Region:Asia

Author(s):Rebecca

Product Code:KRAD4989

Pages:83

Published On:December 2025

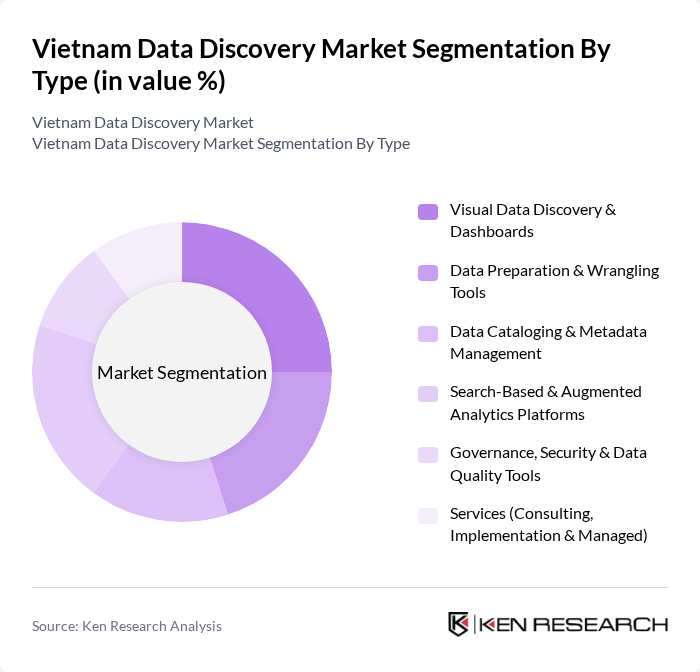

By Type:The market is segmented into various types, including Visual Data Discovery & Dashboards, Data Preparation & Wrangling Tools, Data Cataloging & Metadata Management, Search-Based & Augmented Analytics Platforms, Governance, Security & Data Quality Tools, and Services (Consulting, Implementation & Managed). Each of these subsegments plays a crucial role in enabling organizations to harness the power of data effectively, in line with the broader Vietnam data analytics stack that spans business intelligence, ETL, cataloging, governance, and managed services.

The Visual Data Discovery & Dashboards subsegment is currently leading the market due to the growing need for intuitive, self-service business intelligence tools that allow business users to interpret complex data sets without deep technical expertise. Organizations are increasingly investing in these tools to enhance their decision-making processes, democratize access to analytics, improve operational efficiency, and support real-time performance monitoring. The demand for interactive dashboards, mobile access, and user-friendly interfaces integrated with cloud-based analytics platforms is propelling this subsegment's growth, making it a preferred choice among enterprises and fast-growing digital-native companies.

