Region:Asia

Author(s):Rebecca

Product Code:KRAB2856

Pages:96

Published On:October 2025

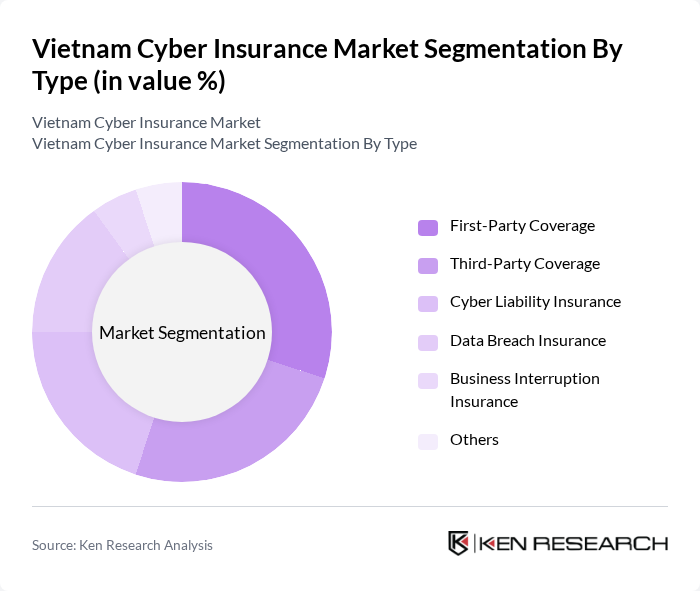

By Type:The market is segmented into various types of coverage, including First-Party Coverage, Third-Party Coverage, Cyber Liability Insurance, Data Breach Insurance, Business Interruption Insurance, and Others. Each type serves distinct needs, with First-Party and Cyber Liability Insurance being particularly prominent due to the increasing focus on protecting organizational assets and managing liability risks associated with cyber incidents. Insurers are also enhancing policy structures to address evolving threats such as ransomware and regulatory fines, reflecting the growing sophistication of cyber risks .

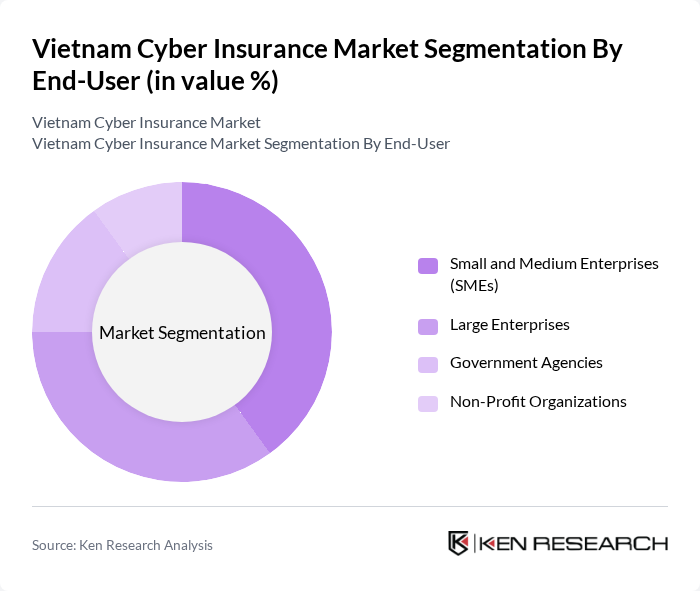

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, and Non-Profit Organizations. SMEs are increasingly adopting cyber insurance as they become more aware of the risks associated with digital operations, with over 13,900 cyber incidents reported in SMEs alone in the past year. Large enterprises, particularly in the BFSI sector, require comprehensive coverage due to extensive data handling and regulatory obligations. The adoption of cyber insurance is also rising among government agencies and non-profits as digital transformation accelerates across all sectors .

The Vietnam Cyber Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bao Viet Holdings, PVI Insurance, BIDV Insurance Corporation (BIC), VietinBank Insurance, Liberty Insurance Vietnam, AIG Vietnam, Chubb Vietnam, Manulife Vietnam, Prudential Vietnam, Generali Vietnam, Tokio Marine Insurance Vietnam, Zurich Insurance Vietnam, AXA Vietnam, FPT Information System (FPT IS), and Viettel Cyber Security contribute to innovation, geographic expansion, and service delivery in this space. Insurers are increasingly partnering with cybersecurity firms to offer bundled risk mitigation and insurance solutions, reflecting the market’s evolution toward integrated cyber risk management .

The Vietnam cyber insurance market is poised for significant growth as businesses increasingly recognize the importance of protecting their digital assets. With the rise in cyber threats and regulatory pressures, companies are expected to invest more in tailored insurance solutions. Additionally, advancements in technology, such as AI-driven risk assessment tools, will enhance the effectiveness of cyber insurance products. As awareness grows, the market will likely see a shift towards comprehensive coverage options that address the unique needs of various sectors, fostering a more resilient digital economy.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Party Coverage Third-Party Coverage Cyber Liability Insurance Data Breach Insurance Business Interruption Insurance Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations |

| By Industry Sector | Financial Services (BFSI) Healthcare Retail & E-commerce Manufacturing Technology & IT Services Critical Infrastructure (Energy, Utilities, Telecom) Others |

| By Coverage Type | Incident Response Coverage Legal Expenses Coverage Regulatory Fines Coverage Crisis Management Coverage |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Premium Range | Low Premium (<$1,000) Medium Premium ($1,000 - $5,000) High Premium (>$5,000) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cyber Insurance | 100 | Risk Managers, Compliance Officers |

| Healthcare Sector Cyber Risk Management | 70 | IT Security Directors, Operations Managers |

| Manufacturing Industry Cyber Insurance Adoption | 60 | Chief Information Officers, Production Managers |

| SME Cyber Insurance Awareness | 50 | Business Owners, IT Managers |

| Telecommunications Cyber Risk Assessment | 40 | Network Security Engineers, Risk Assessment Analysts |

The Vietnam Cyber Insurance Market is currently valued at approximately USD 3 million. This valuation reflects a five-year historical analysis, highlighting the increasing demand for cyber insurance solutions due to rising cyber threats and digital transformation across various sectors.