam, FMC Vietnam Co., Ltd., ADAMA Vietnam, UPL Vietnam Co., Ltd., Nufarm Vietnam, Sumitomo Chemical Vietnam Co., Ltd., An Giang Plant Protection Joint Stock Company (AGPPS), Loc Troi Group, Vinaseed (Vietnam National Seed Group), East-West Seed Vietnam, Southern Seed Corporation (SSC), BioWorks, Inc., Marrone Bio Innovations contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam Crop Protection and Seeds Market is poised for significant transformation as it embraces sustainable practices and technological advancements. The increasing focus on organic farming and biopesticides is expected to reshape the market landscape, driven by consumer demand for safer food products. Additionally, the integration of digital tools in agriculture will enhance efficiency and productivity, positioning Vietnam as a competitive player in the global agricultural market. Continued government support will further bolster these trends, ensuring a resilient agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Seed Treatments Biopesticides Fertilizers Molluscicides Nematicides Others |

| By Application | Foliar Spray Soil Treatment Seed Treatment Chemigation Fumigation Post-Harvest Treatment Others |

| By Crop Type | Cereals (Rice, Corn, Wheat) Oilseeds (Soybean, Sunflower, Rapeseed) Vegetables (Tomato, Cucumber, Pepper) Fruits (Banana, Mango, Citrus) Forage Crops (Alfalfa, Sorghum) Plantation Crops (Coffee, Rubber) Others |

| By End-User | Farmers Agricultural Cooperatives Distributors Exporters Others |

| By Distribution Channel | Direct Sales Agri-input Retailers Online Platforms Agricultural Shows and Expos Others |

| By Region | Mekong Delta Red River Delta Northern Vietnam Central Vietnam Southern Vietnam Others |

| By Price Range | Low Price Mid Price High Price Others |

| By Product Formulation | Liquid Granular Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Protection Product Usage | 120 | Farmers, Agricultural Technicians |

| Seed Market Insights | 90 | Seed Distributors, Retailers |

| Regulatory Impact Assessment | 60 | Policy Makers, Agricultural Consultants |

| Market Trends in Organic Farming | 50 | Organic Farmers, Agronomists |

| Consumer Preferences for Crop Protection | 70 | End-Users, Agricultural Product Buyers |

The Vietnam Crop Protection & Seeds Market is valued at approximately USD 2.4 billion, reflecting significant growth driven by increasing food security demands, advancements in agricultural technology, and the adoption of modern farming practices.