Region:Asia

Author(s):Shubham

Product Code:KRAD6786

Pages:89

Published On:December 2025

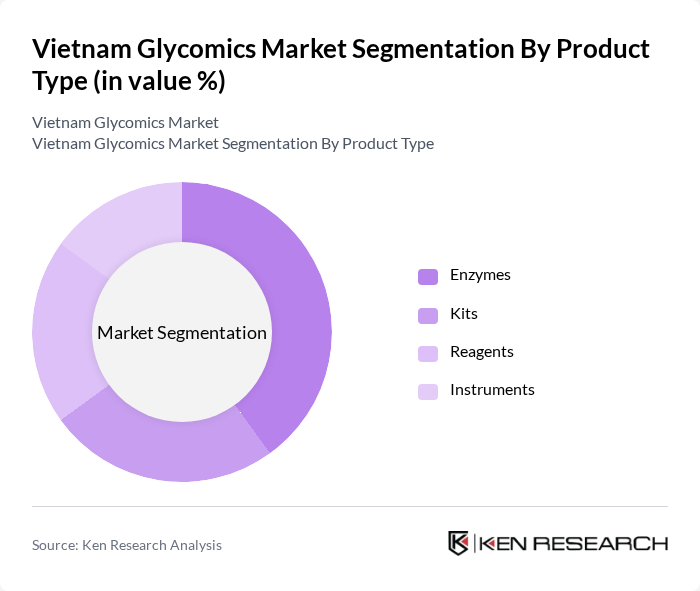

By Product Type:The product type segmentation includes Enzymes, Kits, Reagents, and Instruments. Enzymes constitute the largest product category in the global glycomics market and similarly represent the leading segment in Vietnam, given their essential role in glycan modification, digestion, and analysis across drug discovery, biomarker research, and biopharmaceutical characterization. The demand for high-quality enzymes is driven by the growing focus on personalized medicine, monoclonal antibody and biologics development, and the need for precise glycan profiling and structural elucidation in both academic and clinical research settings.

By Application:The application segmentation encompasses Drug Discovery and Development, Disease Diagnostics, Biopharmaceutical Manufacturing and Quality Control, and Others. Drug Discovery and Development is the leading application area globally and in emerging Asia–Pacific markets, supported by expanding biopharmaceutical pipelines, particularly in monoclonal antibodies, recombinant proteins, and vaccines that require detailed glycan characterization for safety and efficacy. In Vietnam, increasing investment in R&D by pharmaceutical and biotech companies, collaboration between universities and hospitals, and the growing need for novel targeted therapeutics and biosimilars further drive use of glycomics in discovery and preclinical development, while disease diagnostics and biopharmaceutical manufacturing quality control are steadily expanding as testing and bioprocess capabilities mature.

The Vietnam Glycomics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Merck KGaA (Merck Millipore), Agilent Technologies, Inc., Shimadzu Corporation, Bruker Corporation, New England Biolabs Inc., Promega Corporation, Waters Corporation, Takara Bio Inc., Bio-Techne Corporation, RayBiotech, Inc., Biomedic Scientific & Equipment Co., Ltd. (Biomedic Vietnam), VinBioCare Biotechnology Joint Stock Company, Vietnam Academy of Science and Technology (VAST) – Institute of Biotechnology, Hanoi Medical University – Center for Molecular Biology contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam glycomics market is poised for significant advancements, driven by technological innovations and increased collaboration among research institutions. As the government continues to prioritize biotechnology, funding for glycomics research is expected to rise, fostering a more robust ecosystem. Furthermore, the integration of artificial intelligence in research methodologies will enhance data analysis capabilities, leading to more efficient discoveries. These trends indicate a promising future for the glycomics sector, with potential breakthroughs in personalized medicine and therapeutic development on the horizon.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Enzymes Kits Reagents Instruments |

| By Application | Drug Discovery and Development Disease Diagnostics Biopharmaceutical Manufacturing and Quality Control Others |

| By End-User | Academic and Research Institutes Pharmaceutical and Biotechnology Companies Contract Research Organizations (CROs) Hospitals and Clinical Laboratories |

| By Technology | Mass Spectrometry-based Glycan Analysis Chromatography-based Glycan Separation Glycan Microarrays and High-throughput Screening Nuclear Magnetic Resonance (NMR) Spectroscopy |

| By Research Type | Basic Glycobiology Research Translational and Applied Research Clinical and Biomarker Research Others |

| By Funding Source | Government Grants and National Programs International Donor and Multilateral Funding Private and Corporate Investments University and Institutional Research Budgets |

| By Market Segment | Academic & Public-sector Research Industrial R&D and Biopharma Production Clinical and Diagnostic Applications Contract Services (CROs, CDMOs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Applications of Glycomics | 100 | Healthcare Researchers, Clinical Practitioners |

| Biotechnology Firms in Glycomics | 80 | Business Development Managers, R&D Directors |

| Academic Institutions Focused on Glycomics | 70 | Professors, Graduate Researchers |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Specialists |

| Pharmaceutical Companies Utilizing Glycomics | 90 | Product Managers, Clinical Trial Coordinators |

The Vietnam Glycomics Market is valued at approximately USD 10 million, reflecting a five-year historical analysis and benchmarking against Asia-Pacific and global glycomics revenues. This growth is driven by advancements in biotechnology and increasing research activities in glycobiology.