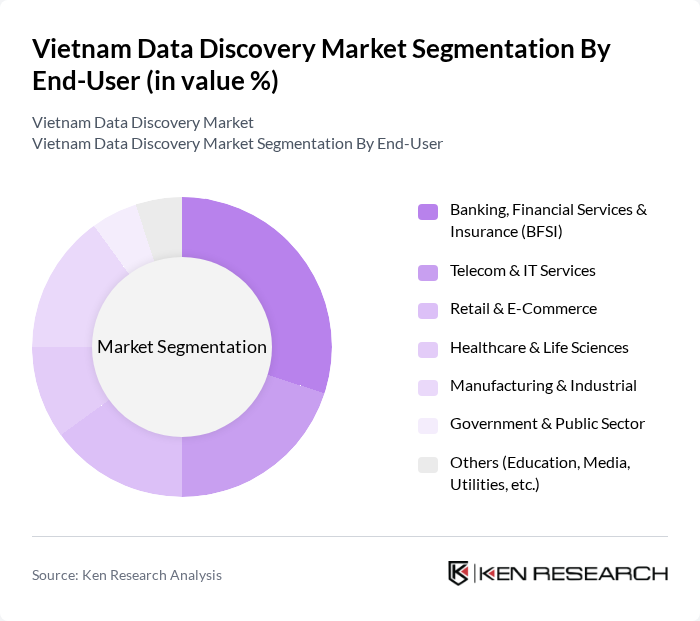

By End-User:The end-user segmentation includes Banking, Financial Services & Insurance (BFSI), Telecom & IT Services, Retail & E-Commerce, Healthcare & Life Sciences, Manufacturing & Industrial, Government & Public Sector, and Others (Education, Media, Utilities, etc.). Each sector has unique data discovery needs, driving the demand for tailored solutions that support use cases such as customer analytics, fraud detection, network optimization, personalized marketing, predictive maintenance, and clinical or patient analytics.

The Banking, Financial Services & Insurance (BFSI) sector is the dominant end-user in the market, driven by the need for advanced analytics to manage credit and fraud risk, support regulatory and compliance reporting, optimize pricing, and enhance omnichannel customer experiences. Financial institutions are increasingly leveraging data discovery tools for customer segmentation, transaction monitoring, anti-money laundering analytics, cross-selling, and portfolio optimization, solidifying their position as the leading segment.

The Vietnam Data Discovery Market is characterized by a dynamic mix of regional and international players. Leading participants such as FPT Software, CMC Corporation, Viettel Group, VNPT Technology, VNG Corporation, TMA Solutions, NashTech Vietnam, KMS Technology Vietnam, Misa JSC, Novaon Group, FPT Smart Cloud, CMC Telecom, Viettel Solutions, Hitachi Vantara Vietnam, IBM Vietnam Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam Data Discovery Market is poised for significant evolution, driven by technological advancements and increasing digital transformation initiatives. As organizations prioritize data governance and real-time analytics, the integration of AI and machine learning into data discovery tools will become more prevalent. Furthermore, the growing emphasis on self-service analytics will empower non-technical users to derive insights independently, fostering a data-driven culture across various sectors. This trend is expected to enhance operational efficiency and decision-making capabilities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Visual Data Discovery & Dashboards Data Preparation & Wrangling Tools Data Cataloging & Metadata Management Search?Based & Augmented Analytics Platforms Governance, Security & Data Quality Tools Services (Consulting, Implementation & Managed) |

| By End-User | Banking, Financial Services & Insurance (BFSI) Telecom & IT Services Retail & E?Commerce Healthcare & Life Sciences Manufacturing & Industrial Government & Public Sector Others (Education, Media, Utilities, etc.) |

| By Industry Vertical | Large Enterprises Small & Medium Enterprises (SMEs) Startups & Digital?Native Businesses State?Owned Enterprises Multinational Corporations Operating in Vietnam |

| By Deployment Model | On-Premises Public Cloud Private Cloud Hybrid & Multi?Cloud |

| By Data Source | Structured Enterprise Data (RDBMS, Data Warehouses) Semi-Structured Data (Logs, XML, JSON, APIs) Unstructured Data (Documents, Social, Multimedia) Streaming & Real?Time Data |

| By Geographic Region | Northern Vietnam (incl. Hanoi) Southern Vietnam (incl. Ho Chi Minh City) Central Vietnam Emerging Tier?2 & Industrial Provinces |

| By Customer Size | Large Enterprises Upper Mid-Market Lower Mid-Market Small & Micro Businesses |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Data Discovery | 120 | Data Analysts, IT Managers |

| Healthcare Data Management | 90 | Healthcare IT Directors, Data Scientists |

| Retail Analytics Solutions | 110 | Marketing Managers, Business Intelligence Analysts |

| Manufacturing Data Insights | 80 | Operations Managers, Supply Chain Analysts |

| Telecommunications Data Utilization | 70 | Network Engineers, Data Governance Officers |

The Vietnam Data Discovery Market is valued at approximately USD 3.6 billion, reflecting significant growth driven by the increasing adoption of data analytics across various sectors, including banking, finance, retail, telecom, manufacturing, and healthcare.